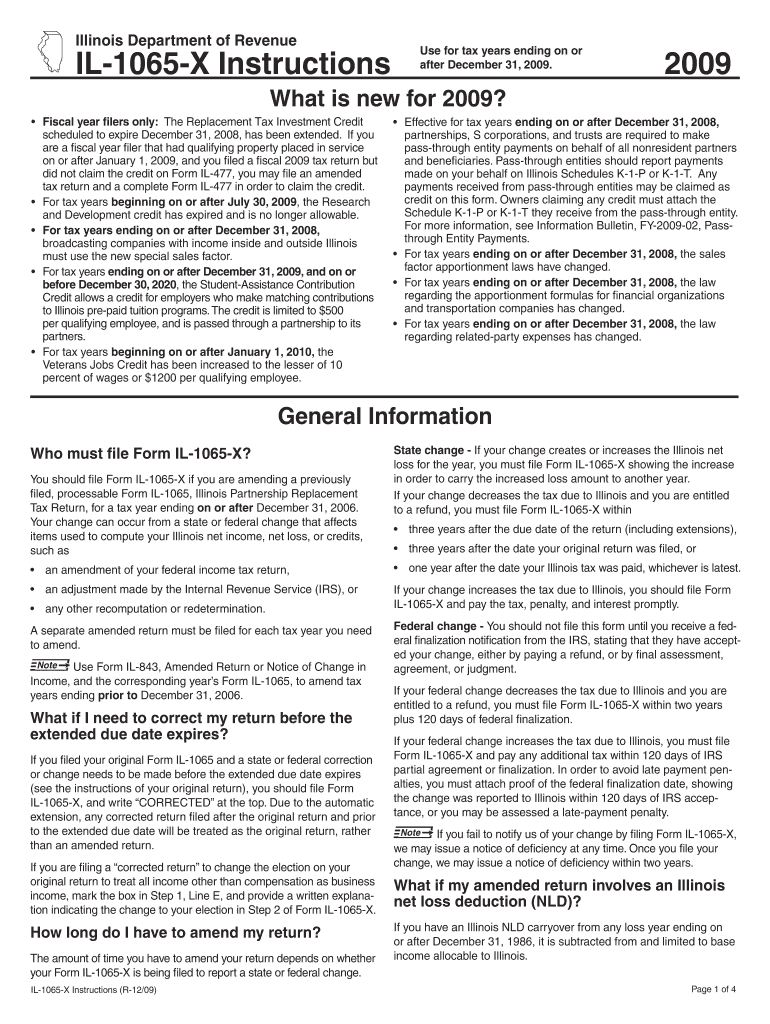

Fiscal Year Filers Only the Replacement Tax Investment Credit Form

Understanding the Fiscal Year Filers Only The Replacement Tax Investment Credit

The Fiscal Year Filers Only The Replacement Tax Investment Credit is a tax incentive designed for businesses that operate on a fiscal year basis. This credit allows eligible taxpayers to receive a reduction in their tax liability by investing in qualified property. The investment must meet specific criteria set forth by the IRS, ensuring that it supports economic growth and development. This credit is particularly beneficial for businesses looking to expand their operations or improve their infrastructure.

Steps to Complete the Fiscal Year Filers Only The Replacement Tax Investment Credit

To successfully complete the process for the Fiscal Year Filers Only The Replacement Tax Investment Credit, follow these steps:

- Determine eligibility based on your business structure and investment type.

- Gather necessary documentation, including proof of investment and financial records.

- Complete the required forms accurately, ensuring all information is current and correct.

- Submit the forms by the designated deadline, either electronically or via mail.

- Keep copies of all submitted documents for your records.

Eligibility Criteria for the Fiscal Year Filers Only The Replacement Tax Investment Credit

To qualify for the Fiscal Year Filers Only The Replacement Tax Investment Credit, businesses must meet specific criteria. These criteria typically include:

- Operating on a fiscal year basis rather than a calendar year.

- Investing in qualifying property that meets IRS standards.

- Maintaining accurate financial records to substantiate the investment.

- Filing the appropriate tax forms within the required timeframe.

Required Documents for the Fiscal Year Filers Only The Replacement Tax Investment Credit

When applying for the Fiscal Year Filers Only The Replacement Tax Investment Credit, businesses must prepare and submit several key documents. These documents may include:

- Proof of investment, such as invoices or contracts.

- Financial statements that reflect the investment's impact.

- Completed tax forms specific to the investment credit.

- Any additional documentation requested by the IRS or state tax authorities.

IRS Guidelines for the Fiscal Year Filers Only The Replacement Tax Investment Credit

The IRS provides detailed guidelines regarding the Fiscal Year Filers Only The Replacement Tax Investment Credit. These guidelines outline:

- The types of investments that qualify for the credit.

- How to calculate the credit amount based on eligible investments.

- Filing procedures and deadlines that must be adhered to.

- Potential audits and compliance checks by the IRS.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for businesses seeking the Fiscal Year Filers Only The Replacement Tax Investment Credit. Important dates to remember include:

- The deadline for submitting tax forms related to the credit.

- Any extension dates that may apply for fiscal year filers.

- Dates for potential audits or reviews by tax authorities.

Quick guide on how to complete fiscal year filers only the replacement tax investment credit

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or cover sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, be it via email, SMS, or invite link, or download it to your computer.

Eliminate concerns of lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from the device of your choice. Edit and eSign [SKS] to ensure excellent communication throughout your form preparation sequence with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Fiscal Year Filers Only The Replacement Tax Investment Credit

Create this form in 5 minutes!

How to create an eSignature for the fiscal year filers only the replacement tax investment credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fiscal Year Filers Only The Replacement Tax Investment Credit?

The Fiscal Year Filers Only The Replacement Tax Investment Credit is a tax incentive designed for businesses that file their taxes on a fiscal year basis. This credit allows eligible companies to reduce their tax liability by investing in qualified assets. Understanding this credit can help businesses maximize their tax savings and improve cash flow.

-

How can airSlate SignNow help with the Fiscal Year Filers Only The Replacement Tax Investment Credit?

airSlate SignNow provides an efficient platform for businesses to manage their documentation related to the Fiscal Year Filers Only The Replacement Tax Investment Credit. By streamlining the eSigning process, businesses can quickly prepare and submit necessary forms, ensuring compliance and timely filing. This efficiency can save time and reduce the risk of errors.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents. These features ensure that businesses can easily create, send, and sign documents related to the Fiscal Year Filers Only The Replacement Tax Investment Credit. Additionally, the platform provides audit trails for compliance purposes.

-

Is airSlate SignNow cost-effective for small businesses filing for the Fiscal Year Filers Only The Replacement Tax Investment Credit?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With flexible pricing plans, companies can choose a package that fits their budget while still accessing essential features for managing the Fiscal Year Filers Only The Replacement Tax Investment Credit. This affordability helps small businesses maximize their tax benefits without overspending.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management software, making it easier to manage the Fiscal Year Filers Only The Replacement Tax Investment Credit. These integrations allow for seamless data transfer and improved workflow efficiency, ensuring that all necessary documentation is readily available and organized.

-

What are the benefits of using airSlate SignNow for tax credits?

Using airSlate SignNow for managing tax credits like the Fiscal Year Filers Only The Replacement Tax Investment Credit provides numerous benefits. It enhances efficiency by reducing paperwork and streamlining the signing process. Additionally, the platform's security features ensure that sensitive tax information is protected, giving businesses peace of mind.

-

How does airSlate SignNow ensure compliance with tax regulations?

airSlate SignNow ensures compliance with tax regulations by providing features such as secure document storage, audit trails, and customizable templates that adhere to legal standards. This is particularly important for businesses claiming the Fiscal Year Filers Only The Replacement Tax Investment Credit, as compliance is crucial for successful tax filings. Regular updates to the platform also help maintain adherence to changing regulations.

Get more for Fiscal Year Filers Only The Replacement Tax Investment Credit

- Comrec checklist college of medicine medcol form

- Military housing office marine corps air station beaufort beaufort marines form

- Yexus lub neej pdf form

- Lejekontrakt typeformular u 1991

- Supply and demand super teacher worksheets deaccessproject form

- Pediatric symptom checklist 17 psc 17 wyomingpal form

- Machtiging motorrijtuigenbelasting automatisch betalen form

- Royal caribbean application form kings recruit

Find out other Fiscal Year Filers Only The Replacement Tax Investment Credit

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA