Illinois Department of Revenue Gains from Sales or Exchanges of Property Acquired Before August 1, 1969 Schedule F Tax Year Endi Form

Understanding the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F

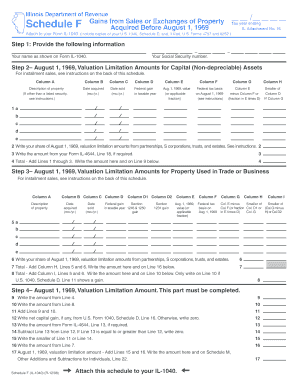

The Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F is a specific tax form used to report gains from the sale or exchange of property that was acquired prior to August 1, 1969. This form is crucial for taxpayers who have engaged in transactions involving such properties, as it helps determine the tax implications of these sales or exchanges. It is essential to accurately report any gains to comply with state tax regulations and avoid potential penalties.

Steps to Complete the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F

Completing the Schedule F involves several steps to ensure accurate reporting. First, gather all necessary documentation related to the property, including purchase records and any improvements made. Next, calculate the total gain from the sale or exchange by subtracting the property's adjusted basis from the sale price. Fill out the form by entering this information in the appropriate sections, ensuring that all calculations are correct. Finally, review the completed form for accuracy before submission to the Illinois Department of Revenue.

Key Elements of the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F

The key elements of this form include sections for reporting the property description, acquisition date, sale or exchange date, sale price, and adjusted basis. Additionally, taxpayers must provide details on any improvements made to the property, as these can affect the adjusted basis. Understanding these elements is vital for accurately reporting gains and ensuring compliance with tax laws.

Legal Use of the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F

This form serves a legal purpose in documenting the financial transactions related to property sales or exchanges. Proper use of Schedule F ensures that taxpayers fulfill their legal obligations under Illinois tax law. Failure to accurately report gains can lead to penalties and interest charges, making it essential for taxpayers to understand the legal implications of this form.

Filing Deadlines and Important Dates for the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F

Taxpayers must be aware of the filing deadlines associated with Schedule F to avoid late penalties. Typically, the form must be submitted along with the annual tax return by the due date, which is usually April 15 for most taxpayers. However, extensions may apply, and it is advisable to check the latest guidelines from the Illinois Department of Revenue for specific dates and any changes in deadlines.

Form Submission Methods for the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F

Taxpayers can submit the completed Schedule F through various methods. The form can be filed online via the Illinois Department of Revenue's e-filing system, mailed to the appropriate address, or submitted in person at designated offices. Each method has its own requirements and processing times, so it is important to choose the option that best fits the taxpayer's needs.

Quick guide on how to complete illinois department of revenue gains from sales or exchanges of property acquired before august 1 1969 schedule f tax year

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without interruptions. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and elevate your document-centric processes today.

The simplest way to edit and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form navigation, or errors that require new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Endi

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue gains from sales or exchanges of property acquired before august 1 1969 schedule f tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No.?

The Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No. is a tax form used to report gains from the sale or exchange of certain properties. This form is essential for taxpayers who have acquired property before the specified date and need to comply with state tax regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No.?

airSlate SignNow provides an efficient platform for preparing and eSigning the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No. Our solution simplifies document management, ensuring that you can complete and submit your tax forms quickly and securely.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing tax documents like the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No. These features enhance efficiency and ensure compliance with tax regulations.

-

Is airSlate SignNow cost-effective for small businesses handling tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. By streamlining the process of managing documents like the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No., businesses can save time and reduce costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This allows users to seamlessly manage the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No. alongside their existing tools, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No., provides numerous benefits. These include improved accuracy, faster processing times, and enhanced security for sensitive information.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents. When handling forms like the Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Ending IL Attachment No., users can trust that their information is safe and secure.

Get more for Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Endi

Find out other Illinois Department Of Revenue Gains From Sales Or Exchanges Of Property Acquired Before August 1, 1969 Schedule F Tax Year Endi

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease