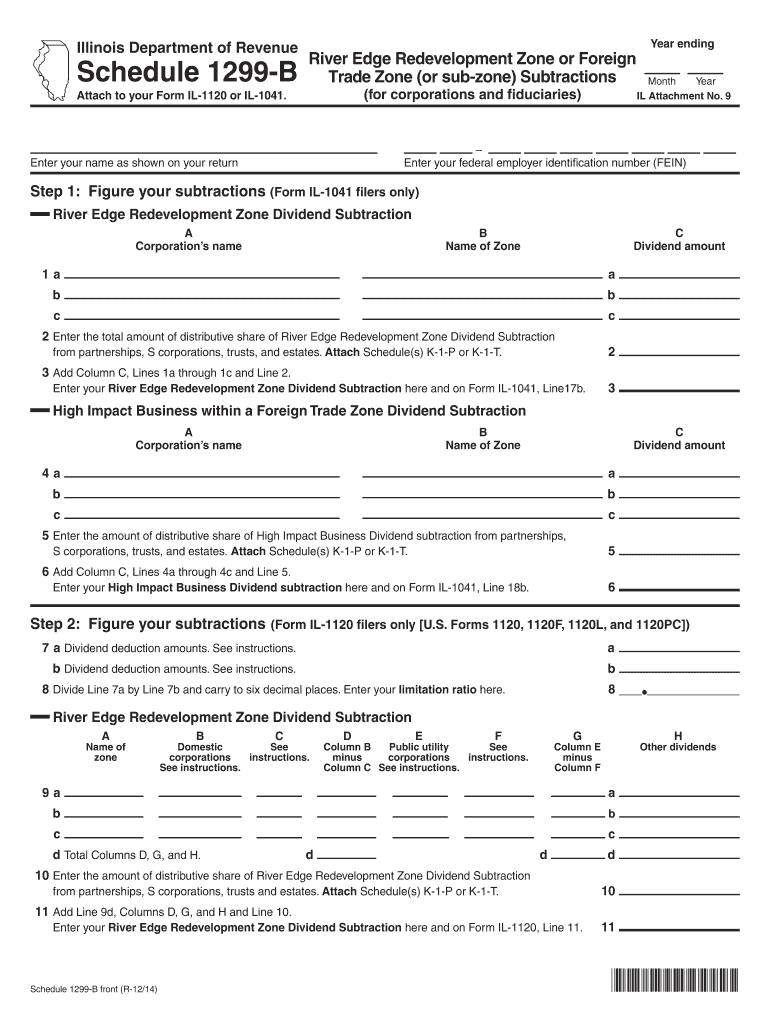

Trade Zone or Sub Zone Subtractions Form

Understanding Trade Zone or Sub zone Subtractions

The Trade Zone or Sub zone Subtractions refer to specific deductions available to businesses operating within designated trade zones or sub zones. These areas are established to promote economic development and trade by providing tax incentives. Businesses can benefit from reduced tax liabilities, which can significantly enhance their operational efficiency. Understanding these subtractions is essential for maximizing financial advantages while ensuring compliance with local and federal regulations.

Steps to Complete the Trade Zone or Sub zone Subtractions

Completing the Trade Zone or Sub zone Subtractions involves several key steps:

- Identify the applicable trade zone or sub zone where your business operates.

- Gather necessary documentation that supports your eligibility for the subtraction.

- Fill out the required forms accurately, ensuring all information aligns with your business records.

- Submit the completed forms by the specified deadlines to avoid penalties.

Each of these steps is crucial for ensuring that the subtraction is applied correctly and that your business remains compliant with tax regulations.

Legal Use of the Trade Zone or Sub zone Subtractions

Utilizing the Trade Zone or Sub zone Subtractions legally requires adherence to specific guidelines set by the Internal Revenue Service (IRS) and state authorities. Businesses must ensure they qualify for the deductions based on their operations within the designated zones. Misuse of these subtractions can lead to penalties, including fines or audits. It is advisable to consult with a tax professional to navigate the legal landscape effectively.

Key Elements of the Trade Zone or Sub zone Subtractions

The key elements that define the Trade Zone or Sub zone Subtractions include:

- Eligibility criteria, which determine which businesses can apply for the deductions.

- The specific forms required for claiming the subtractions.

- Documentation needed to substantiate claims, such as financial statements and operational records.

- Filing deadlines that must be adhered to in order to avoid penalties.

Understanding these elements is crucial for businesses looking to take full advantage of the available tax benefits.

Examples of Using the Trade Zone or Sub zone Subtractions

Examples can illustrate how businesses effectively leverage Trade Zone or Sub zone Subtractions:

- A manufacturing company operating in a trade zone may reduce its tax liability based on the materials imported duty-free.

- A logistics firm could benefit from deductions related to the storage and distribution of goods within a sub zone.

- Retail businesses may apply for subtractions based on sales conducted within the trade zone, enhancing their profit margins.

These examples highlight the practical applications of the subtractions, demonstrating their impact on various business types.

Filing Deadlines for Trade Zone or Sub zone Subtractions

Filing deadlines for the Trade Zone or Sub zone Subtractions are critical to ensure compliance and avoid penalties. Typically, businesses must submit their claims by the end of the tax year, but specific deadlines may vary based on state regulations. It is essential to check both federal and state guidelines to determine the exact dates. Keeping track of these deadlines helps businesses maintain their eligibility for the subtractions.

Required Documents for Trade Zone or Sub zone Subtractions

To successfully claim the Trade Zone or Sub zone Subtractions, businesses must prepare and submit various documents, including:

- Proof of business operations within the trade zone or sub zone.

- Financial records that support the claimed deductions.

- Completed forms specific to the trade zone or sub zone subtractions.

- Any additional documentation required by state authorities.

Having these documents organized and readily available can streamline the filing process and enhance the likelihood of a successful claim.

Create this form in 5 minutes or less

Related searches to Trade Zone or Sub zone Subtractions

Create this form in 5 minutes!

How to create an eSignature for the trade zone or sub zone subtractions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Trade Zone or Sub zone Subtractions?

Trade Zone or Sub zone Subtractions refer to specific deductions applicable to businesses operating in designated trade areas. These subtractions can signNowly impact tax liabilities and overall financial planning. Understanding these deductions is crucial for businesses looking to optimize their operations and compliance.

-

How can airSlate SignNow help with Trade Zone or Sub zone Subtractions?

airSlate SignNow streamlines the documentation process for Trade Zone or Sub zone Subtractions by allowing businesses to easily create, send, and eSign necessary documents. This efficiency reduces the time spent on paperwork, enabling businesses to focus on maximizing their deductions. Our platform ensures that all documents are securely stored and easily accessible.

-

What features does airSlate SignNow offer for managing Trade Zone or Sub zone Subtractions?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, which are essential for managing Trade Zone or Sub zone Subtractions. These tools help businesses ensure compliance and accuracy in their documentation. Additionally, our platform provides real-time tracking of document status, enhancing transparency.

-

Is there a cost associated with using airSlate SignNow for Trade Zone or Sub zone Subtractions?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses managing Trade Zone or Sub zone Subtractions. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your business size and requirements.

-

Can airSlate SignNow integrate with other tools for Trade Zone or Sub zone Subtractions?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, enhancing your ability to manage Trade Zone or Sub zone Subtractions. This integration allows for a more cohesive workflow, ensuring that all relevant data is synchronized and easily accessible across platforms.

-

What are the benefits of using airSlate SignNow for Trade Zone or Sub zone Subtractions?

Using airSlate SignNow for Trade Zone or Sub zone Subtractions provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, allowing businesses to finalize documents quickly. This leads to faster decision-making and improved operational effectiveness.

-

How secure is airSlate SignNow when handling Trade Zone or Sub zone Subtractions?

Security is a top priority at airSlate SignNow, especially when handling sensitive information related to Trade Zone or Sub zone Subtractions. Our platform employs advanced encryption and security protocols to protect your documents. You can trust that your data is safe and compliant with industry standards.

Get more for Trade Zone or Sub zone Subtractions

Find out other Trade Zone or Sub zone Subtractions

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy