Checklist Gift Tax Section Worldwide Leaders in Pu Form

What is the Checklist for Gift Tax Section

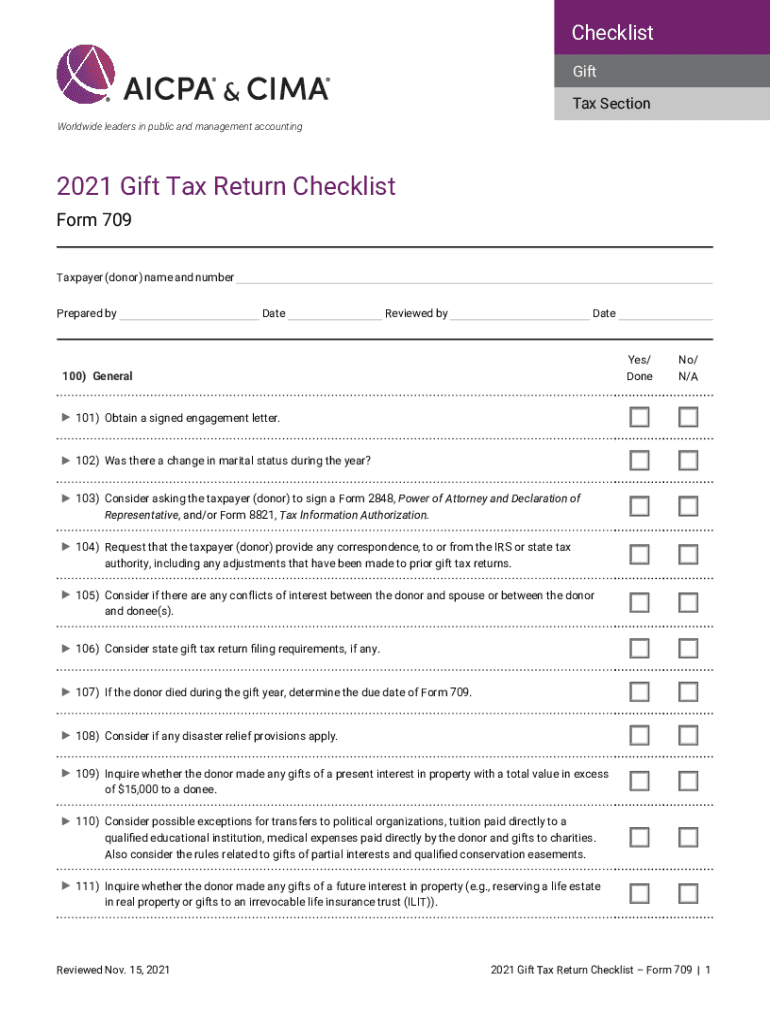

The Checklist for Gift Tax Section is a comprehensive tool designed to help individuals navigate the complexities of gift taxation in the United States. It outlines the necessary steps and requirements for reporting gifts to the Internal Revenue Service (IRS). This checklist is particularly useful for those who wish to ensure compliance with federal tax laws while making significant gifts to family members or charitable organizations.

How to Use the Checklist for Gift Tax Section

Using the Checklist for Gift Tax Section involves several straightforward steps. First, gather all relevant information about the gifts you have made, including the value of each gift and the recipient's details. Next, review the checklist to ensure you have all required documentation, such as Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. Follow the instructions to accurately complete the form, ensuring all gifts are reported correctly to avoid penalties.

Key Elements of the Checklist for Gift Tax Section

The key elements of the Checklist for Gift Tax Section include the identification of the donor and recipient, the total value of gifts made during the tax year, and any applicable exclusions or deductions. It is essential to understand the annual exclusion limit for gifts, which allows individuals to give a specified amount without incurring tax liabilities. Additionally, the checklist highlights the importance of keeping detailed records of all gifts for future reference and potential audits.

IRS Guidelines for Gift Tax Reporting

The IRS provides specific guidelines for reporting gifts, which are crucial for compliance. According to IRS regulations, any gift exceeding the annual exclusion amount must be reported using Form 709. It is important to familiarize yourself with these guidelines to avoid errors in reporting. The IRS also outlines the consequences of non-compliance, emphasizing the importance of timely and accurate submissions.

Required Documents for Gift Tax Section

To complete the Gift Tax Section, certain documents are required. These include Form 709, a record of all gifts made during the tax year, and any supporting documentation that verifies the value of the gifts. Additionally, if gifts were made to a trust or as part of a business transaction, relevant trust documents or business records may also be necessary. Ensuring all documents are in order will facilitate a smoother filing process.

Filing Deadlines for Gift Tax Section

Filing deadlines for the Gift Tax Section are critical to avoid penalties. Generally, Form 709 must be filed by April fifteenth of the year following the year in which the gifts were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to mark these deadlines on your calendar to ensure timely submission.

Examples of Using the Checklist for Gift Tax Section

Examples of using the Checklist for Gift Tax Section can provide clarity on how to apply the information effectively. For instance, if an individual gifts a car valued at twenty thousand dollars to a family member, they would first check the checklist for documentation requirements. They would then determine if the value exceeds the annual exclusion limit and proceed to report it on Form 709. Another example could involve multiple small gifts to various recipients, where the checklist helps ensure that each gift is accounted for correctly.

Quick guide on how to complete checklistgifttax sectionworldwide leaders in pu

Complete Checklist Gift Tax Section Worldwide Leaders In Pu seamlessly on any device

Managing documents online has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and safely store it on the internet. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Manage Checklist Gift Tax Section Worldwide Leaders In Pu on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric tasks today.

The simplest way to edit and electronically sign Checklist Gift Tax Section Worldwide Leaders In Pu effortlessly

- Locate Checklist Gift Tax Section Worldwide Leaders In Pu and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes requiring new printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Checklist Gift Tax Section Worldwide Leaders In Pu to ensure excellent communication throughout all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the checklistgifttax sectionworldwide leaders in pu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Checklist Gift Tax Section feature in airSlate SignNow?

The Checklist Gift Tax Section feature in airSlate SignNow allows users to create and manage checklists for tax-related gifts. This feature ensures that all necessary steps are followed, making it easier to comply with tax regulations. By using this feature, businesses can streamline their documentation process and avoid potential pitfalls.

-

How does airSlate SignNow support businesses in managing their Checklist Gift Tax Section?

airSlate SignNow provides tools that help businesses efficiently manage their Checklist Gift Tax Section. With customizable templates and automated workflows, users can ensure that all required documents are completed accurately. This not only saves time but also enhances compliance with tax laws.

-

What are the pricing options for airSlate SignNow's Checklist Gift Tax Section?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for the Checklist Gift Tax Section. Pricing is competitive and designed to provide value for businesses of all sizes. You can choose a plan that fits your budget while gaining access to essential features.

-

Can I integrate airSlate SignNow with other tools for managing the Checklist Gift Tax Section?

Yes, airSlate SignNow offers integrations with various tools and platforms to enhance your Checklist Gift Tax Section management. This includes popular CRM systems, accounting software, and more. These integrations help streamline your workflow and improve overall efficiency.

-

What benefits does airSlate SignNow provide for the Checklist Gift Tax Section?

Using airSlate SignNow for your Checklist Gift Tax Section offers numerous benefits, including increased efficiency and reduced errors. The platform's user-friendly interface makes it easy to create and manage checklists, ensuring compliance with tax regulations. Additionally, it enhances collaboration among team members.

-

Is airSlate SignNow suitable for businesses of all sizes when it comes to the Checklist Gift Tax Section?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an ideal solution for managing the Checklist Gift Tax Section. Whether you're a small startup or a large enterprise, the platform can scale to meet your needs and help you stay organized.

-

How secure is airSlate SignNow when handling Checklist Gift Tax Section documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents related to the Checklist Gift Tax Section. The platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are safe and secure while using our services.

Get more for Checklist Gift Tax Section Worldwide Leaders In Pu

- Progress monitoring nonsense word fluency first grade dibels uoregon form

- Police voluntary statement form

- Uspa b license proficiency card form

- Soap medical transcription form

- Recp application form navmc 11505 10 04 naval forms online

- 1033 application form

- Form for open records request department of agriculture of kentucky

- Visa and mastercard consumer credit card application form

Find out other Checklist Gift Tax Section Worldwide Leaders In Pu

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice