California Income Tax Return Form

What is the California Income Tax Return Form

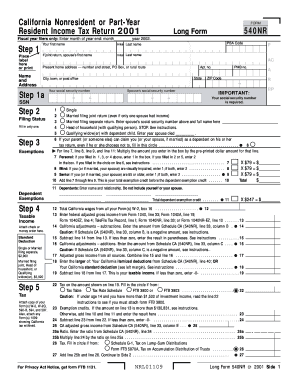

The California resident income tax return form is a document that residents of California use to report their income and calculate their state tax liability. This form is essential for individuals and families to comply with California tax laws. The form includes various sections where taxpayers provide personal information, income details, deductions, and credits applicable to their situation. Understanding this form is crucial for ensuring accurate reporting and compliance with state regulations.

Steps to Complete the California Income Tax Return Form

Completing the California resident income tax return form involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, dividends, and any other earnings.

- Calculate deductions and credits you may qualify for, such as standard deductions or itemized deductions.

- Compute your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

How to Obtain the California Income Tax Return Form

The California resident income tax return form can be obtained through several avenues. Taxpayers can download the form directly from the California Franchise Tax Board (FTB) website. Alternatively, physical copies are available at various locations, including public libraries and post offices. Additionally, many tax preparation software programs include the California tax forms as part of their services, allowing for easy completion and electronic submission.

Legal Use of the California Income Tax Return Form

The California resident income tax return form is legally binding when completed and submitted according to state regulations. To ensure that the form is recognized as valid, it must be signed and dated by the taxpayer. Utilizing electronic signatures through compliant platforms can further enhance the legal standing of the submitted document. It is important to adhere to all guidelines and requirements set forth by the California Franchise Tax Board to avoid any issues with tax compliance.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the California resident income tax return form. Typically, the filing deadline for individual income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension, which generally allows for an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To accurately complete the California resident income tax return form, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Records of any tax credits claimed

- Previous year’s tax return for reference

Having these documents organized and ready will facilitate a smoother filing process.

Form Submission Methods

Taxpayers have multiple options for submitting the California resident income tax return form. The most common methods include:

- Online submission through the California Franchise Tax Board website or authorized e-filing services.

- Mailing a paper form to the appropriate address provided by the FTB.

- In-person submission at designated FTB offices, though this may require an appointment.

Choosing the right method can depend on personal preference and the complexity of the tax situation.

Quick guide on how to complete california income tax return form

Execute California Income Tax Return Form seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage California Income Tax Return Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and eSign California Income Tax Return Form effortlessly

- Locate California Income Tax Return Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to apply your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign California Income Tax Return Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california income tax return form

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the California resident income tax form?

The California resident income tax form is a document used by residents of California to report their income and calculate their tax liability. It helps ensure compliance with state tax laws. Completing this form accurately is essential for filing taxes correctly in California.

-

How can I access the California resident income tax form?

You can access the California resident income tax form online through the California Franchise Tax Board website. Alternatively, airSlate SignNow can help streamline the process of filling out and submitting your forms electronically, making it quicker and more efficient.

-

Is there a fee to file the California resident income tax form using airSlate SignNow?

AirSlate SignNow offers a cost-effective solution to eSign and submit documents, including the California resident income tax form. While the convenience of eSigning may involve a subscription fee, it saves time and reduces errors in the filing process, making it a valuable investment.

-

What are the benefits of using airSlate SignNow for my California resident income tax form?

Using airSlate SignNow for your California resident income tax form provides a user-friendly interface that simplifies the eSigning process. It allows you to securely send, sign, and store documents online, improving your productivity and ensuring compliance with California tax regulations.

-

Does airSlate SignNow integrate with accounting software for tax forms?

Yes, airSlate SignNow offers integrations with various accounting software that facilitate the completion of the California resident income tax form. This integration ensures that your financial information is accurately reflected on your tax form, making the filing process seamless and efficient.

-

Can I collaborate with others on my California resident income tax form using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to collaborate on the California resident income tax form in real-time. This feature is especially useful for families or business partners who need to complete their tax forms together, ensuring everyone’s information is included correctly.

-

What security measures does airSlate SignNow have for sensitive tax documents?

AirSlate SignNow employs industry-standard security measures to protect sensitive documents, including the California resident income tax form. Features such as encryption, secure cloud storage, and user authentication ensure that your tax information remains safe and confidential.

Get more for California Income Tax Return Form

- Nj inheritance waiver tax form 01 pdf

- Noida authority transfer memorandum online form

- Boxing form

- Prenuptial agreement florida pdf form

- Grade 8 mapeh module pdf download answer key form

- Concept of genetics by klug and cummings pdf download form

- Safety violation penalty format

- Borang koperasi tentera form

Find out other California Income Tax Return Form

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile