Illinois Department of Revenue Schedule 1299 C Income Tax Subtractions and Credits for Individuals IL Attachment No Form

Understanding the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

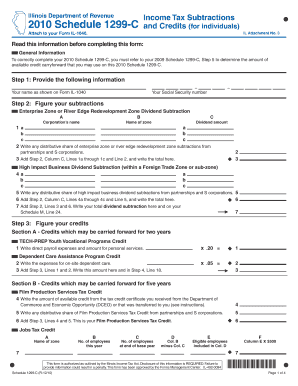

The Illinois Department Of Revenue Schedule 1299 C is a crucial form for individuals looking to claim specific income tax subtractions and credits. This attachment is designed to help taxpayers identify eligible deductions that can reduce their taxable income, ultimately lowering their overall tax liability. It is essential for individuals to understand the various subtractions and credits available, as these can significantly impact their tax return. The Schedule 1299 C includes sections for reporting different types of income adjustments, such as retirement income, social security benefits, and other qualifying subtractions.

How to Complete the Illinois Department Of Revenue Schedule 1299 C

Completing the Illinois Department Of Revenue Schedule 1299 C involves several steps. First, gather all necessary documentation that supports your claims for subtractions and credits. This may include tax forms, receipts, and other relevant financial information. Next, carefully fill out the form by following the provided instructions. Ensure that you accurately report your income and any applicable deductions. Double-check your entries for accuracy before submitting the form. It is advisable to keep copies of all submitted documents for your records.

Eligibility Criteria for the Illinois Department Of Revenue Schedule 1299 C

To be eligible to use the Illinois Department Of Revenue Schedule 1299 C, individuals must meet specific criteria. Generally, this form is intended for residents of Illinois who are filing their state income tax returns. Taxpayers must have income that qualifies for subtractions or credits listed on the form. Additionally, certain income types, such as pensions or social security, may have specific requirements that must be met. It is important for individuals to review the eligibility guidelines carefully to ensure they can accurately complete the form.

Key Elements of the Illinois Department Of Revenue Schedule 1299 C

The Illinois Department Of Revenue Schedule 1299 C contains several key elements that taxpayers must understand. These include sections for reporting different types of income, such as wages, pensions, and social security. Each section provides specific instructions on how to calculate and report subtractions. Additionally, the form outlines various credits available to individuals, including those related to education and property taxes. Familiarizing oneself with these elements can help taxpayers maximize their deductions and credits.

Filing Deadlines for the Illinois Department Of Revenue Schedule 1299 C

Filing deadlines for the Illinois Department Of Revenue Schedule 1299 C align with the general state income tax filing deadlines. Typically, individual income tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these deadlines to avoid penalties and ensure timely processing of their tax returns. Extensions may be available, but they must be requested before the original deadline.

Form Submission Methods for the Illinois Department Of Revenue Schedule 1299 C

Taxpayers have several options for submitting the Illinois Department Of Revenue Schedule 1299 C. The form can be filed electronically through approved e-filing software, which is a convenient option for many individuals. Alternatively, taxpayers may choose to mail a paper version of the form to the appropriate address provided by the Illinois Department of Revenue. In-person submission is also an option at designated tax offices. Each method has its own processing times and requirements, so individuals should select the option that best suits their needs.

Quick guide on how to complete illinois department of revenue schedule 1299 c income tax subtractions and credits for individuals il attachment no 10998658

Ease of Preparing [SKS] on Any Device

Digital document management has become increasingly preferred by companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, alter, and eSign your documents quickly without interruption. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign [SKS] with minimal effort

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule 1299 c income tax subtractions and credits for individuals il attachment no 10998658

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No.?

The Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. is a form used by individuals to claim various tax subtractions and credits on their income tax returns. This form helps taxpayers reduce their taxable income and maximize their tax benefits. Understanding how to properly fill out this form can lead to signNow savings.

-

How can airSlate SignNow assist with the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No.?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. This ensures that your documents are securely signed and submitted on time, reducing the hassle of traditional paperwork. Our solution is designed to simplify the tax filing process.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individuals and larger organizations. Our plans are cost-effective, ensuring that you can manage your Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, all of which are beneficial for managing the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. These features enhance efficiency and ensure that your documents are organized and easily accessible whenever needed.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is fully compliant with all relevant tax regulations, ensuring that your use of the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. meets legal standards. Our platform prioritizes security and compliance, giving you peace of mind when handling sensitive tax documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, making it easier to manage the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. alongside your other financial tools. This seamless integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, including the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No., provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on what matters most—your finances.

Get more for Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

- Newly widowed individuals package vermont form

- Employment interview package vermont form

- Employment employee personnel file package vermont form

- Assignment of mortgage package vermont form

- Assignment of lease package vermont form

- Vermont purchase form

- Satisfaction cancellation or release of mortgage package vermont form

- Premarital agreements package vermont form

Find out other Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free