IL 2220 Instructions Income Tax Business Form

Understanding the IL 2220 Instructions for Income Tax

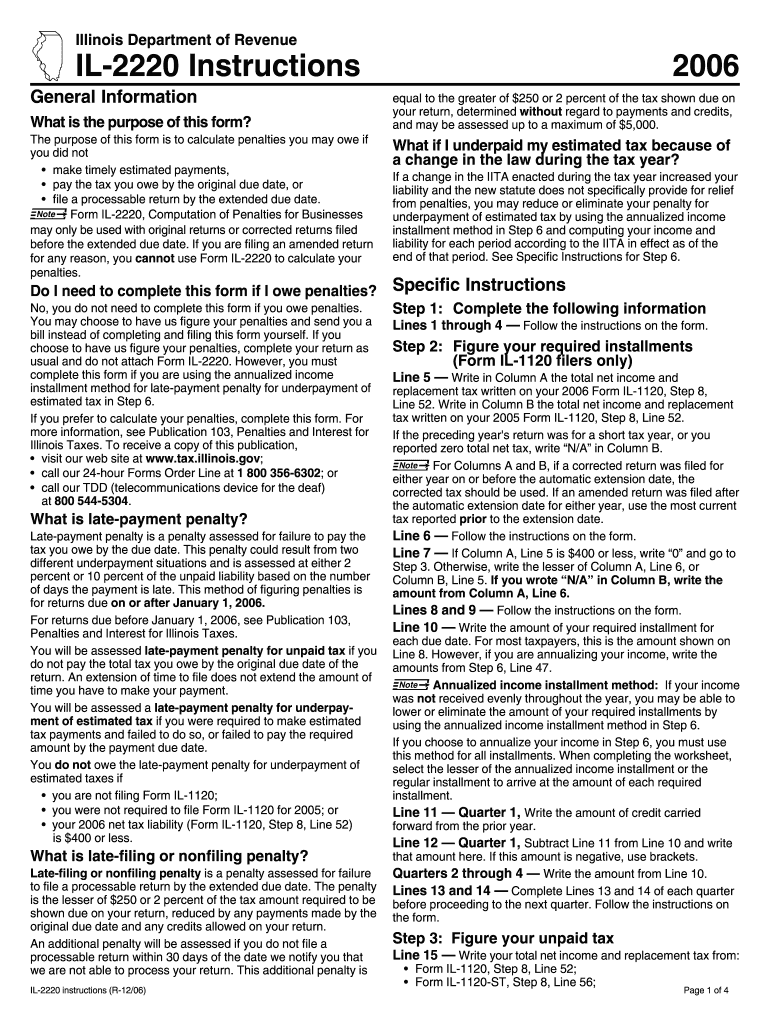

The IL 2220 Instructions are essential for businesses in Illinois to understand their tax obligations. This form specifically addresses the requirements for calculating and paying estimated income tax for corporations and partnerships. It is crucial for businesses to comply with these instructions to avoid penalties and ensure accurate tax reporting.

Steps to Complete the IL 2220 Instructions

Completing the IL 2220 Instructions involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated tax liability based on your expected income for the year.

- Fill out the IL 2220 form accurately, ensuring all figures are correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the IL 2220 Instructions. Typically, businesses must submit their estimated tax payments quarterly. The specific due dates may vary, so it is advisable to check the latest updates from the Illinois Department of Revenue to ensure compliance.

Key Elements of the IL 2220 Instructions

The IL 2220 Instructions include several key elements that businesses must understand:

- The calculation of estimated tax payments based on projected income.

- Guidelines for determining whether a business qualifies for exceptions or special considerations.

- Information on penalties for underpayment of estimated taxes.

- Instructions for making adjustments if income fluctuates throughout the year.

Legal Use of the IL 2220 Instructions

The IL 2220 Instructions serve a legal purpose in ensuring that businesses meet their tax obligations under Illinois law. Proper use of this form helps businesses avoid legal issues related to tax compliance and ensures that they are contributing their fair share to state revenue.

Obtaining the IL 2220 Instructions

Businesses can obtain the IL 2220 Instructions through the Illinois Department of Revenue's website or by contacting their office directly. It is important to ensure that you are using the most current version of the form and instructions to avoid any compliance issues.

Quick guide on how to complete il 2220 instructions

Complete il 2220 instructions effortlessly on any device

Web-based document administration has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely保存 it online. airSlate SignNow equips you with all the resources necessary to generate, alter, and eSign your documents rapidly without any holdups. Manage il 2220 instructions across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest way to alter and eSign form il 2220 instructions effortlessly

- Locate il 2220 instructions and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal standing as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign form il 2220 instructions and ensure effective communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to il 2220 instructions

Create this form in 5 minutes!

How to create an eSignature for the form il 2220 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form il 2220 instructions

-

What are the IL 2220 instructions for using airSlate SignNow?

The IL 2220 instructions for airSlate SignNow guide users on how to complete and submit their forms electronically. This process simplifies document management and ensures compliance with state requirements. By following these instructions, users can efficiently eSign and send their documents.

-

How much does airSlate SignNow cost for IL 2220 instructions?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing IL 2220 instructions. We offer different tiers to accommodate various business needs, ensuring you get the best value for your investment. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for IL 2220 instructions?

airSlate SignNow provides a range of features tailored for IL 2220 instructions, including customizable templates, secure eSigning, and real-time tracking. These features enhance the efficiency of document handling and ensure that all necessary steps are followed. Users can easily manage their documents from any device.

-

How can airSlate SignNow benefit my business with IL 2220 instructions?

Using airSlate SignNow for IL 2220 instructions can signNowly streamline your document workflow. It reduces the time spent on paperwork and minimizes errors associated with manual processes. This efficiency allows your team to focus on more critical tasks, ultimately improving productivity.

-

Can I integrate airSlate SignNow with other tools for IL 2220 instructions?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms, enhancing your ability to manage IL 2220 instructions. Whether you use CRM systems, cloud storage, or project management tools, our integrations ensure a smooth workflow. This flexibility allows you to customize your document management process.

-

Is airSlate SignNow secure for handling IL 2220 instructions?

Absolutely! airSlate SignNow prioritizes security, ensuring that all IL 2220 instructions and documents are protected with advanced encryption and compliance measures. We adhere to industry standards to safeguard your sensitive information. You can trust us to keep your data secure while you eSign and send documents.

-

What support options are available for IL 2220 instructions with airSlate SignNow?

airSlate SignNow provides comprehensive support for users navigating IL 2220 instructions. Our customer service team is available via chat, email, and phone to assist with any questions or issues. Additionally, we offer a robust knowledge base filled with resources to help you maximize your experience.

Get more for il 2220 instructions

Find out other form il 2220 instructions

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF