Illinois Department of Revenue Schedule 1299 B Enterprise Zone or Foreign Trade Zone or Sub Zone Subtractions for Corporations a Form

Understanding the Illinois Department Of Revenue Schedule 1299 B

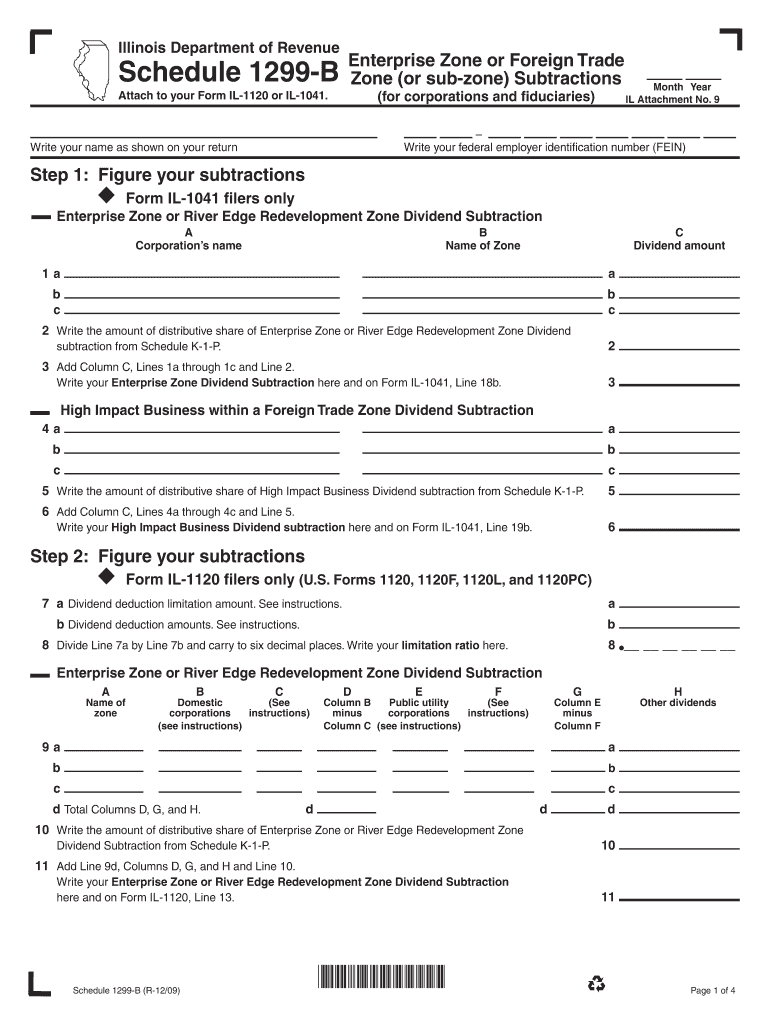

The Illinois Department Of Revenue Schedule 1299 B is a crucial form for corporations operating within designated enterprise zones or foreign trade zones in Illinois. This form allows businesses to report specific subtractions from their income, which can significantly impact their tax liabilities. The subtractions are designed to encourage economic development in certain areas by providing tax incentives to qualifying corporations. Understanding the details of this form is essential for compliance and maximizing potential tax benefits.

How to Use the Schedule 1299 B

Using the Schedule 1299 B involves several steps to ensure accurate reporting of income subtractions. Corporations must first determine their eligibility based on their location within an enterprise zone or foreign trade zone. Once eligibility is confirmed, businesses should gather all necessary documentation, including financial statements and records of operations within the designated zones. Completing the form accurately is vital, as it requires specific information about income generated and expenses incurred in these zones.

Steps to Complete the Schedule 1299 B

Completing the Schedule 1299 B involves a systematic approach:

- Identify the enterprise zone or foreign trade zone where your business operates.

- Gather financial records and documentation related to your business activities in that zone.

- Fill out the form, ensuring all sections are completed accurately, including income and subtraction calculations.

- Review the form for accuracy and completeness before submission.

- Submit the completed form along with your corporate tax return to the Illinois Department Of Revenue.

Eligibility Criteria for the Schedule 1299 B

To qualify for the benefits outlined in the Schedule 1299 B, corporations must meet specific eligibility criteria. These include operating within a designated enterprise zone or foreign trade zone, maintaining proper documentation of business activities, and adhering to state regulations regarding income reporting. It is crucial for businesses to verify their eligibility before filing to ensure compliance and avoid potential penalties.

Required Documents for Submission

When submitting the Schedule 1299 B, corporations should prepare a set of required documents to support their claims. Essential documents include:

- Financial statements that detail income and expenses.

- Proof of operations within the designated zone, such as lease agreements or utility bills.

- Any additional documentation that demonstrates compliance with state regulations.

Filing Deadlines for the Schedule 1299 B

Corporations must adhere to specific filing deadlines to ensure compliance with Illinois tax regulations. The Schedule 1299 B should be submitted along with the corporate income tax return, typically due on the fifteenth day of the month following the end of the corporation's fiscal year. It is essential to stay informed about any changes to these deadlines to avoid late penalties.

Quick guide on how to complete illinois department of revenue schedule 1299 b enterprise zone or foreign trade zone or sub zone subtractions for corporations

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule 1299 B Enterprise Zone Or Foreign Trade Zone or Sub zone Subtractions for Corporations A

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule 1299 b enterprise zone or foreign trade zone or sub zone subtractions for corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule 1299 B Enterprise Zone Or Foreign Trade Zone or Sub zone Subtractions for Corporations And?

The Illinois Department Of Revenue Schedule 1299 B Enterprise Zone Or Foreign Trade Zone or Sub zone Subtractions for Corporations And is a tax form that allows corporations to claim subtractions from their taxable income based on their activities in designated enterprise zones or foreign trade zones. This form is essential for businesses looking to maximize their tax benefits while operating in these areas.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Schedule 1299 B?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and manage their Illinois Department Of Revenue Schedule 1299 B documents electronically. With our user-friendly interface, you can streamline the process of completing and submitting this important tax form, ensuring compliance and accuracy.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and document tracking, which are crucial for managing tax documents like the Illinois Department Of Revenue Schedule 1299 B. These features enhance efficiency and ensure that your documents are handled securely and professionally.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, providing affordable pricing plans that cater to various needs. By using our platform for the Illinois Department Of Revenue Schedule 1299 B, businesses can save time and reduce costs associated with traditional document management.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage your Illinois Department Of Revenue Schedule 1299 B alongside your other financial documents. This seamless integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Illinois Department Of Revenue Schedule 1299 B, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information, including data related to the Illinois Department Of Revenue Schedule 1299 B. You can trust our platform to keep your documents safe and confidential throughout the signing process.

Get more for Illinois Department Of Revenue Schedule 1299 B Enterprise Zone Or Foreign Trade Zone or Sub zone Subtractions for Corporations A

Find out other Illinois Department Of Revenue Schedule 1299 B Enterprise Zone Or Foreign Trade Zone or Sub zone Subtractions for Corporations A

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later