Illinois Department of Revenue Year Ending Schedule J Attach to Your Form IL 1120

Understanding the Illinois Department Of Revenue Year Ending Schedule J

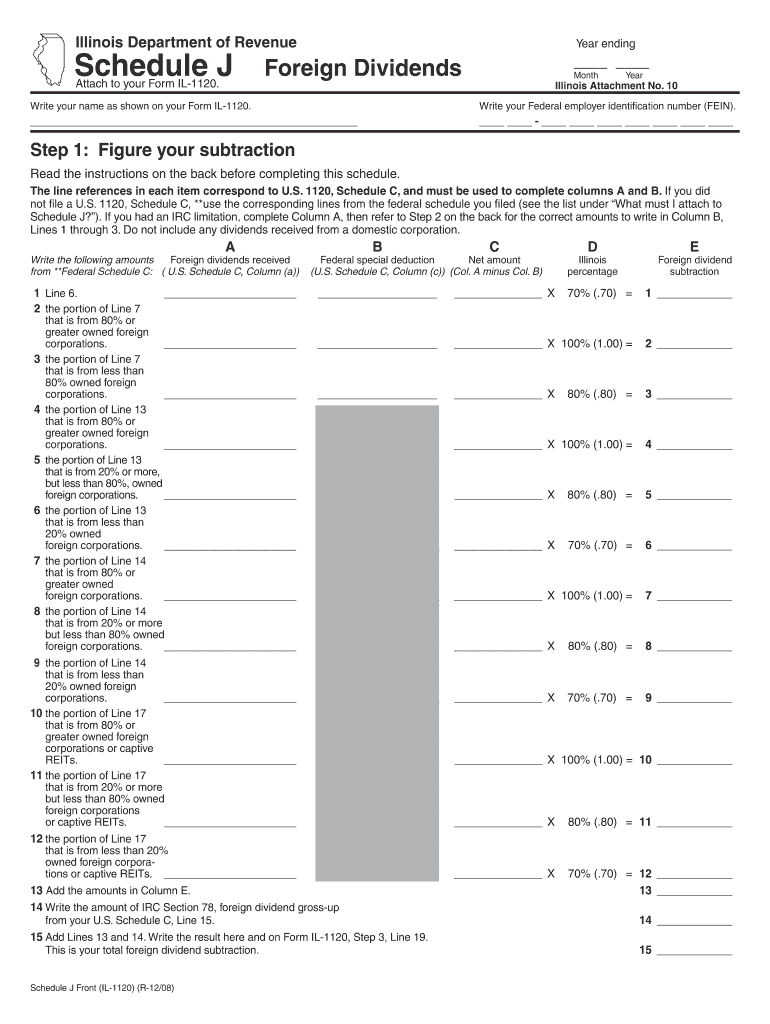

The Illinois Department Of Revenue Year Ending Schedule J is a crucial document that corporations must attach to their Form IL 1120. This schedule is specifically designed to report the income and expenses of a corporation for the tax year ending. It provides detailed information that helps the state assess the corporation's tax liability accurately. Corporations must ensure that all relevant financial data is included in this schedule to comply with state tax regulations.

How to Utilize the Illinois Department Of Revenue Year Ending Schedule J

To effectively use the Illinois Department Of Revenue Year Ending Schedule J, businesses should start by gathering all necessary financial documents, including income statements and expense reports. Once these documents are compiled, corporations can fill out the schedule by entering the required figures in the appropriate sections. It is essential to follow the instructions provided by the Illinois Department of Revenue to ensure accuracy. After completing the schedule, it must be attached to the Form IL 1120 before submission.

Steps for Completing the Illinois Department Of Revenue Year Ending Schedule J

Completing the Illinois Department Of Revenue Year Ending Schedule J involves several key steps:

- Gather all financial records, including revenue and expense statements.

- Review the instructions for the schedule to understand the required information.

- Fill in the income section with total revenue earned during the tax year.

- Document all allowable deductions in the expense section.

- Calculate the net income by subtracting total expenses from total revenue.

- Double-check all entries for accuracy and completeness.

- Attach the completed schedule to your Form IL 1120 before filing.

Key Components of the Illinois Department Of Revenue Year Ending Schedule J

The Illinois Department Of Revenue Year Ending Schedule J includes several critical components that must be accurately reported:

- Total Revenue: This section requires the total amount of income generated by the corporation during the tax year.

- Deductible Expenses: Corporations can list various business expenses that are permissible under Illinois tax law.

- Net Income Calculation: This is derived from the total revenue minus total deductible expenses, which determines the corporation's taxable income.

- Signature Section: An authorized representative of the corporation must sign the schedule, affirming the accuracy of the information provided.

Legal Considerations for the Illinois Department Of Revenue Year Ending Schedule J

Filing the Illinois Department Of Revenue Year Ending Schedule J is not only a matter of compliance but also a legal requirement for corporations operating in Illinois. Failure to submit this schedule accurately and on time can lead to penalties, including fines or interest on unpaid taxes. It is essential for corporations to keep detailed records and ensure that all information reported is truthful and complete to avoid legal repercussions.

Filing Deadlines for the Illinois Department Of Revenue Year Ending Schedule J

Corporations must adhere to specific filing deadlines for the Illinois Department Of Revenue Year Ending Schedule J. Generally, the schedule must be submitted along with Form IL 1120 by the due date of the corporation's tax return. For most corporations, this deadline is the fifteenth day of the third month following the end of the tax year. It is advisable to verify the exact due date each year, as it may vary depending on specific circumstances or changes in tax law.

Quick guide on how to complete illinois department of revenue year ending schedule j attach to your form il 1120

Complete [SKS] effortlessly on any gadget

Digital document administration has gained traction among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, adjust, and eSign your documents quickly without interruptions. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-driven activity today.

The easiest method to modify and eSign [SKS] seamlessly

- Find [SKS] and click on Get Form to get started.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document administration needs in just a few clicks from any device you prefer. Alter and eSign [SKS] while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Year Ending Schedule J Attach To Your Form IL 1120

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue year ending schedule j attach to your form il 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Year Ending Schedule J?

The Illinois Department Of Revenue Year Ending Schedule J is a form that businesses must complete and attach to their Form IL 1120 to report income and deductions accurately. This schedule helps ensure compliance with state tax regulations and provides a clear overview of a company's financial activities for the year.

-

How do I attach the Illinois Department Of Revenue Year Ending Schedule J to my Form IL 1120?

To attach the Illinois Department Of Revenue Year Ending Schedule J to your Form IL 1120, simply include the completed schedule with your tax return submission. Ensure that all required information is filled out accurately to avoid delays in processing your return.

-

What features does airSlate SignNow offer for completing the Illinois Department Of Revenue Year Ending Schedule J?

airSlate SignNow provides an intuitive platform for completing the Illinois Department Of Revenue Year Ending Schedule J, allowing users to fill out forms electronically and eSign documents securely. This streamlines the process, making it easier to manage tax documentation efficiently.

-

Is airSlate SignNow cost-effective for businesses needing to file the Illinois Department Of Revenue Year Ending Schedule J?

Yes, airSlate SignNow is a cost-effective solution for businesses that need to file the Illinois Department Of Revenue Year Ending Schedule J. With competitive pricing plans, it offers a budget-friendly option for managing and eSigning important tax documents.

-

Can I integrate airSlate SignNow with other software for filing the Illinois Department Of Revenue Year Ending Schedule J?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to file the Illinois Department Of Revenue Year Ending Schedule J. This integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the Illinois Department Of Revenue Year Ending Schedule J?

Using airSlate SignNow for the Illinois Department Of Revenue Year Ending Schedule J offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. The platform simplifies the eSigning process, allowing you to focus on your business while ensuring compliance with tax regulations.

-

How can airSlate SignNow help me avoid mistakes when filing the Illinois Department Of Revenue Year Ending Schedule J?

airSlate SignNow helps minimize mistakes when filing the Illinois Department Of Revenue Year Ending Schedule J by providing clear instructions and validation checks. This ensures that all necessary fields are completed correctly, reducing the risk of errors that could lead to penalties.

Get more for Illinois Department Of Revenue Year Ending Schedule J Attach To Your Form IL 1120

Find out other Illinois Department Of Revenue Year Ending Schedule J Attach To Your Form IL 1120

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple