Illinois Department of Revenue Schedule CR Attach to Your Form IL 1041 Credit for Tax Paid to Other States Year Ending Residents

Understanding the Illinois Department Of Revenue Schedule CR

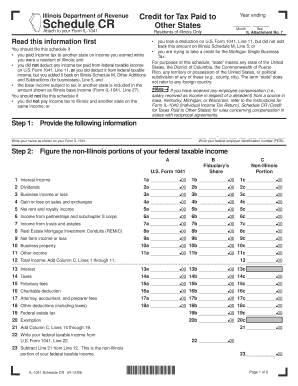

The Illinois Department Of Revenue Schedule CR is a critical form for residents of Illinois who are filing Form IL-1041. This schedule allows taxpayers to claim a credit for taxes paid to other states. It is specifically designed for individuals and entities that have income sourced from outside Illinois and have paid taxes to those states. By utilizing Schedule CR, taxpayers can reduce their Illinois tax liability, ensuring they are not taxed twice on the same income.

How to Use Schedule CR with Form IL-1041

To effectively use the Illinois Department Of Revenue Schedule CR, taxpayers should attach it to their Form IL-1041 when filing. This process involves accurately completing the schedule to reflect the taxes paid to other states. Taxpayers must provide details such as the amount of tax paid, the state in which it was paid, and any relevant income associated with that tax. Ensuring that all information is correct and complete is essential to avoid delays in processing and potential issues with the Illinois Department of Revenue.

Steps to Complete Schedule CR

Completing the Illinois Department Of Revenue Schedule CR involves several key steps:

- Gather documentation of taxes paid to other states, including tax returns and payment receipts.

- Fill out the schedule by entering your name, address, and the relevant tax information.

- Calculate the credit based on the taxes paid and the income sourced from those states.

- Attach the completed Schedule CR to your Form IL-1041 before submission.

Double-check all entries for accuracy to ensure compliance and to facilitate a smooth filing process.

Eligibility Criteria for Using Schedule CR

To be eligible to use the Illinois Department Of Revenue Schedule CR, taxpayers must meet specific criteria. Primarily, the taxpayer must be a resident of Illinois and have paid income taxes to another state on income that is also subject to Illinois tax. This form is intended for individuals, estates, or trusts that have income sourced from outside Illinois. It is important to review all eligibility requirements to ensure compliance with state tax laws.

Required Documents for Schedule CR

When completing the Illinois Department Of Revenue Schedule CR, certain documents are necessary to substantiate the claim for credit. These documents include:

- Tax returns from other states where taxes were paid.

- Proof of payment for the taxes claimed, such as receipts or bank statements.

- Any relevant schedules or forms that detail income sourced from those states.

Having these documents readily available will streamline the completion of the schedule and support the accuracy of the information provided.

Form Submission Methods for Schedule CR

Taxpayers can submit the Illinois Department Of Revenue Schedule CR along with their Form IL-1041 through various methods. The options include:

- Online submission via the Illinois Department of Revenue's e-filing system.

- Mailing a paper copy of the completed forms to the appropriate address.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can depend on personal preference, the complexity of the return, and the need for immediate confirmation of receipt.

Quick guide on how to complete illinois department of revenue schedule cr attach to your form il 1041 credit for tax paid to other states year ending

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Revise and Electronically Sign [SKS] Effortlessly

- Find [SKS] and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule CR Attach To Your Form IL 1041 Credit For Tax Paid To Other States Year Ending Residents

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule cr attach to your form il 1041 credit for tax paid to other states year ending

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule CR?

The Illinois Department Of Revenue Schedule CR is a form that residents of Illinois use to claim a credit for taxes paid to other states. This form must be attached to your Form IL 1041 when filing. It is essential for ensuring that you receive the appropriate tax credits and avoid double taxation.

-

How do I attach the Schedule CR to my Form IL 1041?

To attach the Illinois Department Of Revenue Schedule CR to your Form IL 1041, simply include it as an additional document when submitting your tax return. Ensure that all required information is filled out accurately to avoid delays in processing. This step is crucial for claiming your credit for tax paid to other states.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for signing tax documents like the Illinois Department Of Revenue Schedule CR offers a streamlined, efficient process. It allows you to eSign documents securely and quickly, ensuring that your Form IL 1041 is submitted on time. This can save you both time and stress during tax season.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to manage document signing. With various pricing plans, it caters to different budgets while offering essential features like eSigning and document management. This makes it an ideal choice for those looking to simplify their tax filing process, including the Illinois Department Of Revenue Schedule CR.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Illinois Department Of Revenue Schedule CR. These features help ensure that your Form IL 1041 is completed accurately and efficiently. Additionally, you can easily store and retrieve your documents whenever needed.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow can be integrated with various software applications, enhancing your workflow for tax document management. This includes accounting software that may assist in preparing your Form IL 1041 and attaching the Illinois Department Of Revenue Schedule CR. Integrations help streamline processes and improve overall efficiency.

-

What should I do if I make a mistake on my Schedule CR?

If you make a mistake on your Illinois Department Of Revenue Schedule CR, you should correct it as soon as possible. You can amend your Form IL 1041 by filing an amended return with the correct Schedule CR attached. It's important to address any errors promptly to avoid potential penalties or issues with your tax credits.

Get more for Illinois Department Of Revenue Schedule CR Attach To Your Form IL 1041 Credit For Tax Paid To Other States Year Ending Residents

Find out other Illinois Department Of Revenue Schedule CR Attach To Your Form IL 1041 Credit For Tax Paid To Other States Year Ending Residents

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement