Identify the Entities from Whom You Received Income Form

What is the Identify The Entities From Whom You Received Income

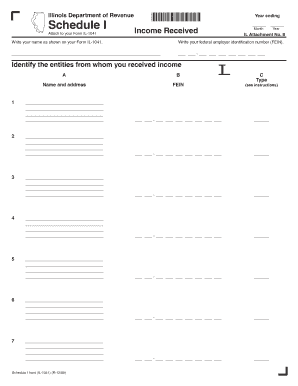

The form titled "Identify The Entities From Whom You Received Income" is primarily used for documenting the sources of income received by an individual or business. This form helps in maintaining accurate records for tax purposes, ensuring that all income is reported correctly to the Internal Revenue Service (IRS). It is essential for individuals who may have multiple income streams, such as freelance work, rental income, or investment earnings. By identifying these entities, taxpayers can better manage their financial obligations and comply with federal tax regulations.

How to use the Identify The Entities From Whom You Received Income

Using the "Identify The Entities From Whom You Received Income" form involves several straightforward steps. First, gather all relevant documentation that outlines your income sources, such as pay stubs, bank statements, and contracts. Next, fill out the form by listing each entity from which you received income, including their names and contact information. Be sure to include the amounts received and the nature of the income. Once completed, this form can serve as a reference for your tax filings and financial records.

Steps to complete the Identify The Entities From Whom You Received Income

Completing the "Identify The Entities From Whom You Received Income" form requires careful attention to detail. Follow these steps:

- Collect all income-related documents.

- List each entity from whom you received income, including their address and contact details.

- Specify the type of income received (e.g., wages, dividends, rental income).

- Record the total amount received from each entity.

- Review the form for accuracy before submission.

By following these steps, you can ensure that your income sources are clearly identified and documented.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of income and the use of forms like "Identify The Entities From Whom You Received Income." It is crucial to adhere to these guidelines to avoid penalties. According to the IRS, all income must be reported, regardless of the source. This includes income from self-employment, investments, and other forms of compensation. Familiarizing yourself with IRS publications related to income reporting can help ensure compliance and provide clarity on any questions you may have.

Required Documents

To accurately complete the "Identify The Entities From Whom You Received Income," certain documents are essential. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Bank statements showing deposits.

- Rental agreements for rental income.

- Investment statements for dividends and interest.

Having these documents on hand will facilitate a smoother process in identifying your income sources.

Penalties for Non-Compliance

Failing to accurately report income can lead to significant penalties imposed by the IRS. Non-compliance may result in fines, interest on unpaid taxes, and potential audits. It is essential to ensure that all income sources are identified and reported correctly. The IRS may impose additional penalties for negligence or fraud, making it crucial to maintain accurate records and complete the "Identify The Entities From Whom You Received Income" form diligently.

Quick guide on how to complete identify the entities from whom you received income

Complete [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow apps for Android or iOS and simplify any document-related procedure today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Identify The Entities From Whom You Received Income

Create this form in 5 minutes!

How to create an eSignature for the identify the entities from whom you received income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer to help me identify the entities from whom I received income?

airSlate SignNow provides a range of features that streamline document management and eSigning. With customizable templates and automated workflows, you can easily identify the entities from whom you received income, ensuring that all necessary documentation is in order. The platform also allows for secure storage and easy retrieval of signed documents.

-

How can airSlate SignNow assist in tracking income sources?

Using airSlate SignNow, you can efficiently track income sources by organizing and categorizing your documents. The platform enables you to identify the entities from whom you received income by keeping all related contracts and agreements in one place. This organization helps in maintaining clear records for accounting and tax purposes.

-

Is airSlate SignNow cost-effective for small businesses looking to identify income sources?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, small businesses can access powerful tools to identify the entities from whom they received income without breaking the bank. The value provided by the platform far exceeds its cost, making it a smart investment.

-

Can I integrate airSlate SignNow with other software to manage income documentation?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and CRM software. This allows you to easily identify the entities from whom you received income by linking your documents directly to your financial systems, enhancing your overall workflow and efficiency.

-

What benefits does airSlate SignNow provide for identifying income sources?

The primary benefit of using airSlate SignNow is its ability to simplify the process of identifying the entities from whom you received income. The platform enhances collaboration, reduces paperwork, and speeds up the eSigning process, allowing you to focus more on your business rather than administrative tasks. Additionally, it ensures compliance and security for all your documents.

-

How secure is airSlate SignNow when handling sensitive income-related documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect your sensitive documents. When you identify the entities from whom you received income, you can trust that your information is safe and secure throughout the entire eSigning process.

-

What types of documents can I manage with airSlate SignNow to identify income sources?

With airSlate SignNow, you can manage a variety of documents, including contracts, invoices, and agreements. This versatility allows you to effectively identify the entities from whom you received income by keeping all relevant paperwork organized and easily accessible. The platform supports multiple file formats, making it adaptable to your needs.

Get more for Identify The Entities From Whom You Received Income

Find out other Identify The Entities From Whom You Received Income

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF