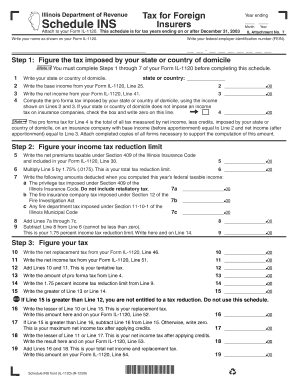

Illinois Department of Revenue Schedule INS Tax for Foreign Insurers Year Ending Month Attach to Your Form IL 1120

Understanding the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers

The Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers is a specific tax form used by foreign insurance companies operating in Illinois. This form is crucial for reporting income and determining tax obligations for the year ending in a specified month. It ensures compliance with state tax regulations and helps foreign insurers accurately report their financial activities within the state.

Steps to Complete the Illinois Department Of Revenue Schedule INS Tax

Completing the Schedule INS requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including income statements and balance sheets.

- Determine the year ending month for your reporting period.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Attach the completed Schedule INS to your Form IL 1120.

- Review the form for accuracy before submission.

Obtaining the Illinois Department Of Revenue Schedule INS Tax

The Schedule INS can be obtained from the Illinois Department of Revenue's official website. It is available for download in PDF format, allowing users to print and fill it out manually. Alternatively, businesses may find it through tax preparation software that supports Illinois tax forms.

Key Elements of the Illinois Department Of Revenue Schedule INS Tax

Several key elements must be included in the Schedule INS to ensure proper reporting:

- Identification of the foreign insurer, including name and address.

- Details of gross premiums collected during the reporting period.

- Information on any deductions applicable to the insurer.

- Calculation of the total tax owed based on the reported figures.

Filing Deadlines for the Illinois Department Of Revenue Schedule INS Tax

It is essential to be aware of the filing deadlines associated with the Schedule INS. Typically, the form must be submitted along with Form IL 1120 by the due date of the corporate income tax return. For most corporations, this deadline is the fifteenth day of the month following the end of the fiscal year.

Legal Use of the Illinois Department Of Revenue Schedule INS Tax

The Schedule INS is legally required for foreign insurers operating in Illinois to report their tax obligations accurately. Failure to file or inaccuracies in reporting can lead to penalties and interest charges. It is vital for insurers to understand their legal responsibilities and ensure compliance with state tax laws.

Quick guide on how to complete illinois department of revenue schedule ins tax for foreign insurers year ending month attach to your form il 1120

Effortlessly Create [SKS] on Any Gadget

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the features required to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign [SKS] With Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight key sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule ins tax for foreign insurers year ending month attach to your form il 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120?

The Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120 is a tax form that foreign insurers must complete to report their insurance premiums and calculate their tax liability in Illinois. This form is essential for compliance with state tax regulations and must be submitted alongside Form IL 1120.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and submit the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120. With its user-friendly interface, you can easily manage your documents and ensure timely submissions.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure cloud storage, which are crucial for managing tax documents like the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120. These features streamline the process, making it easier to handle multiple forms efficiently.

-

Is airSlate SignNow cost-effective for businesses handling tax forms?

Yes, airSlate SignNow is a cost-effective solution for businesses that need to manage tax forms, including the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120. With competitive pricing plans, it allows businesses to save on printing and mailing costs while ensuring compliance.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easier to manage your financial documents, including the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120. This integration helps streamline workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance, including the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120, provides numerous benefits. These include improved accuracy, reduced processing time, and enhanced security for sensitive documents, ensuring that your tax submissions are both timely and compliant.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect sensitive tax documents like the Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120. You can trust that your data is safe while using our platform.

Get more for Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120

Find out other Illinois Department Of Revenue Schedule INS Tax For Foreign Insurers Year Ending Month Attach To Your Form IL 1120

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe