Schedule M Income Tax Business Form

What is the Schedule M Income Tax Business

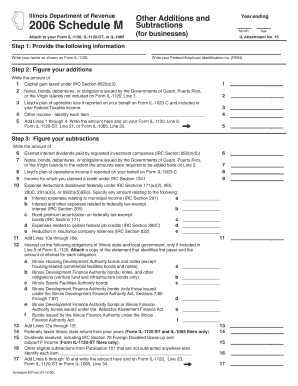

The Schedule M Income Tax Business is a specific form used by businesses to report income and deductions for tax purposes. This form is particularly relevant for partnerships, corporations, and limited liability companies (LLCs) that need to provide detailed information about their income sources and expenses. By completing this form, businesses can ensure compliance with IRS regulations while accurately reflecting their financial situation on their tax returns.

How to use the Schedule M Income Tax Business

Using the Schedule M Income Tax Business involves several steps. First, businesses must gather all relevant financial documents, including income statements, expense reports, and previous tax returns. Next, they should carefully fill out the form, providing accurate figures for income and deductions. It is essential to follow IRS guidelines to avoid errors that could lead to penalties. Once completed, the form can be submitted along with the main tax return, ensuring that all information is consistent and accurate.

Steps to complete the Schedule M Income Tax Business

Completing the Schedule M Income Tax Business requires a systematic approach:

- Gather financial records, including income and expense documentation.

- Review IRS instructions for the Schedule M to understand the requirements.

- Fill out the form, ensuring that all income sources and deductions are accurately reported.

- Double-check the figures for accuracy and completeness.

- Submit the form along with the main tax return by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule M Income Tax Business. These guidelines outline the necessary information, including which income and deductions must be reported. It is crucial for businesses to review these guidelines to ensure compliance and to avoid potential audits or penalties. Understanding these requirements can also help businesses maximize their deductions, ultimately reducing their taxable income.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule M Income Tax Business align with the overall tax return deadlines. Generally, businesses must file their tax returns by March 15 for partnerships and corporations or April 15 for sole proprietorships. It is important to be aware of these dates to avoid late fees and penalties. Additionally, businesses should consider any extensions that may apply, which can allow for additional time to file without incurring penalties.

Penalties for Non-Compliance

Non-compliance with the Schedule M Income Tax Business can result in significant penalties. The IRS may impose fines for late filing, underreporting income, or failing to provide required information. Businesses should be diligent in completing and submitting the form accurately and on time to avoid these consequences. Understanding the potential penalties can encourage businesses to prioritize their tax obligations and maintain accurate financial records.

Quick guide on how to complete schedule m income tax business 10998426

Effortlessly set up [SKS] on any device

Digital document management has surged in popularity among organizations and individuals alike. It serves as an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, amend, and electronically sign your documents promptly without any holdups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to alter and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M Income Tax Business

Create this form in 5 minutes!

How to create an eSignature for the schedule m income tax business 10998426

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule M Income Tax Business?

Schedule M Income Tax Business is a form used by businesses to report income and deductions. It helps ensure that all income is accurately reported to the IRS, which is crucial for compliance. Using airSlate SignNow can streamline the process of preparing and submitting this form.

-

How can airSlate SignNow help with Schedule M Income Tax Business?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and send their Schedule M Income Tax Business documents. With its user-friendly interface, you can easily manage your tax documents and ensure they are submitted on time. This reduces the risk of errors and enhances compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for small businesses and larger enterprises. Each plan includes features that support the preparation and signing of documents like the Schedule M Income Tax Business. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for Schedule M Income Tax Business and automated reminders for deadlines. These features help ensure that your tax documents are organized and submitted promptly, reducing stress during tax season.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Schedule M Income Tax Business documents alongside your financial records. This integration helps streamline your workflow and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your Schedule M Income Tax Business documents offers numerous benefits, including enhanced security, ease of use, and time savings. The platform allows for quick eSigning and document sharing, which can signNowly speed up the tax filing process. Additionally, it helps maintain compliance with IRS regulations.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and employs advanced encryption to protect sensitive tax information, including your Schedule M Income Tax Business documents. The platform is designed to ensure that your data remains confidential and secure throughout the signing and submission process.

Get more for Schedule M Income Tax Business

- Vastine mahdolliseen knnyttmiseen ja maahantulokieltoon migri form

- Lsbn clinical disclosure form louisiana state board of nursing

- Da form 7278 r risk level worksheet

- Fuel truck permit film location application los angeles county fire lacounty form

- Richiesta di trascrizione del certificato di nascita request of birth conslondra esteri form

- Halappendices nc form page 1882017

- Skip a payment application greater texas federal credit union gtfcu form

- Everything changes 4ls1a columbus city schools form

Find out other Schedule M Income Tax Business

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online