Illinois Department of Revenue Schedule UB Common Year Ending for the Unitary Business Group Combined Apportionment for Unitary Form

What is the Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment

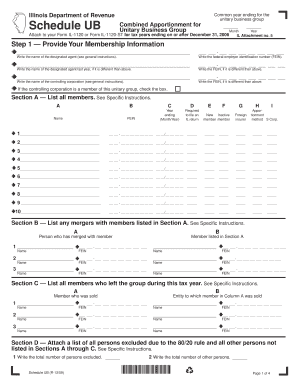

The Illinois Department Of Revenue Schedule UB is a crucial form for businesses operating as a unitary business group in Illinois. This schedule is used to report combined apportionment for tax purposes. It applies to businesses that are part of a unitary group and need to file Form IL 1120 or Form IL 1120 ST for tax years ending on or after December. The form helps determine the appropriate amount of income that should be allocated to Illinois for taxation, ensuring compliance with state tax regulations.

How to use the Illinois Department Of Revenue Schedule UB

Using the Illinois Department Of Revenue Schedule UB involves several steps. First, gather all necessary financial information from each entity within the unitary business group. This includes income statements, balance sheets, and any other relevant financial documents. Next, complete the schedule by entering the appropriate figures based on the combined financial data. Finally, attach the completed Schedule UB to your Form IL 1120 or Form IL 1120 ST when submitting your tax return. It is essential to ensure that all calculations are accurate to avoid penalties.

Steps to complete the Illinois Department Of Revenue Schedule UB

Completing the Illinois Department Of Revenue Schedule UB requires careful attention to detail. Start by identifying all entities within the unitary business group. Then, calculate the total income, property, payroll, and sales for the group. These figures will be essential for determining the apportionment factors. Fill out the schedule by entering these totals in the designated sections. Review all entries for accuracy and completeness before attaching the schedule to your main tax return. Double-check that all figures align with supporting documents.

Key elements of the Illinois Department Of Revenue Schedule UB

Key elements of the Illinois Department Of Revenue Schedule UB include the apportionment factors, which are critical for determining how much income is taxable in Illinois. The schedule typically requires information on total sales, property, and payroll for each entity in the unitary group. Additionally, it may ask for details on the type of business activities conducted by each entity. Understanding these elements is vital for accurate reporting and compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Department Of Revenue Schedule UB align with the deadlines for Form IL 1120 and Form IL 1120 ST. Generally, these forms are due on the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this typically means the deadline is April 15. It is essential to stay informed about any changes to deadlines or extensions that may be applicable to ensure timely filing and avoid penalties.

Penalties for Non-Compliance

Failure to comply with the requirements of the Illinois Department Of Revenue Schedule UB can result in significant penalties. These may include fines for late filing, inaccuracies in reporting, or failure to submit the required documentation. Additionally, businesses may face interest charges on any unpaid taxes. To mitigate these risks, it is crucial to ensure that all forms are completed accurately and submitted on time, adhering to the guidelines set forth by the Illinois Department of Revenue.

Quick guide on how to complete illinois department of revenue schedule ub common year ending for the unitary business group combined apportionment for unitary 10998606

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors requiring new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Adjust and electronically sign [SKS] and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule ub common year ending for the unitary business group combined apportionment for unitary 10998606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment?

The Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment is a form used by businesses to report their income and apportionment for tax purposes. It is specifically designed for unitary business groups and must be attached to Form IL 1120 or Form IL 1120 ST for tax years ending on or after December.

-

How can airSlate SignNow assist with the Illinois Department Of Revenue Schedule UB?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Illinois Department Of Revenue Schedule UB. Our solution simplifies the document management process, ensuring that your forms are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Illinois Department Of Revenue Schedule UB. These features help streamline the filing process and enhance compliance with state regulations.

-

Is airSlate SignNow cost-effective for small businesses handling tax forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage tax forms, including the Illinois Department Of Revenue Schedule UB. Our pricing plans are designed to fit various budgets, ensuring that businesses can access essential document management tools without overspending.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage the Illinois Department Of Revenue Schedule UB alongside your financial records. This integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. By utilizing our platform for the Illinois Department Of Revenue Schedule UB, businesses can ensure timely submissions and maintain compliance with tax regulations.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by employing advanced encryption and secure storage solutions. When handling sensitive forms like the Illinois Department Of Revenue Schedule UB, you can trust that your information is protected against unauthorized access.

Get more for Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment For Unitary

- Residential rental lease application vermont form

- Salary verification form for potential lease vermont

- Landlord agreement to allow tenant alterations to premises vermont form

- Notice of default on residential lease vermont form

- Landlord tenant lease co signer agreement vermont form

- Application for sublease vermont form

- Inventory and condition of leased premises for pre lease and post lease vermont form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out vermont form

Find out other Illinois Department Of Revenue Schedule UB Common Year Ending For The Unitary Business Group Combined Apportionment For Unitary

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application