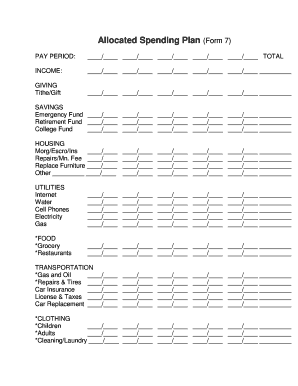

Allocated Spending Plan Form

What is the Allocated Spending Plan

The allocated spending plan is a financial tool designed to help individuals and families manage their budgets effectively. It allows users to allocate specific amounts of money to various spending categories, ensuring that expenses do not exceed income. This plan is particularly popular among those looking to gain control over their finances, reduce debt, and save for future goals. By clearly defining spending limits, users can make informed decisions about their financial priorities and avoid overspending.

How to use the Allocated Spending Plan

Using the allocated spending plan involves several straightforward steps. First, assess your total monthly income, including all sources such as wages, bonuses, and any side income. Next, identify your essential expenses, which may include housing, utilities, groceries, and transportation. After that, allocate specific amounts to discretionary spending categories like entertainment, dining out, and hobbies. Regularly track your spending against these allocations to ensure you stay within your budget. Adjustments may be necessary as circumstances change, allowing for better financial management over time.

Steps to complete the Allocated Spending Plan

Completing the allocated spending plan requires a systematic approach. Start by gathering all financial information, including income statements and expense records. Follow these steps:

- List all sources of income for the month.

- Identify fixed expenses that remain constant each month.

- Estimate variable expenses, such as groceries and entertainment.

- Allocate funds to each category based on your financial goals.

- Monitor your spending throughout the month and adjust allocations as needed.

This structured method ensures that you have a comprehensive view of your finances and can make informed decisions.

Key elements of the Allocated Spending Plan

Several key elements make up an effective allocated spending plan. These include:

- Income Assessment: A thorough understanding of all income sources.

- Expense Categories: Clear delineation between fixed and variable expenses.

- Spending Limits: Defined limits for each category to prevent overspending.

- Tracking Mechanism: A system for monitoring actual spending against the plan.

- Review Process: Regular reviews to adjust the plan based on changing financial situations.

Incorporating these elements helps ensure the plan is practical and effective in achieving financial stability.

Legal use of the Allocated Spending Plan

The allocated spending plan serves as a personal financial management tool and does not typically require legal validation. However, it is essential to ensure that the plan complies with any relevant financial regulations, particularly if it involves joint accounts or shared finances. Maintaining transparency with all parties involved is crucial, especially in situations where multiple individuals contribute to a household budget. While the plan itself is not legally binding, it can serve as a reference in financial discussions or disputes.

Examples of using the Allocated Spending Plan

Examples of how to effectively use the allocated spending plan can vary widely based on individual circumstances. For instance:

- A family may allocate funds for groceries, utilities, and childcare while setting aside money for family outings and vacations.

- A college student might focus on tuition, textbooks, and living expenses while budgeting for entertainment and dining.

- A retiree may prioritize healthcare costs, housing, and leisure activities, ensuring that their fixed income covers all necessary expenses.

These examples illustrate the flexibility of the allocated spending plan in catering to diverse financial situations.

Quick guide on how to complete allocated spending plan

Complete Allocated Spending Plan effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without hindrance. Manage Allocated Spending Plan on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Allocated Spending Plan seamlessly

- Obtain Allocated Spending Plan and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all your information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Allocated Spending Plan and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an allocated spending plan in airSlate SignNow?

An allocated spending plan in airSlate SignNow refers to a structured budgeting method that allows businesses to assign financial resources for specific projects or initiatives. This helps organizations manage their budget effectively while utilizing our eSigning capabilities, streamlining document workflows, and ensuring compliance.

-

How does airSlate SignNow support an allocated spending plan?

airSlate SignNow supports an allocated spending plan by providing tools for tracking expenses and managing document approvals related to each budget category. Our platform allows users to create, send, and sign documents that correspond with their financial allocations, ensuring transparency and accountability in financial management.

-

Are there pricing options for businesses with an allocated spending plan?

Yes, airSlate SignNow offers flexible pricing options tailored to accommodate businesses with an allocated spending plan. Depending on your organization's size and features needed, you can choose a plan that best meets your budget and document signing needs, ensuring a cost-effective solution for managing your resources.

-

What features of airSlate SignNow enhance an allocated spending plan?

Key features of airSlate SignNow that enhance an allocated spending plan include customizable templates, real-time tracking of document status, and integration with financial tools. These features enable efficient management of budgets and facilitate faster approvals, making it easier to adhere to your financial allocations.

-

Can I integrate airSlate SignNow with my accounting software for my allocated spending plan?

Absolutely! airSlate SignNow can be integrated with various accounting software solutions, allowing for seamless management of your allocated spending plan. This integration streamlines the process of tracking expenses and enhances collaboration between teams working on budget-related documents.

-

What are the benefits of using airSlate SignNow for my allocated spending plan?

Using airSlate SignNow for your allocated spending plan offers numerous benefits, such as improved efficiency in document handling, reduced turnaround times for approvals, and enhanced security for sensitive financial information. This streamlined approach helps organizations maintain control over their budgets without sacrificing productivity.

-

How can airSlate SignNow help reduce overspending in an allocated spending plan?

airSlate SignNow helps reduce overspending in an allocated spending plan by providing tools for budget tracking and document approval workflows that require authorization before funds are released. This proactive approach encourages responsible spending and ensures that all expenditures align with your preset financial allocations.

Get more for Allocated Spending Plan

Find out other Allocated Spending Plan

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim