Illinois Department of Revenue Schedule 1299 D Attach to Your Form IL 1120, IL 1041, or IL 990 T

Understanding the Illinois Department Of Revenue Schedule 1299 D

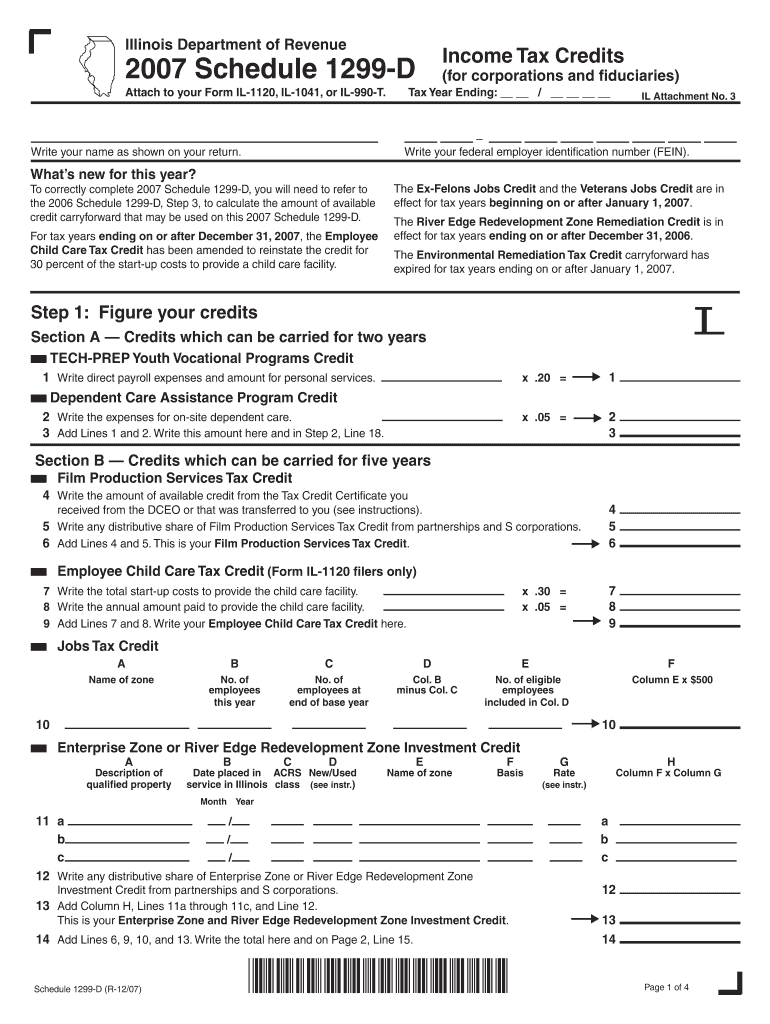

The Illinois Department Of Revenue Schedule 1299 D is a crucial form that taxpayers must attach to their Form IL 1120, IL 1041, or IL 990 T. This schedule is specifically designed for businesses and entities that are claiming a credit for tax paid to other states. It provides a detailed account of the credits that can be claimed, ensuring compliance with Illinois tax laws.

How to Use the Illinois Department Of Revenue Schedule 1299 D

To effectively use the Schedule 1299 D, taxpayers should first ensure they have completed the primary tax form, whether it is IL 1120, IL 1041, or IL 990 T. After completing the main form, attach the Schedule 1299 D to provide the necessary details about the credits being claimed. This includes reporting the amount of tax paid to other states and calculating the allowable credit to reduce the Illinois tax liability.

Steps to Complete the Illinois Department Of Revenue Schedule 1299 D

Completing the Schedule 1299 D involves several steps:

- Gather all relevant documentation regarding taxes paid to other states.

- Fill out the identification section, including your business name and tax identification number.

- Report the amount of tax paid to other states in the designated sections.

- Calculate the allowable credit based on the guidelines provided by the Illinois Department of Revenue.

- Review the completed schedule for accuracy before attaching it to your main tax form.

Key Elements of the Illinois Department Of Revenue Schedule 1299 D

Important elements of the Schedule 1299 D include:

- Identification Information: This section requires the taxpayer's name, address, and identification number.

- Tax Credit Calculation: Detailed instructions on how to calculate the credit for taxes paid to other states.

- Signature Section: A space for the taxpayer or authorized representative to sign, affirming the accuracy of the information provided.

Filing Deadlines for the Illinois Department Of Revenue Schedule 1299 D

It is essential to be aware of the filing deadlines for Schedule 1299 D. Generally, this schedule must be submitted along with the corresponding tax form by the due date of that form. For most taxpayers, this is typically the 15th day of the fourth month following the end of the tax year. However, extensions may be available, and it is advisable to check the Illinois Department of Revenue website for the most current deadlines.

Digital Submission of the Illinois Department Of Revenue Schedule 1299 D

Taxpayers can submit the Schedule 1299 D electronically when filing their tax forms online. This method is often faster and more secure than traditional paper filing. Utilizing digital tools can streamline the process, allowing for easier tracking and management of submitted documents. Ensure that all necessary information is accurately filled out before submission to avoid delays.

Quick guide on how to complete illinois department of revenue schedule 1299 d attach to your form il 1120 il 1041 or il 990 t

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and secure it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign [SKS] without stress

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule 1299 d attach to your form il 1120 il 1041 or il 990 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule 1299 D?

The Illinois Department Of Revenue Schedule 1299 D is a form that businesses must attach to their Form IL 1120, IL 1041, or IL 990 T to report certain tax credits. This schedule helps ensure compliance with state tax regulations and allows for the proper calculation of tax liabilities.

-

How do I complete the Illinois Department Of Revenue Schedule 1299 D?

To complete the Illinois Department Of Revenue Schedule 1299 D, gather all necessary financial documents and follow the instructions provided by the Illinois Department of Revenue. Ensure that you accurately report all applicable credits and attach the completed schedule to your Form IL 1120, IL 1041, or IL 990 T.

-

What are the benefits of using airSlate SignNow for submitting the Illinois Department Of Revenue Schedule 1299 D?

Using airSlate SignNow allows you to easily eSign and send your Illinois Department Of Revenue Schedule 1299 D securely and efficiently. Our platform streamlines the document submission process, ensuring that your forms are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Illinois Department Of Revenue Schedule 1299 D?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution provides access to features that simplify the process of preparing and submitting the Illinois Department Of Revenue Schedule 1299 D, making it a valuable investment for your business.

-

Can I integrate airSlate SignNow with other software for filing the Illinois Department Of Revenue Schedule 1299 D?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to streamline your workflow when filing the Illinois Department Of Revenue Schedule 1299 D. This integration helps ensure that your data is consistent and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing the Illinois Department Of Revenue Schedule 1299 D?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage to help you manage the Illinois Department Of Revenue Schedule 1299 D efficiently. These tools simplify the process of preparing, signing, and storing your tax documents.

-

How can I ensure my Illinois Department Of Revenue Schedule 1299 D is submitted on time?

To ensure timely submission of your Illinois Department Of Revenue Schedule 1299 D, use airSlate SignNow's reminders and tracking features. These tools help you stay organized and alert you to deadlines, ensuring that your forms are submitted promptly with all necessary attachments.

Get more for Illinois Department Of Revenue Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

- Yexus lub neej pdf form

- Lejekontrakt typeformular u 1991

- Supply and demand super teacher worksheets deaccessproject form

- Pediatric symptom checklist 17 psc 17 wyomingpal form

- Machtiging motorrijtuigenbelasting automatisch betalen form

- Royal caribbean application form kings recruit

- Tactical worksheet usar midwest search and rescue midwestsearchandrescue form

- Tulare county league of mexican american woman form

Find out other Illinois Department Of Revenue Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe