IL990 T X Tax Illinois Form

What is the IL990 T X Tax Illinois

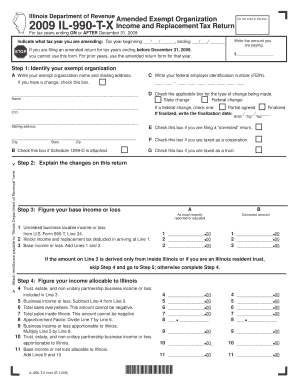

The IL990 T X Tax Illinois is a specific tax form used by certain businesses and organizations in Illinois to report and pay taxes on unrelated business income. This form is essential for tax-exempt organizations that generate income from activities not directly related to their exempt purpose. By accurately completing the IL990 T X, organizations ensure compliance with state tax regulations while managing their tax liabilities effectively.

How to use the IL990 T X Tax Illinois

To use the IL990 T X Tax Illinois, organizations must first determine if they have unrelated business income that needs to be reported. Once confirmed, they should gather all necessary financial information related to the income-generating activities. The form requires detailed reporting of income, expenses, and any applicable deductions. After filling out the form, it should be submitted to the appropriate state tax authority along with any required payments.

Steps to complete the IL990 T X Tax Illinois

Completing the IL990 T X Tax Illinois involves several key steps:

- Gather financial records related to unrelated business income.

- Fill out the form with accurate income and expense figures.

- Calculate the tax owed based on the reported income.

- Review the form for accuracy and completeness.

- Submit the form and payment to the Illinois Department of Revenue by the deadline.

Filing Deadlines / Important Dates

Filing deadlines for the IL990 T X Tax Illinois typically align with the organization's fiscal year-end. Organizations must file the form by the 15th day of the fifth month following the end of their fiscal year. It is crucial to stay informed about any changes in deadlines or requirements, as these can vary from year to year.

Required Documents

To complete the IL990 T X Tax Illinois, organizations need to provide several key documents:

- Financial statements detailing income and expenses.

- Records of unrelated business income activities.

- Any previous tax returns relevant to the current filing.

- Documentation supporting deductions claimed on the form.

Penalties for Non-Compliance

Failure to file the IL990 T X Tax Illinois or to pay the required taxes can result in significant penalties. Organizations may face fines, interest on unpaid taxes, and potential loss of tax-exempt status. It is essential to adhere to filing requirements to avoid these repercussions and maintain compliance with state regulations.

Quick guide on how to complete il990 t x tax illinois

Complete [SKS] easily on any device

Online document management has gained prominence among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The optimal way to modify and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il990 t x tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL990 T X Tax Illinois form?

The IL990 T X Tax Illinois form is used for reporting and paying taxes related to certain transactions in the state of Illinois. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations. Understanding this form can help streamline your tax reporting process.

-

How can airSlate SignNow help with the IL990 T X Tax Illinois?

airSlate SignNow simplifies the process of preparing and submitting the IL990 T X Tax Illinois form by allowing users to eSign documents securely. Our platform ensures that all necessary signatures are collected efficiently, reducing the time spent on paperwork. This can enhance your overall tax filing experience.

-

What are the pricing options for using airSlate SignNow for IL990 T X Tax Illinois?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on the IL990 T X Tax Illinois form. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically designed for handling the IL990 T X Tax Illinois?

Yes, airSlate SignNow includes features that are particularly beneficial for managing the IL990 T X Tax Illinois form. These features include customizable templates, automated reminders for signatures, and secure document storage. This ensures that your tax documents are organized and easily accessible.

-

Can I integrate airSlate SignNow with other software for IL990 T X Tax Illinois?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage the IL990 T X Tax Illinois form. This integration allows for a more streamlined workflow, reducing the chances of errors and improving efficiency in your tax processes.

-

What are the benefits of using airSlate SignNow for IL990 T X Tax Illinois?

Using airSlate SignNow for the IL990 T X Tax Illinois form provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform allows for quick eSigning and document management, which can signNowly reduce the stress associated with tax filing. Additionally, you can track the status of your documents in real-time.

-

Is airSlate SignNow user-friendly for filing IL990 T X Tax Illinois?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to file the IL990 T X Tax Illinois form. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively. This accessibility helps businesses focus on their core operations.

Get more for IL990 T X Tax Illinois

- Warning of default on commercial lease vermont form

- Warning of default on residential lease vermont form

- Landlord tenant closing statement to reconcile security deposit vermont form

- Vermont name change form

- Name change notification form vermont

- Commercial building or space lease vermont form

- Vermont relative caretaker legal documents package vermont form

- Vt legal form

Find out other IL990 T X Tax Illinois

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word