Schedule 4255 Income Tax Misc Form

What is the Schedule 4255 Income Tax Misc

The Schedule 4255 Income Tax Misc is a tax form used by individuals and businesses in the United States to report specific types of income and deductions. This form is particularly relevant for taxpayers who need to disclose miscellaneous income that does not fit into standard categories. It helps the IRS ensure that all income is accurately reported and taxed accordingly. Understanding this form is essential for compliance with federal tax regulations.

How to use the Schedule 4255 Income Tax Misc

Using the Schedule 4255 Income Tax Misc involves several steps. First, gather all necessary financial documents that pertain to the miscellaneous income you need to report. Next, accurately fill out the form, ensuring that all income sources are included. It is important to follow the IRS guidelines closely to avoid any errors. Once completed, the form should be submitted along with your main tax return, either electronically or via mail.

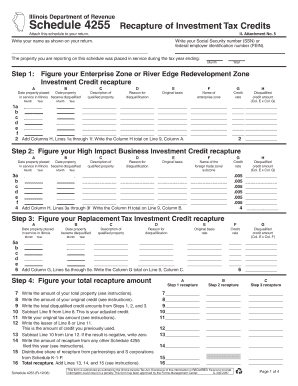

Steps to complete the Schedule 4255 Income Tax Misc

Completing the Schedule 4255 Income Tax Misc requires careful attention to detail. Begin by entering your personal information at the top of the form. Then, list each source of miscellaneous income, providing the amount earned from each source. Ensure that you include any relevant deductions that apply to your situation. Double-check all entries for accuracy before submitting the form with your tax return. It may be helpful to consult with a tax professional if you have questions during this process.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 4255 Income Tax Misc align with the standard tax return deadlines. Typically, individual taxpayers must submit their returns by April 15 of each year. If you require additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these important dates is crucial for timely and compliant tax filing.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Schedule 4255 Income Tax Misc. Taxpayers should refer to the IRS instructions for this form, which detail eligibility criteria, reporting requirements, and common mistakes to avoid. Adhering to these guidelines helps ensure that your tax return is processed smoothly and reduces the risk of audits or penalties.

Required Documents

To accurately complete the Schedule 4255 Income Tax Misc, you will need several documents. This includes records of all miscellaneous income sources, such as 1099 forms, bank statements, and receipts for any deductions you plan to claim. Having these documents organized and readily available will facilitate the completion of the form and support your reported income during any potential review by the IRS.

Penalties for Non-Compliance

Failing to accurately report income on the Schedule 4255 Income Tax Misc can result in significant penalties. The IRS may impose fines for underreporting income, which could include interest on unpaid taxes and additional penalties for late submissions. To avoid these consequences, it is essential to complete the form correctly and file it on time, ensuring full compliance with tax laws.

Quick guide on how to complete schedule 4255 income tax misc

Easily Prepare [SKS] on Any Device

The use of online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and effortlessly. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Most Convenient Way to Modify and Electronically Sign [SKS]

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 4255 Income Tax Misc

Create this form in 5 minutes!

How to create an eSignature for the schedule 4255 income tax misc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 4255 Income Tax Misc. and why is it important?

Schedule 4255 Income Tax Misc. is a form used by taxpayers to report specific types of income and deductions. Understanding this schedule is crucial for accurate tax reporting and compliance, ensuring you maximize your deductions and minimize your tax liability.

-

How can airSlate SignNow help with completing Schedule 4255 Income Tax Misc.?

airSlate SignNow provides an intuitive platform for eSigning and managing documents, including tax forms like Schedule 4255 Income Tax Misc. With our solution, you can easily fill out, sign, and send your tax documents securely and efficiently.

-

What features does airSlate SignNow offer for managing Schedule 4255 Income Tax Misc.?

Our platform offers features such as customizable templates, secure eSigning, and document tracking, all of which streamline the process of managing Schedule 4255 Income Tax Misc. This ensures that you can focus on your business while we handle the paperwork.

-

Is airSlate SignNow cost-effective for small businesses needing Schedule 4255 Income Tax Misc.?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible, allowing small businesses to access essential features for managing Schedule 4255 Income Tax Misc. without breaking the bank.

-

Can I integrate airSlate SignNow with other software for Schedule 4255 Income Tax Misc. management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your Schedule 4255 Income Tax Misc. seamlessly. This integration helps streamline your workflow and ensures all your documents are in one place.

-

What are the benefits of using airSlate SignNow for Schedule 4255 Income Tax Misc.?

Using airSlate SignNow for Schedule 4255 Income Tax Misc. provides numerous benefits, including enhanced security, ease of use, and time savings. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring compliance with tax regulations.

-

How secure is airSlate SignNow when handling Schedule 4255 Income Tax Misc. documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Schedule 4255 Income Tax Misc. documents, ensuring that your sensitive information remains confidential and secure.

Get more for Schedule 4255 Income Tax Misc

- Doh 166 form

- Application for admission fishburne military school fishburne form

- B 1040 us bankruptcy court casb uscourts form

- Residential sample bill duquesne light form

- Patient specific direction psd for university hospitals of form

- Write no objection letter from parents form

- Pretrial catalogue florida sample form

- Soil test pit log form owrp asttbc

Find out other Schedule 4255 Income Tax Misc

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast