Illinois Department of Revenue Schedule 1299 C Income Tax Subtractions and Credits for Individuals IL Attachment No Form

What is the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

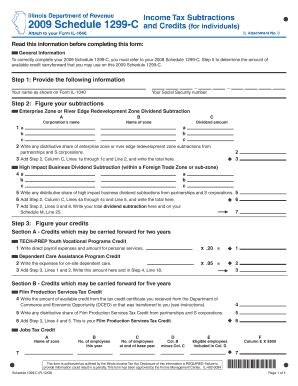

The Illinois Department Of Revenue Schedule 1299 C is a crucial form used by individuals to report specific income tax subtractions and credits. This attachment allows taxpayers to detail various deductions and credits they may qualify for, which can ultimately reduce their taxable income. Understanding this form is essential for ensuring accurate tax reporting and maximizing potential tax benefits.

How to use the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Using the Schedule 1299 C involves several steps. First, gather all necessary documentation related to your income and potential deductions. Next, fill out the form by providing accurate information regarding your income sources and the specific subtractions or credits you are claiming. It is important to ensure that all entries are clear and precise to avoid any discrepancies during the review process by the Illinois Department of Revenue.

Steps to complete the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Completing the Schedule 1299 C requires careful attention to detail. Start by entering your personal information at the top of the form. Then, proceed to list each subtraction or credit you are claiming. Ensure that you provide the required supporting documentation for each item. After filling out all sections, review the form for accuracy before submission. This thorough process helps prevent errors that could lead to delays or penalties.

Key elements of the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

The key elements of the Schedule 1299 C include sections for personal identification, income reporting, and detailed entries for each subtraction or credit. Taxpayers must provide clear descriptions and amounts for each item claimed. Additionally, the form may require specific codes or references to ensure compliance with state tax regulations. Understanding these elements is vital for effective completion and submission.

Eligibility Criteria

To be eligible for the deductions and credits reported on the Schedule 1299 C, taxpayers must meet specific criteria set forth by the Illinois Department of Revenue. This may include income limits, residency requirements, and the nature of the expenses incurred. It is important to review these criteria carefully to ensure that you qualify for the benefits you are claiming on the form.

Required Documents

When completing the Schedule 1299 C, certain documents are required to substantiate the claims made. This may include income statements, receipts for deductible expenses, and any other relevant financial documentation. Having these documents ready will facilitate a smoother filing process and help ensure that all claims are valid and supported.

Form Submission Methods

The Schedule 1299 C can be submitted through various methods, including online filing, mail, or in-person submission at designated tax offices. Each method has its own requirements and processing times, so it is advisable to choose the one that best suits your needs. Ensure that you follow the submission guidelines to avoid delays in processing your tax return.

Quick guide on how to complete illinois department of revenue schedule 1299 c income tax subtractions and credits for individuals il attachment no 10998625

Prepare [SKS] seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] to ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule 1299 c income tax subtractions and credits for individuals il attachment no 10998625

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No.?

The Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. is a form used by individuals to report various income tax subtractions and credits. This form helps taxpayers reduce their taxable income and claim eligible credits, ultimately lowering their tax liability. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No.?

airSlate SignNow provides an efficient platform for electronically signing and sending the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. This streamlines the process, ensuring that your documents are securely signed and submitted on time. Our solution simplifies tax documentation management for individuals.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure e-signatures, and document tracking, which are essential for managing tax documents like the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. These features enhance efficiency and ensure compliance with tax regulations. Users can easily manage their tax-related documents from anywhere.

-

Is airSlate SignNow cost-effective for individuals filing taxes?

Yes, airSlate SignNow is a cost-effective solution for individuals filing taxes, including those using the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. Our pricing plans are designed to fit various budgets, making it accessible for everyone. By reducing paperwork and streamlining the signing process, you can save both time and money.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, enhancing your ability to manage the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. seamlessly. This integration allows for a smoother workflow, enabling you to import and export documents easily. It ensures that all your tax-related tasks are connected and efficient.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No., offers numerous benefits. It provides a secure and user-friendly platform for e-signatures, reduces the risk of errors, and speeds up the submission process. This ultimately leads to a more organized and stress-free tax filing experience.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, ensuring that your sensitive tax documents, such as the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No., are protected. We use advanced encryption and secure cloud storage to safeguard your information. You can trust that your documents are handled with the utmost care and confidentiality.

Get more for Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Find out other Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple