IL 1023 C X Tax Illinois Form

What is the IL 1023 C X Tax Illinois

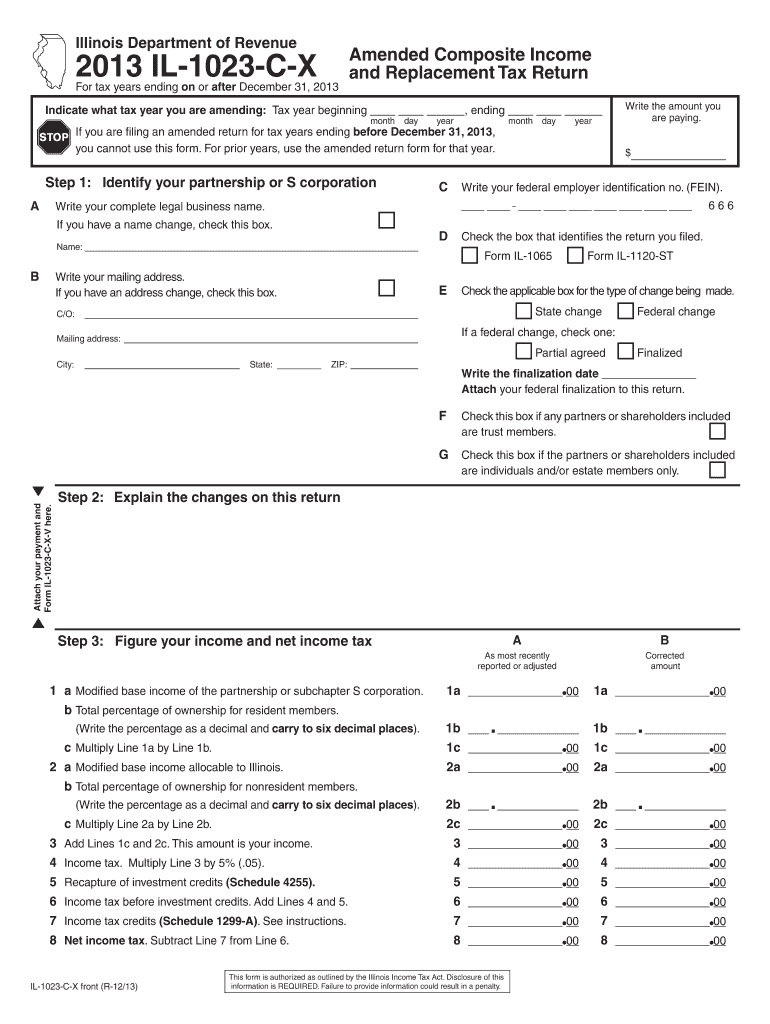

The IL 1023 C X Tax Illinois is a specific tax form used by certain organizations to apply for exemption from state income tax in Illinois. This form is primarily utilized by non-profit organizations, charities, and other entities that qualify under specific criteria set by the Illinois Department of Revenue. By submitting this form, organizations can demonstrate their eligibility for tax-exempt status, which can significantly reduce their tax liabilities and enhance their operational capabilities.

Steps to complete the IL 1023 C X Tax Illinois

Completing the IL 1023 C X Tax Illinois involves several important steps:

- Gather necessary documentation, including proof of your organization’s purpose and activities.

- Fill out the form accurately, ensuring all required fields are completed.

- Provide any additional information or attachments that support your application.

- Review the form for accuracy and completeness before submission.

- Submit the form to the Illinois Department of Revenue through the appropriate method.

Legal use of the IL 1023 C X Tax Illinois

The legal use of the IL 1023 C X Tax Illinois is crucial for organizations seeking tax-exempt status. This form must be filed in accordance with Illinois state laws and regulations. Organizations must ensure they meet the eligibility criteria specified by the state, which typically includes being organized and operated exclusively for charitable, educational, or religious purposes. Misuse or incorrect filing of this form can lead to penalties or denial of tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1023 C X Tax Illinois are critical for organizations to maintain compliance. Generally, the form should be submitted within a specific timeframe after the organization is established or when it first seeks tax-exempt status. It is advisable to check the Illinois Department of Revenue’s official guidelines for the most current deadlines, as these can vary based on the type of organization and other factors.

Required Documents

When completing the IL 1023 C X Tax Illinois, several documents are typically required to support the application. These may include:

- Articles of incorporation or organization.

- Bylaws or governing documents.

- Financial statements or budgets.

- Detailed descriptions of the organization’s activities and programs.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods

The IL 1023 C X Tax Illinois can be submitted through various methods, depending on the preferences of the organization. Common submission methods include:

- Online submission through the Illinois Department of Revenue’s website.

- Mailing a physical copy of the completed form to the appropriate office.

- In-person submission at designated state offices.

Choosing the right submission method can help ensure timely processing of the application.

Quick guide on how to complete il 1023 c x tax illinois

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the required forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and maintain excellent communication throughout any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1023 c x tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1023 C X Tax Illinois form?

The IL 1023 C X Tax Illinois form is used by organizations to apply for exemption from Illinois income tax. This form is essential for non-profit entities seeking tax-exempt status in the state. Understanding how to properly fill out this form can signNowly impact your organization's financial health.

-

How can airSlate SignNow help with the IL 1023 C X Tax Illinois process?

airSlate SignNow streamlines the process of completing and submitting the IL 1023 C X Tax Illinois form. With our easy-to-use eSignature solution, you can quickly gather necessary signatures and ensure compliance. This saves time and reduces the risk of errors in your application.

-

What are the pricing options for using airSlate SignNow for IL 1023 C X Tax Illinois?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those dealing with the IL 1023 C X Tax Illinois form. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing IL 1023 C X Tax Illinois documents?

airSlate SignNow provides a range of features to manage IL 1023 C X Tax Illinois documents effectively. These include customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance your workflow and ensure that your documents are always organized and accessible.

-

Can I integrate airSlate SignNow with other software for IL 1023 C X Tax Illinois?

Yes, airSlate SignNow offers seamless integrations with various software applications that can assist in managing the IL 1023 C X Tax Illinois process. This includes CRM systems, document management tools, and accounting software. Integrating these tools can enhance your efficiency and streamline your operations.

-

What are the benefits of using airSlate SignNow for IL 1023 C X Tax Illinois?

Using airSlate SignNow for IL 1023 C X Tax Illinois provides numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick eSigning and document sharing, which accelerates the application process. Additionally, it helps ensure compliance with state regulations.

-

Is airSlate SignNow secure for handling IL 1023 C X Tax Illinois documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all IL 1023 C X Tax Illinois documents are protected with advanced encryption and secure access controls. We comply with industry standards to safeguard your sensitive information, giving you peace of mind while managing your documents.

Get more for IL 1023 C X Tax Illinois

Find out other IL 1023 C X Tax Illinois

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later