Bir 1600 Form Download

What is the Bir 1600 Form Download

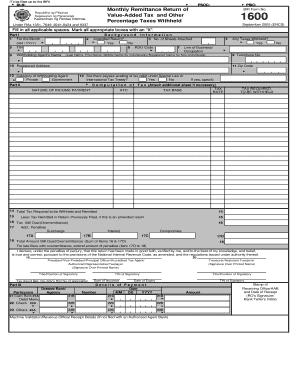

The Bir 1600 form is a remittance form used primarily for tax purposes in the Philippines. It is essential for businesses and individuals who need to report and remit various taxes, including income tax, value-added tax, and other applicable levies. The Bir 1600 form download provides users with a digital version of this document, enabling them to fill it out electronically. This format not only streamlines the process but also ensures that the form can be easily stored and shared as needed.

Steps to Complete the Bir 1600 Form Download

Completing the Bir 1600 form requires careful attention to detail. Here are the steps to ensure accurate submission:

- Download the Bir 1600 form from a reliable source.

- Open the form using a compatible PDF reader or editing software.

- Fill in the required fields, including taxpayer information, tax types, and amounts.

- Review the completed form for accuracy and completeness.

- Save the filled form in a secure location for your records.

Legal Use of the Bir 1600 Form Download

The Bir 1600 form is legally binding when filled out correctly and submitted on time. It must comply with relevant tax laws and regulations in the Philippines. Utilizing electronic signatures can enhance the legal validity of the form, provided that the eSignature meets the standards set by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Ensuring compliance with these regulations is crucial for the form's acceptance by tax authorities.

Key Elements of the Bir 1600 Form Download

When filling out the Bir 1600 form, several key elements must be included:

- Taxpayer Identification Number (TIN): This is essential for identifying the taxpayer.

- Tax Type: Specify the type of tax being remitted, such as income tax or value-added tax.

- Payment Amount: Clearly indicate the total amount being remitted.

- Period Covered: State the specific period for which the taxes are being reported.

- Signature: Include a signature or eSignature to validate the form.

Form Submission Methods

The Bir 1600 form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many tax authorities allow electronic submission through their official portals.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Taxpayers may also submit the form directly at designated tax offices.

Filing Deadlines / Important Dates

It is crucial to adhere to specific filing deadlines for the Bir 1600 form to avoid penalties. Generally, the deadlines coincide with the end of the tax period being reported. Taxpayers should be aware of these dates to ensure timely submission, which may vary based on the type of tax and the taxpayer's status. Regularly checking for updates from the tax authority can help in staying informed about any changes to deadlines.

Quick guide on how to complete bir 1600 form download

Effortlessly Prepare Bir 1600 Form Download on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as users can find the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Bir 1600 Form Download on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The Easiest Way to Edit and eSign Bir 1600 Form Download Seamlessly

- Obtain Bir 1600 Form Download and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that lead to the need for printing new document copies. airSlate SignNow streamlines all your document management needs in just a few clicks from any device of your choice. Edit and eSign Bir 1600 Form Download while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the bir form 1600 and why is it important?

The bir form 1600 is a crucial document used for tax filing in the Philippines. It's essential for businesses to properly file this form to ensure compliance with tax regulations. Understanding the significance of the bir form 1600 can help you avoid penalties and streamline your financial processes.

-

How does airSlate SignNow assist with the bir form 1600?

airSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign the bir form 1600. With its intuitive interface, you can ensure that all necessary signatures are obtained quickly and securely, making the filing process more efficient. Utilizing this tool can save you time and reduce errors in your documentation.

-

What features of airSlate SignNow support the bir form 1600?

AirSlate SignNow offers key features for the bir form 1600, including customizable templates, eSignature functionality, and automated workflows. These features streamline the process of preparing and filing your tax documents. With automated reminders, you can ensure that deadlines are met efficiently.

-

Is airSlate SignNow cost-effective for handling the bir form 1600?

Yes, airSlate SignNow is a cost-effective solution for managing the bir form 1600. With various pricing plans available, you can choose one that fits your business size and needs. Investing in this service can lead to signNow savings in time and operational compliance costs.

-

Can airSlate SignNow integrate with other software for the bir form 1600?

Absolutely! AirSlate SignNow offers seamless integrations with various software applications that can aid in the preparation of the bir form 1600. This means you can connect your accounting software, CRM, or other platforms to streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the bir form 1600?

Using airSlate SignNow for the bir form 1600 offers numerous benefits, including increased efficiency, improved accuracy, and enhanced compliance. The digital solution allows for real-time tracking of document status, which reduces the chances of missing critical tax deadlines. Additionally, it ensures that all signatures are securely captured.

-

How secure is airSlate SignNow when handling the bir form 1600?

Security is a priority at airSlate SignNow, especially when it involves sensitive documents like the bir form 1600. The platform employs robust encryption methods and secure storage to protect your information. You can confidently eSign and manage your documents without concerns about data bsignNowes.

Get more for Bir 1600 Form Download

- Ration card 7 no form

- 1199 union office 42nd street form

- List of board of directors template form

- Sample transportation contract form

- Alabama elderly simplified application project form

- James madison high school online high school diploma form

- Child support certification form

- Bmi card application form bmi healthcare

Find out other Bir 1600 Form Download

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe