Schedule K 1 T2 Income Tax Business Tax Illinois Form

What is the Schedule K-1 T2 Income Tax Business Tax Illinois

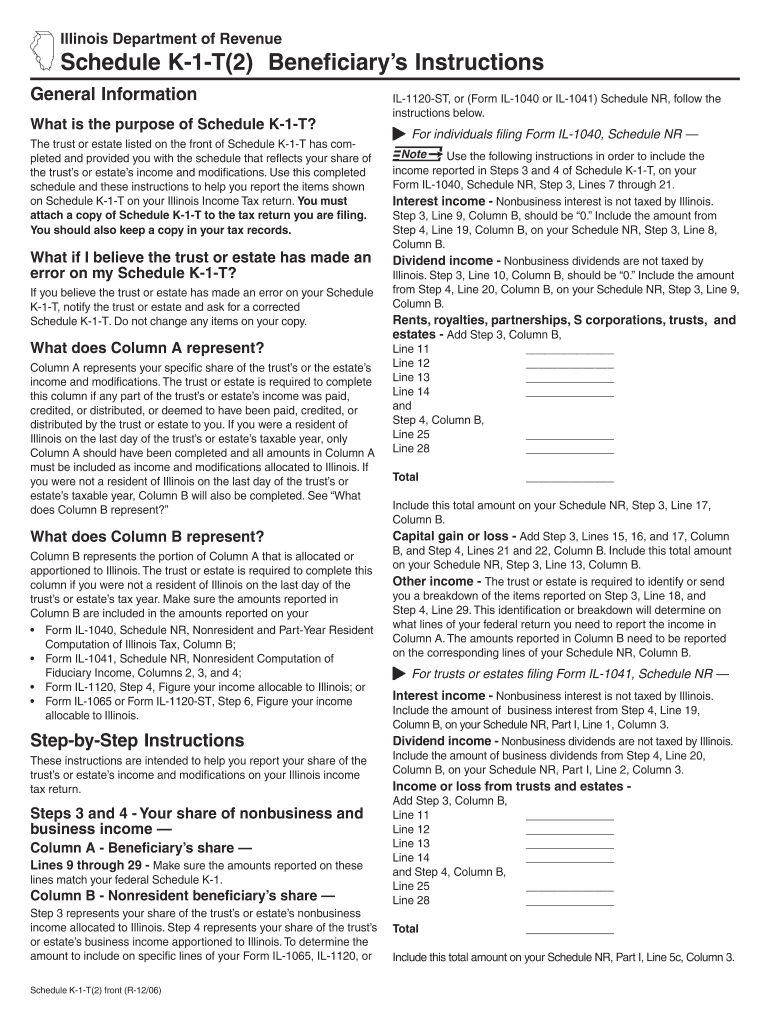

The Schedule K-1 T2 is a tax form used in Illinois for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who are shareholders or partners in a business entity that passes its income through to its owners. The K-1 provides detailed information about each partner's or shareholder's share of the entity's income, which must be reported on their personal income tax returns. Understanding this form is crucial for ensuring accurate tax reporting and compliance with state tax laws.

How to use the Schedule K-1 T2 Income Tax Business Tax Illinois

Using the Schedule K-1 T2 involves several steps. First, ensure you receive the form from your partnership or S corporation, as they are responsible for preparing and distributing it. Once you have the K-1, review the information provided, including your share of income, deductions, and credits. This information will need to be reported on your individual tax return. It is important to accurately input the figures from the K-1 into your tax software or onto your paper return to avoid discrepancies with the IRS or state tax authorities.

Steps to complete the Schedule K-1 T2 Income Tax Business Tax Illinois

Completing the Schedule K-1 T2 requires careful attention to detail. Follow these steps:

- Obtain the K-1 from the entity you are involved with.

- Review the form for accuracy, checking that your name, address, and taxpayer identification number are correct.

- Identify your share of income, deductions, and credits as reported on the K-1.

- Transfer the relevant information to your individual income tax return, typically on Form IL-1040.

- Keep a copy of the K-1 for your records, as it may be needed for future reference or in case of an audit.

Key elements of the Schedule K-1 T2 Income Tax Business Tax Illinois

Key elements of the Schedule K-1 T2 include the following:

- Partner or Shareholder Information: This section includes the name, address, and taxpayer identification number of the individual receiving the K-1.

- Entity Information: Details about the partnership or S corporation, including its name and employer identification number (EIN).

- Income and Deductions: The K-1 outlines the individual’s share of the entity’s income, losses, deductions, and credits.

- Tax Year: The form specifies the tax year for which the income is reported.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 T2 are aligned with the tax return deadlines for partnerships and S corporations. Typically, the K-1 must be issued to partners and shareholders by March 15 for calendar year entities. Individuals receiving the K-1 must report the income on their tax returns by April 15. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with tax regulations.

Legal use of the Schedule K-1 T2 Income Tax Business Tax Illinois

The Schedule K-1 T2 is legally required for reporting income from pass-through entities. It must be accurately completed and provided to all partners or shareholders to ensure that each individual can report their share of income correctly on their tax returns. Failure to issue a K-1 or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is important for both the entity and the individuals receiving the K-1 to understand their legal obligations regarding this form.

Quick guide on how to complete schedule k 1 t2 income tax business tax illinois 10998417

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify your document-centric tasks today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and eSign [SKS] to ensure effective communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule K 1 T2 Income Tax Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 t2 income tax business tax illinois 10998417

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule K 1 T2 Income Tax Business Tax Illinois?

Schedule K 1 T2 Income Tax Business Tax Illinois is a tax form used by partnerships and S corporations to report income, deductions, and credits to the IRS. It provides detailed information about each partner's share of the business income, which is essential for accurate tax filing. Understanding this form is crucial for businesses operating in Illinois to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with Schedule K 1 T2 Income Tax Business Tax Illinois?

airSlate SignNow streamlines the process of preparing and signing Schedule K 1 T2 Income Tax Business Tax Illinois forms. Our platform allows businesses to easily send, eSign, and manage documents securely, ensuring that all tax-related paperwork is handled efficiently. This can save time and reduce errors during tax season.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling Schedule K 1 T2 Income Tax Business Tax Illinois forms. Our plans include various features such as unlimited eSignatures and document storage, making it a cost-effective solution for managing tax documents. You can choose a plan that fits your business size and requirements.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage Schedule K 1 T2 Income Tax Business Tax Illinois forms. These integrations allow for easy data transfer and document management, ensuring that your tax processes are efficient and streamlined. Check our integration options to find the best fit for your business.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features designed for effective tax document management, including customizable templates for Schedule K 1 T2 Income Tax Business Tax Illinois forms, secure eSigning, and real-time tracking of document status. These features help businesses maintain compliance and ensure that all necessary signatures are obtained promptly.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like Schedule K 1 T2 Income Tax Business Tax Illinois forms. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your tax documents are safe and secure while using our services.

-

Can airSlate SignNow assist with filing Schedule K 1 T2 Income Tax Business Tax Illinois?

While airSlate SignNow does not file taxes directly, it simplifies the preparation and signing process for Schedule K 1 T2 Income Tax Business Tax Illinois forms. By using our platform, you can ensure that all necessary documents are completed accurately and signed in a timely manner, making it easier for you to file your taxes with confidence.

Get more for Schedule K 1 T2 Income Tax Business Tax Illinois

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497428272 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497428273 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497428274 form

- Virginia dissolve form

- Virginia dissolve llc form

- Living trust for husband and wife with no children virginia form

- Living trust for individual who is single divorced or widow or widower with no children virginia form

- Living trust for individual who is single divorced or widow or widower with children virginia form

Find out other Schedule K 1 T2 Income Tax Business Tax Illinois

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple