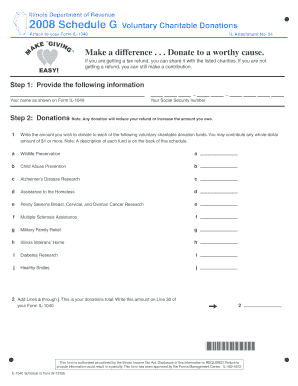

If You Are Getting a Tax Refund, You Can Share it with the Listed Charities Form

Understanding the Tax Refund Donation Process

If you receive a tax refund, you have the opportunity to donate a portion of it to listed charities. This process allows you to support causes you care about while potentially benefiting from tax deductions. The IRS provides guidelines on how to designate your refund for charitable contributions, which can be a meaningful way to give back to your community and support organizations that align with your values.

Steps to Donate Your Tax Refund

To share your tax refund with charities, follow these steps:

- Determine the amount you wish to donate from your tax refund.

- Review the list of eligible charities provided by the IRS or your tax preparation software.

- Complete your tax return, ensuring that you indicate your donation on the appropriate line.

- Submit your tax return electronically or by mail, depending on your preference.

By following these steps, you can easily allocate part of your tax refund to support charitable organizations.

IRS Guidelines for Charitable Donations

The IRS has specific guidelines regarding charitable donations made from tax refunds. To qualify for a deduction, the charity must be recognized as a tax-exempt organization under section 501(c)(3) of the Internal Revenue Code. It is essential to keep records of your donations, including receipts from the charities, to substantiate your contributions when filing your taxes.

Eligibility Criteria for Charitable Contributions

Not all taxpayers are eligible to donate part of their tax refund to charities. To qualify, you must:

- Be receiving a tax refund from your federal tax return.

- Choose a charity that is recognized by the IRS.

- Ensure your donation does not exceed the amount of your refund.

Understanding these criteria can help you make informed decisions about your charitable contributions.

Required Documentation for Donations

When donating part of your tax refund, proper documentation is crucial. You should retain:

- Receipts from the charity confirming your donation.

- A copy of your tax return showing the donation amount.

- Any correspondence with the charity regarding your contribution.

This documentation will be helpful if you need to verify your donation during tax filing or in case of an audit.

Examples of Charitable Donations from Tax Refunds

Many taxpayers choose to support various causes through their tax refunds. Examples include:

- Donating to local food banks to help combat hunger.

- Supporting educational programs for underprivileged children.

- Contributing to health research organizations for disease prevention.

These examples illustrate the positive impact that donations can have on communities and the importance of supporting charitable organizations.

Quick guide on how to complete if you are getting a tax refund you can share it with the listed charities

Prepare [SKS] effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as a great eco-friendly substitute for conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to distribute your form, via email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, frustrating searches for forms, or mistakes that require new printed copies. airSlate SignNow meets all your document management concerns in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to If You Are Getting A Tax Refund, You Can Share It With The Listed Charities

Create this form in 5 minutes!

How to create an eSignature for the if you are getting a tax refund you can share it with the listed charities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I use my tax refund to support charities?

If you are getting a tax refund, you can share it with the listed charities by donating a portion of your refund directly to them. This not only helps those in need but may also provide you with potential tax deductions for the following year. Make sure to check the eligibility of the charities before making your donation.

-

What features does airSlate SignNow offer for charitable organizations?

airSlate SignNow provides features that allow charitable organizations to easily manage documents and eSignatures. This includes customizable templates, secure document storage, and the ability to track donations. If you are getting a tax refund, you can share it with the listed charities and streamline their donation processes using our platform.

-

Is airSlate SignNow cost-effective for small charities?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and charities alike. With flexible pricing plans, small charities can benefit from our services without breaking the bank. If you are getting a tax refund, you can share it with the listed charities and help them afford essential tools like airSlate SignNow.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, including CRM systems and accounting software. This allows charities to manage their operations more efficiently. If you are getting a tax refund, you can share it with the listed charities and help them enhance their operational capabilities through these integrations.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Charities can easily send and receive signed documents, which speeds up the donation process. If you are getting a tax refund, you can share it with the listed charities and help them leverage these benefits.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. This ensures that sensitive information remains protected throughout the signing process. If you are getting a tax refund, you can share it with the listed charities, knowing that their documents will be handled securely.

-

What types of documents can I eSign with airSlate SignNow?

You can eSign a wide variety of documents with airSlate SignNow, including contracts, agreements, and donation forms. This versatility makes it an ideal solution for charities looking to streamline their processes. If you are getting a tax refund, you can share it with the listed charities and help them manage their documentation more effectively.

Get more for If You Are Getting A Tax Refund, You Can Share It With The Listed Charities

Find out other If You Are Getting A Tax Refund, You Can Share It With The Listed Charities

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online