Year Ending Illinois Department of Revenue Schedule CR Attach to Your Form IL 1041 Credit for Tax Paid to Other States Month Res

Understanding the Year Ending Illinois Department Of Revenue Schedule CR

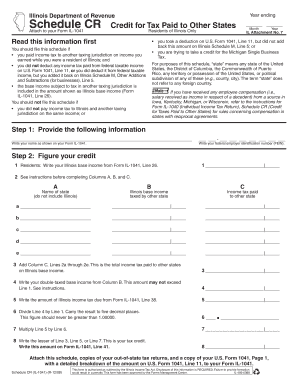

The Year Ending Illinois Department Of Revenue Schedule CR is a crucial form for residents of Illinois who are filing their Form IL-1041. This schedule allows taxpayers to claim a credit for taxes paid to other states. It is specifically designed for individuals who have income sourced from outside Illinois and have already paid taxes to those states. By completing this schedule, taxpayers can potentially reduce their Illinois tax liability, ensuring they are not taxed twice on the same income.

How to Use the Schedule CR with Form IL-1041

To effectively use the Schedule CR, residents must first complete their Form IL-1041. Once this is done, they need to gather documentation of the taxes paid to other states. This documentation may include tax returns or payment receipts from those states. After compiling the necessary information, taxpayers can fill out the Schedule CR, detailing the amounts paid to other states and calculating the credit to be claimed. It is essential to attach this completed schedule to the Form IL-1041 when submitting it to the Illinois Department of Revenue.

Steps to Complete the Schedule CR

Completing the Schedule CR involves several important steps:

- Gather all relevant documents showing taxes paid to other states.

- Fill out the personal information section of the Schedule CR.

- Detail the income earned in other states and the taxes paid.

- Calculate the credit based on the lesser of the taxes paid or the Illinois tax on that income.

- Review the completed schedule for accuracy.

- Attach the Schedule CR to your Form IL-1041 before submission.

State-Specific Rules for the Schedule CR

Illinois has specific rules that govern the use of Schedule CR. Residents must ensure that the taxes claimed as credits were actually paid to another state and that the income was earned while they were a resident of Illinois. Additionally, the credit cannot exceed the amount of Illinois tax attributable to the income earned in the other state. It is important for taxpayers to be aware of these limitations and to consult the Illinois Department of Revenue guidelines if they have questions regarding eligibility.

Filing Deadlines for Schedule CR and Form IL-1041

Taxpayers must adhere to specific filing deadlines for the Schedule CR and Form IL-1041. Typically, these forms are due on the 15th day of the fourth month following the end of the tax year. For most individuals, this means that if the tax year ends on December 31, the forms must be filed by April 15 of the following year. It is advisable to check for any updates or changes to deadlines that may be announced by the Illinois Department of Revenue.

Eligibility Criteria for Claiming the Credit

To qualify for the credit on the Schedule CR, taxpayers must meet certain eligibility criteria. They must be residents of Illinois and have income that is subject to tax in both Illinois and another state. The taxes paid to the other state must be valid and documented. Furthermore, the credit is only applicable to taxes paid on income that is also reported on the Illinois return. Understanding these criteria is essential for taxpayers to ensure they can legitimately claim the credit.

Quick guide on how to complete year ending illinois department of revenue schedule cr attach to your form il 1041 credit for tax paid to other states month

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the year ending illinois department of revenue schedule cr attach to your form il 1041 credit for tax paid to other states month

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Year Ending Illinois Department Of Revenue Schedule CR?

The Year Ending Illinois Department Of Revenue Schedule CR is a form that Illinois residents must attach to their Form IL 1041 to claim a credit for taxes paid to other states. This form is essential for ensuring that you receive the appropriate tax credits and avoid double taxation. It's important to complete this form accurately to comply with Illinois tax regulations.

-

Who needs to file the Year Ending Illinois Department Of Revenue Schedule CR?

Residents of Illinois who have paid taxes to other states and are filing Form IL 1041 must complete the Year Ending Illinois Department Of Revenue Schedule CR. This applies to individuals and entities that have income sourced from outside Illinois. Proper filing ensures that you can claim the credit for taxes paid to other states.

-

How do I attach the Schedule CR to my Form IL 1041?

To attach the Year Ending Illinois Department Of Revenue Schedule CR to your Form IL 1041, simply include it as an additional document when submitting your tax return. Ensure that all required information is filled out correctly to avoid delays in processing. Following the instructions provided by the Illinois Department of Revenue will help streamline your filing process.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for signing tax documents like the Year Ending Illinois Department Of Revenue Schedule CR offers a secure and efficient solution. It allows you to eSign documents quickly, reducing the time spent on paperwork. Additionally, airSlate SignNow provides a cost-effective way to manage your tax documents digitally, ensuring compliance and ease of access.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including options for individuals and businesses. The cost is competitive and reflects the value of the features provided, such as secure eSigning and document management. Investing in airSlate SignNow can save you time and resources when handling tax forms like the Year Ending Illinois Department Of Revenue Schedule CR.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This integration allows you to manage your documents and eSign forms like the Year Ending Illinois Department Of Revenue Schedule CR directly within your preferred tax software. This streamlines the process and minimizes the risk of errors.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including secure eSigning, customizable templates, and real-time tracking of document status. These features are particularly useful for managing tax documents such as the Year Ending Illinois Department Of Revenue Schedule CR. With airSlate SignNow, you can ensure that your documents are organized and easily accessible.

Get more for Year Ending Illinois Department Of Revenue Schedule CR Attach To Your Form IL 1041 Credit For Tax Paid To Other States Month Res

Find out other Year Ending Illinois Department Of Revenue Schedule CR Attach To Your Form IL 1041 Credit For Tax Paid To Other States Month Res

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement