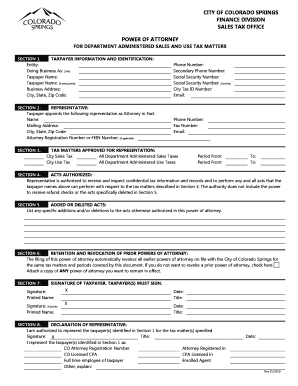

Power of Attorney City of Colorado Springs Finance Division Sales Tax Form

What is the Power of Attorney for City of Colorado Springs Finance Division Sales Tax

The Power of Attorney (POA) for the City of Colorado Springs Finance Division regarding sales tax allows an individual or business to designate another person to act on their behalf in matters related to sales tax obligations. This includes filing returns, making payments, and addressing any inquiries from the tax department. The POA is essential for ensuring that someone with the appropriate authority can manage tax responsibilities, especially for those who may not be able to handle these tasks personally due to time constraints or other reasons.

Steps to Complete the Power of Attorney for City of Colorado Springs Finance Division Sales Tax

Completing the Power of Attorney for the City of Colorado Springs involves several key steps:

- Obtain the official POA form from the City of Colorado Springs Finance Division.

- Fill out the form with accurate information, including the name of the principal (the person granting authority) and the agent (the person receiving authority).

- Specify the scope of powers granted to the agent, ensuring it covers all necessary sales tax responsibilities.

- Sign and date the form in the presence of a notary public to ensure legal validity.

- Submit the completed form to the Finance Division, either online, by mail, or in person.

Legal Use of the Power of Attorney for City of Colorado Springs Finance Division Sales Tax

The legal use of the Power of Attorney for sales tax in Colorado Springs is governed by state laws. It is important to ensure that the POA is executed in compliance with these laws to be considered valid. This includes adhering to any specific requirements regarding signatures, notarization, and the scope of authority granted. A properly executed POA can help avoid complications in tax matters and ensures that the designated agent can act effectively on behalf of the principal.

Required Documents for the Power of Attorney for City of Colorado Springs Finance Division Sales Tax

To complete the Power of Attorney, certain documents are typically required:

- The official Power of Attorney form from the City of Colorado Springs Finance Division.

- A valid form of identification for both the principal and the agent, such as a driver's license or passport.

- Any additional documentation that may support the need for the POA, such as business registration documents if the principal is a business entity.

Filing Deadlines / Important Dates for the Power of Attorney for City of Colorado Springs Finance Division Sales Tax

When dealing with sales tax matters, it is crucial to be aware of filing deadlines and important dates. The Power of Attorney should be submitted well in advance of any tax filing deadlines to ensure that the designated agent has the authority to act on behalf of the principal. Key dates may include:

- Quarterly sales tax return due dates.

- Annual sales tax reconciliation deadlines.

- Any specific deadlines set by the City of Colorado Springs Finance Division for submitting POA forms.

Penalties for Non-Compliance with Sales Tax Regulations

Failure to comply with sales tax regulations can result in significant penalties. These may include:

- Fines for late filing or payment of sales tax returns.

- Interest on unpaid taxes.

- Potential legal action for persistent non-compliance.

It is essential to ensure that the Power of Attorney is in place and that all tax obligations are met to avoid these penalties.

Quick guide on how to complete power of attorney city of colorado springs finance division sales tax

Manage Power Of Attorney City Of Colorado Springs Finance Division Sales Tax seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, amend, and electronically sign your documents swiftly and without hindrances. Handle Power Of Attorney City Of Colorado Springs Finance Division Sales Tax on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign Power Of Attorney City Of Colorado Springs Finance Division Sales Tax effortlessly

- Obtain Power Of Attorney City Of Colorado Springs Finance Division Sales Tax and then click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the frustration of tedious form searching, or the need for printing new document copies due to errors. airSlate SignNow fulfills your document management needs with just a few clicks from your selected device. Modify and electronically sign Power Of Attorney City Of Colorado Springs Finance Division Sales Tax and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the co city sales tax rate in Colorado?

The co city sales tax rate varies depending on the municipality. To get the exact rate, businesses should check the local city regulations. Understanding the co city sales tax is essential for compliance and accurate pricing of goods and services.

-

How does airSlate SignNow help with co city sales tax documentation?

airSlate SignNow provides an efficient way to manage documents related to co city sales tax. With our eSignature solution, businesses can quickly send and sign tax documents, ensuring they remain compliant without unnecessary delays.

-

Is airSlate SignNow cost-effective for handling co city sales tax paperwork?

Yes, airSlate SignNow is an affordable solution for managing co city sales tax documentation. Our pricing plans cater to all business sizes, providing the tools necessary to streamline tax document handling without breaking the bank.

-

What features does airSlate SignNow offer for co city sales tax processing?

airSlate SignNow offers features like eSigning, template management, and audit trails specifically beneficial for co city sales tax processing. These tools help ensure your tax documents are securely handled and easily accessible.

-

Can I integrate airSlate SignNow with my accounting software for co city sales tax?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions to streamline co city sales tax management. These integrations help automate the workflow, simplifying both documentation and reporting.

-

How can airSlate SignNow improve my overall workflow regarding co city sales tax?

By using airSlate SignNow, businesses can signNowly reduce the time spent managing co city sales tax paperwork. Our platform automates the eSignature process, simplifies document tracking, and minimizes errors, leading to enhanced overall productivity.

-

What benefits does airSlate SignNow provide when dealing with co city sales tax audits?

airSlate SignNow offers a comprehensive audit trail which is invaluable during co city sales tax audits. This feature ensures every signed document is logged, making it easier to present your records and remain compliant with tax regulations.

Get more for Power Of Attorney City Of Colorado Springs Finance Division Sales Tax

- Financial planning worksheet form

- Come worship with us its in the room shana wilson williams form

- Duquesne transcripsts form

- Federal resume template word download form

- Kuakini online job application form

- Dwc form 83 42560570

- Ckgs disclaimer form

- Usa boxing physical form fill online printable fillable

Find out other Power Of Attorney City Of Colorado Springs Finance Division Sales Tax

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free