RC 6 X Tax Illinois Form

What is the RC 6 X Tax Illinois

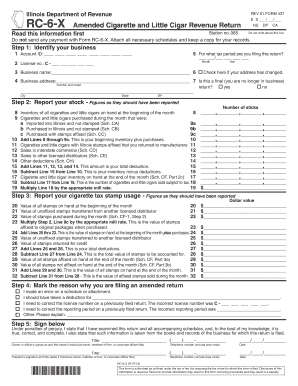

The RC 6 X Tax Illinois form is a crucial document used by businesses to report certain tax-related information to the Illinois Department of Revenue. This form is specifically designed for taxpayers who need to claim exemptions or adjustments related to their tax obligations in Illinois. Understanding the purpose and requirements of this form is essential for ensuring compliance with state tax laws.

How to use the RC 6 X Tax Illinois

Using the RC 6 X Tax Illinois form involves filling it out accurately and submitting it to the appropriate state authority. Taxpayers must provide specific details regarding their tax situation, including any exemptions they are claiming. It is important to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the RC 6 X Tax Illinois

Completing the RC 6 X Tax Illinois form requires several key steps:

- Gather all necessary information, including your tax identification number and details about your tax situation.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill out the form, ensuring that all entries are accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either online or by mail.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the RC 6 X Tax Illinois form. Typically, the form must be submitted by the end of the tax year or as specified by the Illinois Department of Revenue. Missing these deadlines can result in penalties or interest charges, so keeping track of important dates is vital for compliance.

Required Documents

When completing the RC 6 X Tax Illinois form, certain documents may be required to support your claims. These can include:

- Proof of income or loss, such as financial statements or tax returns.

- Documentation of any exemptions or deductions being claimed.

- Identification numbers, including your Social Security number or Employer Identification Number (EIN).

Penalties for Non-Compliance

Failure to submit the RC 6 X Tax Illinois form on time or providing inaccurate information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the risks associated with non-compliance underscores the importance of accurately completing and timely submitting the form.

Quick guide on how to complete rc 6 x tax illinois

Complete [SKS] with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rc 6 x tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RC 6 X Tax Illinois form?

The RC 6 X Tax Illinois form is a crucial document used for claiming a tax credit for certain businesses in Illinois. It helps businesses reduce their tax liability by providing necessary information about their operations and expenses. Understanding how to properly fill out this form can signNowly benefit your business's financial health.

-

How can airSlate SignNow help with the RC 6 X Tax Illinois form?

airSlate SignNow streamlines the process of completing and submitting the RC 6 X Tax Illinois form by allowing users to eSign documents securely and efficiently. Our platform simplifies document management, ensuring that all necessary information is accurately captured and submitted on time. This can save businesses valuable time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow for RC 6 X Tax Illinois?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it an affordable solution for managing the RC 6 X Tax Illinois form. Our pricing is transparent, with no hidden fees, allowing you to choose a plan that fits your budget. Additionally, we provide a free trial to help you evaluate our services before committing.

-

What features does airSlate SignNow offer for managing tax documents like the RC 6 X Tax Illinois?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the RC 6 X Tax Illinois. These features enhance efficiency and ensure compliance with tax regulations. Our user-friendly interface makes it easy for anyone to navigate and utilize these tools effectively.

-

Can I integrate airSlate SignNow with other software for filing the RC 6 X Tax Illinois?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to file the RC 6 X Tax Illinois form. This integration allows for automatic data transfer, reducing manual entry and minimizing errors. By connecting your existing tools, you can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the RC 6 X Tax Illinois process?

Using airSlate SignNow for the RC 6 X Tax Illinois process provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, anywhere. Additionally, the eSigning feature speeds up the approval process, allowing you to focus on your business.

-

Is airSlate SignNow compliant with Illinois tax regulations for the RC 6 X Tax Illinois?

Absolutely! airSlate SignNow is designed to comply with all relevant Illinois tax regulations, including those pertaining to the RC 6 X Tax Illinois form. Our platform is regularly updated to reflect any changes in tax laws, ensuring that your documents remain compliant. This gives you peace of mind when managing your tax-related paperwork.

Get more for RC 6 X Tax Illinois

Find out other RC 6 X Tax Illinois

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form