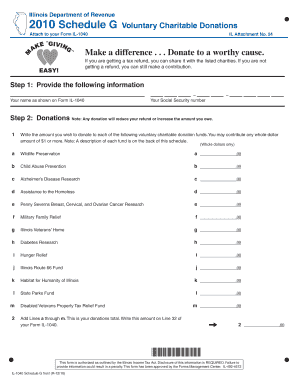

Step 2 Donations Note Any Donation Will Reduce Your Refund or Increase the Amount You Owe Form

Understanding the Step 2 Donations Note

The Step 2 Donations Note is a critical component of the tax filing process, especially for individuals who wish to make charitable contributions. This note clearly states that any donations made will either reduce your tax refund or increase the amount you owe. It is essential to understand how this note impacts your overall tax situation, as it directly affects your financial outcome when filing your taxes.

How to Complete the Step 2 Donations Note

Completing the Step 2 Donations Note involves accurately reporting your charitable contributions on your tax return. Begin by gathering all relevant documentation for your donations, such as receipts or bank statements. When filling out the form, ensure that you include the total amount of donations made during the tax year. This information should be reported in the designated section of your tax return, ensuring compliance with IRS guidelines.

IRS Guidelines for Donations

The IRS has specific guidelines regarding charitable contributions. To qualify for a tax deduction, donations must be made to eligible organizations. It is crucial to keep records of all donations, as the IRS may require proof during an audit. Additionally, the amount you can deduct may be limited based on your adjusted gross income. Familiarizing yourself with these guidelines can help you maximize your tax benefits while ensuring compliance.

Common Scenarios Impacting Your Refund

Different taxpayer scenarios can influence how donations affect your refund or tax liability. For example, self-employed individuals may have different deduction limits compared to employees. Additionally, taxpayers who itemize their deductions may benefit more from charitable contributions than those who take the standard deduction. Understanding these scenarios can help you plan your donations effectively and anticipate their impact on your tax return.

Required Documentation for Donations

When claiming deductions for charitable contributions, it is essential to maintain proper documentation. Acceptable forms of documentation include receipts from the charity, bank statements, or written acknowledgments for contributions over a specific amount. The IRS requires that you keep these records for at least three years after filing your tax return to substantiate your claims in case of an audit.

Filing Deadlines for Tax Returns

Awareness of filing deadlines is crucial when submitting your tax return, especially if you plan to claim charitable deductions. Typically, individual tax returns are due on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to file your return on time to avoid penalties and ensure that any refunds are processed promptly.

Quick guide on how to complete step 2 donations note any donation will reduce your refund or increase the amount you owe

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among both businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The simplest way to modify and electronically sign [SKS]

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe

Create this form in 5 minutes!

How to create an eSignature for the step 2 donations note any donation will reduce your refund or increase the amount you owe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe?

The Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe is crucial for understanding how charitable contributions affect your tax situation. Donations can lower your refund or increase your tax liability, so it's essential to track them accurately. This ensures you are fully aware of how your donations impact your overall financial standing.

-

How does airSlate SignNow help with managing donation documentation?

airSlate SignNow provides a streamlined platform for managing all your donation-related documents. With features like eSigning and document tracking, you can easily keep records of your donations. This is particularly useful for ensuring compliance with the Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe guidelines.

-

Are there any costs associated with using airSlate SignNow for donations?

airSlate SignNow offers various pricing plans to suit different business needs, including options for non-profits. While there may be costs involved, the platform is designed to be cost-effective, especially when considering the benefits of managing donations efficiently. Remember, Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe can impact your finances, so using a reliable service can save you money in the long run.

-

What features does airSlate SignNow offer for donation management?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure document storage. These tools make it easier to manage donations and ensure compliance with tax regulations. Understanding the Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe is simpler with these features at your disposal.

-

Can I integrate airSlate SignNow with other software for donation tracking?

Yes, airSlate SignNow offers integrations with various software solutions, enhancing your donation tracking capabilities. This allows you to sync data across platforms, ensuring that you have a comprehensive view of your donations. Keeping in mind the Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe, these integrations can help you manage your finances more effectively.

-

What are the benefits of using airSlate SignNow for my donation processes?

Using airSlate SignNow streamlines your donation processes, making them more efficient and organized. The platform helps you maintain accurate records, which is essential for understanding the implications of the Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe. Additionally, the ease of use can save you time and reduce administrative burdens.

-

Is airSlate SignNow suitable for non-profit organizations?

Absolutely! airSlate SignNow is designed to cater to the needs of non-profit organizations, providing tools that simplify donation management. By utilizing this platform, non-profits can better track their donations and understand how the Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe affects their financial health.

Get more for Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe

Find out other Step 2 Donations Note Any Donation Will Reduce Your Refund Or Increase The Amount You Owe

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template