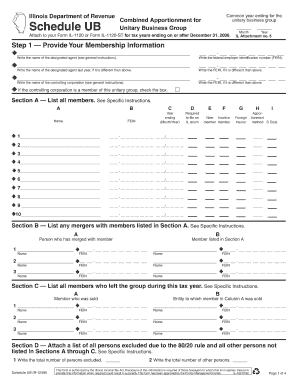

Illinois Department of Revenue Schedule UB Common Year Ending for the Unitary Business Group Combined Apportionment for Unitary Form

Understanding the Illinois Department Of Revenue Schedule UB

The Illinois Department Of Revenue Schedule UB is a crucial form for businesses operating as a unitary business group. This form is specifically designed for combined apportionment, allowing businesses to report income and allocate it appropriately among their members. It must be attached to either Form IL 1120 or Form IL 1120 ST for tax years ending on or after December 31. Understanding this form is essential for compliance with state tax regulations and ensuring accurate reporting of business income.

How to Use the Schedule UB

To effectively use the Illinois Department Of Revenue Schedule UB, businesses should first gather all necessary financial information from each member of the unitary business group. This includes income statements, balance sheets, and any relevant documentation that supports the apportionment calculations. After compiling this data, businesses can proceed to fill out the Schedule UB, ensuring that all figures are accurate and reflective of the group's overall financial situation. Once completed, the form should be attached to the appropriate IL 1120 or IL 1120 ST submission.

Steps to Complete the Schedule UB

Completing the Illinois Department Of Revenue Schedule UB involves several key steps:

- Gather financial documents from all members of the unitary business group.

- Calculate the total income for the group and determine the apportionment factors.

- Fill out the Schedule UB, ensuring all calculations are accurate and complete.

- Attach the completed Schedule UB to your Form IL 1120 or Form IL 1120 ST.

- Review the entire submission for accuracy before filing.

Legal Use of the Schedule UB

The Illinois Department Of Revenue Schedule UB is legally required for businesses that qualify as a unitary business group. It ensures that the income is reported correctly and that the tax liability is calculated based on the combined income of the group. Failure to use this form appropriately can lead to penalties and increased scrutiny from tax authorities. Therefore, it is essential for businesses to understand their obligations under Illinois tax law when utilizing this schedule.

Key Elements of the Schedule UB

Several key elements must be included when filling out the Illinois Department Of Revenue Schedule UB:

- Identification of all members of the unitary business group.

- Total income and apportionment factors for the group.

- Details on how income is allocated among members.

- Signatures of authorized representatives from each member.

Filing Deadlines for the Schedule UB

It is important for businesses to be aware of the filing deadlines associated with the Illinois Department Of Revenue Schedule UB. The form must be submitted along with Form IL 1120 or Form IL 1120 ST by the due date for those forms, typically the 15th day of the fourth month following the end of the tax year. Businesses should ensure timely submission to avoid late fees and penalties.

Quick guide on how to complete illinois department of revenue schedule ub common year ending for the unitary business group combined apportionment for unitary

Prepare [SKS] effortlessly on any device

Online document administration has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] without effort

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment For Unitary

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule ub common year ending for the unitary business group combined apportionment for unitary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment?

The Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment is a form used by businesses to report their income and apportionment for tax purposes. It is essential for unitary business groups to accurately complete this schedule to ensure compliance with Illinois tax regulations.

-

How do I attach the Schedule UB to my Form IL 1120 or Form IL 1120 ST?

To attach the Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment to your Form IL 1120 or Form IL 1120 ST, simply include it as an additional document when submitting your tax return. Ensure that all required information is filled out correctly to avoid delays in processing.

-

What are the benefits of using airSlate SignNow for submitting tax documents?

Using airSlate SignNow allows businesses to easily eSign and send documents, including the Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment. This streamlines the submission process, reduces paperwork, and ensures that your documents are securely delivered and tracked.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those set by the Illinois Department Of Revenue. By using our platform, you can confidently submit your Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment while adhering to all necessary legal requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including eSigning, document templates, and secure storage. These features make it easy to manage your Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment and other important tax documents efficiently.

-

How does airSlate SignNow integrate with other software?

airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This means you can easily connect your existing systems to manage the Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment alongside other business processes.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you need basic eSigning capabilities or advanced features for managing the Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment, there is a plan that fits your needs and budget.

Get more for Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment For Unitary

Find out other Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment For Unitary

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast