Schedule NLD Income Tax Corporate Form

What is the Schedule NLD Income Tax Corporate

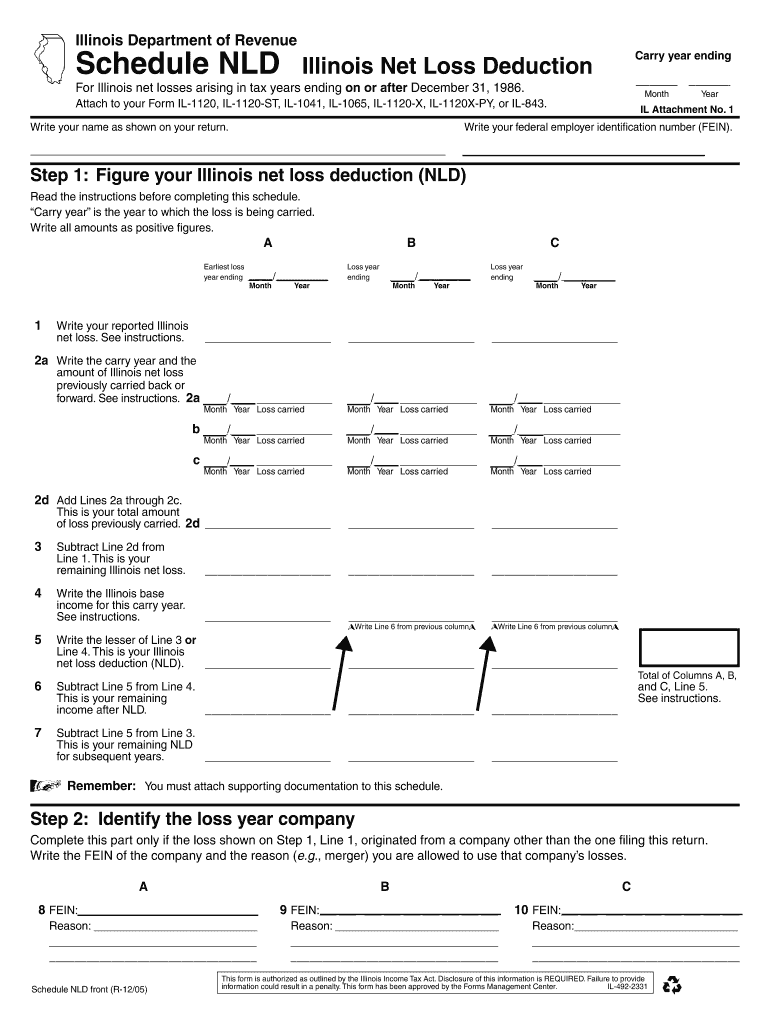

The Schedule NLD Income Tax Corporate is a specific tax form used by corporations in the United States to report non-dividend distributions. This form is essential for corporations that have made distributions to shareholders that are not classified as dividends. Understanding this form is crucial for accurate tax reporting and compliance with federal tax regulations.

How to use the Schedule NLD Income Tax Corporate

To use the Schedule NLD Income Tax Corporate, corporations must first determine if they have made any non-dividend distributions during the tax year. Once identified, the corporation should fill out the form by providing details about the distributions, including the amount and the recipients. This form is typically filed alongside the corporate income tax return, ensuring that all financial activities are reported accurately to the IRS.

Steps to complete the Schedule NLD Income Tax Corporate

Completing the Schedule NLD Income Tax Corporate involves several key steps:

- Gather financial records related to non-dividend distributions.

- Complete the form by entering the required information, including distribution amounts and shareholder details.

- Review the form for accuracy to ensure compliance with IRS guidelines.

- Attach the completed form to the corporate income tax return.

- Submit the tax return by the designated filing deadline.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the Schedule NLD Income Tax Corporate. Generally, the deadline coincides with the due date for the corporate income tax return, which is typically the fifteenth day of the fourth month after the end of the corporation's tax year. It is important to check for any changes in deadlines or extensions that may apply.

Required Documents

When preparing to file the Schedule NLD Income Tax Corporate, corporations should have the following documents ready:

- Financial statements detailing non-dividend distributions.

- Shareholder records to identify recipients of distributions.

- Previous tax returns for reference and accuracy.

Penalties for Non-Compliance

Failure to accurately complete and file the Schedule NLD Income Tax Corporate can result in penalties imposed by the IRS. These may include fines for late filing, inaccuracies, or failure to report required information. It is essential for corporations to ensure compliance to avoid these potential financial repercussions.

Quick guide on how to complete schedule nld income tax corporate

Complete [SKS] effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and bears the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule NLD Income Tax Corporate

Create this form in 5 minutes!

How to create an eSignature for the schedule nld income tax corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule NLD Income Tax Corporate?

Schedule NLD Income Tax Corporate is a tax form required for corporations to report their income and calculate their tax liabilities. It is essential for businesses to accurately complete this form to ensure compliance with tax regulations. Using airSlate SignNow can simplify the process of preparing and submitting your Schedule NLD Income Tax Corporate.

-

How can airSlate SignNow help with Schedule NLD Income Tax Corporate?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and submit their Schedule NLD Income Tax Corporate documents. With its user-friendly interface, you can easily manage your tax documents and ensure they are signed and submitted on time. This streamlines the tax filing process and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan includes features that support the preparation and signing of documents, including Schedule NLD Income Tax Corporate. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow. This includes popular accounting and tax software that can help you manage your Schedule NLD Income Tax Corporate more effectively. These integrations allow for a smoother data transfer and improved efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including eSigning, templates, and automated workflows. These features are particularly useful for managing your Schedule NLD Income Tax Corporate documents, ensuring that they are completed accurately and efficiently. You can also track the status of your documents in real-time.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow, which employs advanced encryption and security protocols to protect your sensitive tax documents. When handling your Schedule NLD Income Tax Corporate, you can trust that your information is safe and secure. This ensures compliance with data protection regulations.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your Schedule NLD Income Tax Corporate documents on the go. This flexibility ensures that you can prepare and sign documents anytime, anywhere, making it easier to meet deadlines and stay organized.

Get more for Schedule NLD Income Tax Corporate

- Mecklenburg court equitable distribution form

- To download the service learning hours form lane technical lanetech

- Enrollment oglala sioux tribe form

- Income tax and benefit return t1 general 2011 all in one index form

- Jumpin fun waiver form

- Evidence item recovery log forensic classroom form

- Sec electronics e type form

- Registration form boston tax institute

Find out other Schedule NLD Income Tax Corporate

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy