Form 14242 Rev 4 Report Suspected Abusive Tax Promotions or Preparers

What is the Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers

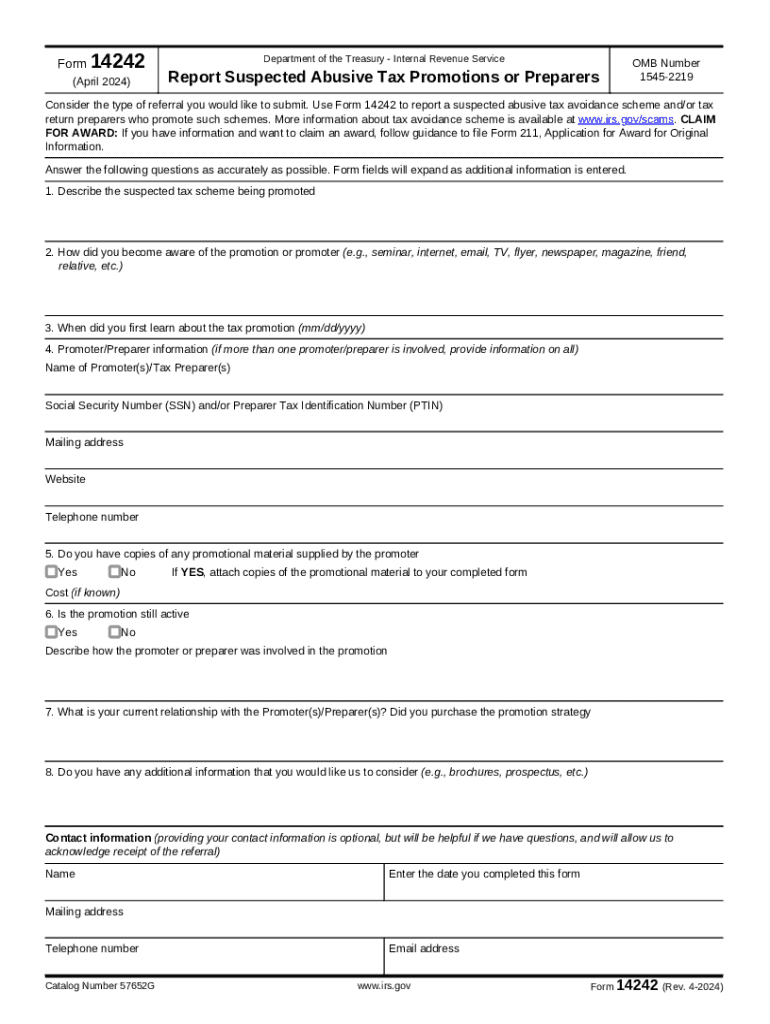

The Form 14242 Rev 4 is a document used by individuals to report suspected abusive tax promotions or tax preparers to the IRS. This form is essential for those who believe that a tax preparer is engaging in fraudulent activities or promoting schemes that violate tax laws. The IRS uses the information provided on this form to investigate potential abuses and protect taxpayers from scams and unethical practices.

How to use the Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers

To use the Form 14242, individuals need to provide detailed information about the suspected abusive tax promotion or preparer. This includes the name and contact information of the individual or business being reported, a description of the suspected abuse, and any relevant documentation that supports the claim. It is important to be as thorough and accurate as possible to assist the IRS in their investigation.

Steps to complete the Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers

Completing the Form 14242 involves several key steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and contact details.

- Provide information about the individual or business you are reporting, including their name, address, and any known tax identification numbers.

- Describe the nature of the suspected abusive practices, including specific details and examples.

- Attach any supporting documents that may help substantiate your claims.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers

The Form 14242 is legally recognized as a means to report suspected tax fraud and abuse. Submitting this form is a protected action under the law, and individuals can report such activities without fear of retaliation. It is crucial to ensure that the information provided is truthful and based on reasonable belief to avoid potential legal repercussions for false reporting.

IRS Guidelines

The IRS provides specific guidelines for submitting the Form 14242. It is recommended to submit the form as soon as possible after identifying suspected abusive practices. The IRS advises individuals to keep a copy of the submitted form for their records. Additionally, the IRS may follow up for further information if necessary, so being reachable is important.

Form Submission Methods (Online / Mail / In-Person)

The Form 14242 can be submitted to the IRS through various methods. It is typically mailed to the address specified on the form. Currently, there is no online submission option for this particular form. Individuals should ensure that they send the form via a reliable mailing method and consider using certified mail for tracking purposes. In-person submissions are not standard for this form and are generally not recommended.

Quick guide on how to complete form 14242 rev 4 report suspected abusive tax promotions or preparers

Effortlessly Prepare Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers on Any Device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers with Ease

- Find Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14242 rev 4 report suspected abusive tax promotions or preparers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for how to report someone to the IRS anonymously?

To report someone to the IRS anonymously, you can use Form 3949-A, which allows you to provide information about suspected tax fraud. Ensure you include as much detail as possible, such as the individual's name, address, and the nature of the fraud. Submitting this form does not require you to disclose your identity.

-

Can I use airSlate SignNow to send my IRS report securely?

Yes, airSlate SignNow provides a secure platform for sending documents, including your IRS report. With advanced encryption and compliance features, you can ensure that your sensitive information remains confidential while you learn how to report someone to the IRS anonymously.

-

Is there a cost associated with reporting someone to the IRS anonymously?

There is no fee to report someone to the IRS anonymously using Form 3949-A. However, if you choose to use services like airSlate SignNow to prepare and send your documents, there may be associated costs depending on the plan you select.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including eSigning, document templates, and secure storage. These tools can help streamline your process when you need to learn how to report someone to the IRS anonymously, making it easier to manage your documents efficiently.

-

How can airSlate SignNow help with compliance when reporting to the IRS?

airSlate SignNow is designed with compliance in mind, ensuring that your documents meet legal standards. When you are figuring out how to report someone to the IRS anonymously, using a compliant platform can help you avoid potential legal issues.

-

Are there integrations available with airSlate SignNow for reporting purposes?

Yes, airSlate SignNow integrates with various applications to enhance your workflow. These integrations can simplify the process of gathering necessary information when you are learning how to report someone to the IRS anonymously.

-

What benefits does airSlate SignNow provide for businesses?

airSlate SignNow empowers businesses by offering a cost-effective solution for document management and eSigning. This can be particularly beneficial when you need to understand how to report someone to the IRS anonymously, as it allows for efficient handling of sensitive documents.

Get more for Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers

- Cumulative patient profile sample 1 form

- Site visit checklist 404383662 form

- Sf78 form

- Supreme court civil form form 109 affidavit supreme court civil form form 109 affidavit

- Notice of discontinuance sample form

- Fl 304 info how to reschedule a hearing in family court form

- Petition for change of registered name due to marriage form

- Edward joyceeducational psychologistchartered ps form

Find out other Form 14242 Rev 4 Report Suspected Abusive Tax Promotions Or Preparers

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple