UNIFORM SALES & USE TAX RESALE CERTIFICATE MULTIJU

Understanding the Uniform Sales & Use Tax Resale Certificate

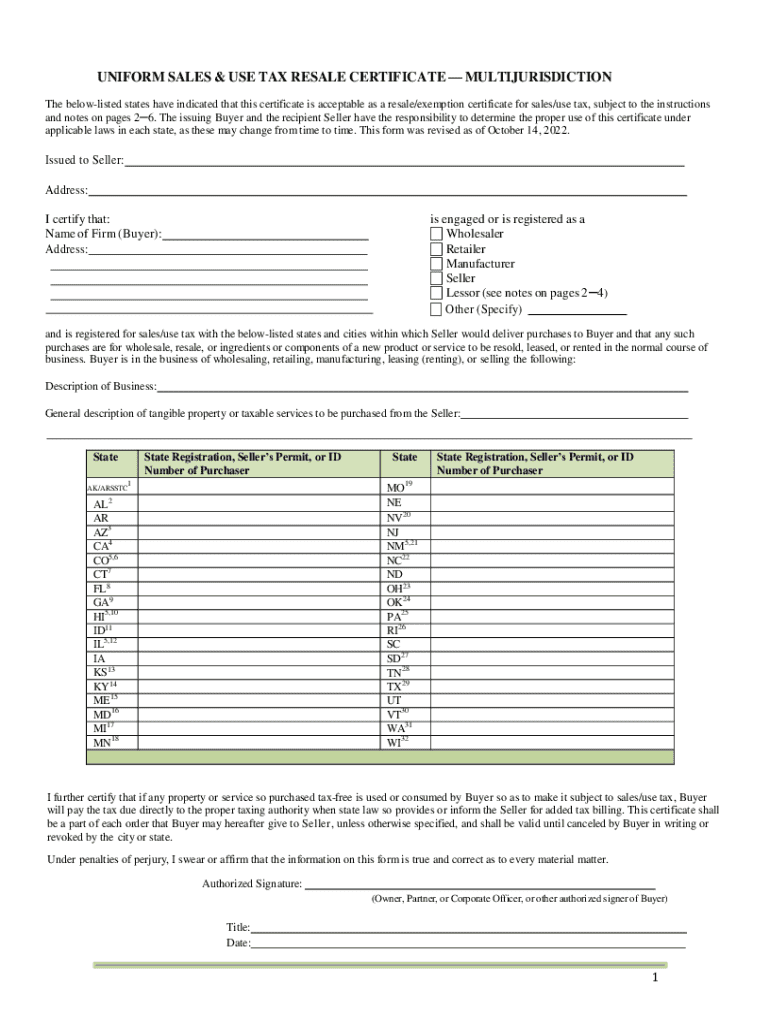

The Uniform Sales & Use Tax Resale Certificate is a crucial document for businesses engaging in the resale of goods. This certificate allows a buyer to purchase items without paying sales tax, as the buyer intends to resell these items. The certificate serves as proof that the buyer is exempt from sales tax on the purchase, which is beneficial for cash flow and operational efficiency. It is essential for businesses to understand the implications of using this certificate, as misuse can lead to penalties.

Steps to Complete the Uniform Sales & Use Tax Resale Certificate

Completing the Uniform Sales & Use Tax Resale Certificate involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your business name, address, and sales tax identification number.

- Provide details about the seller, including their name and address.

- Clearly describe the type of property being purchased for resale.

- Sign and date the certificate to validate the information provided.

Ensure that all information is accurate to avoid complications during audits or transactions.

Legal Use of the Uniform Sales & Use Tax Resale Certificate

The legal use of the Uniform Sales & Use Tax Resale Certificate is governed by state laws. Businesses must ensure that they are using the certificate correctly to avoid potential legal issues. Misuse, such as using the certificate for personal purchases or items not intended for resale, can result in penalties, including fines and back taxes. It is advisable for businesses to keep records of all transactions where the certificate is used to substantiate its legitimacy during audits.

State-Specific Rules for the Uniform Sales & Use Tax Resale Certificate

Each state in the U.S. has its own regulations regarding the use of the Uniform Sales & Use Tax Resale Certificate. It is important for businesses to familiarize themselves with the specific rules in their state, including:

- Eligibility criteria for using the certificate.

- Any required documentation or additional forms that must accompany the certificate.

- Expiration dates or renewal requirements for the certificate.

Consulting state tax authorities or legal professionals can provide clarity on these regulations.

Examples of Using the Uniform Sales & Use Tax Resale Certificate

Practical examples can help illustrate how the Uniform Sales & Use Tax Resale Certificate is utilized in real-world scenarios:

- A retail store purchasing inventory from a wholesaler can present the certificate to avoid paying sales tax on the items.

- A contractor buying materials for a project can use the certificate if they plan to resell the services that incorporate those materials.

These examples highlight the importance of the certificate in various business transactions.

Eligibility Criteria for the Uniform Sales & Use Tax Resale Certificate

Eligibility for obtaining and using the Uniform Sales & Use Tax Resale Certificate typically includes being a registered business with a valid sales tax identification number. Businesses must be engaged in selling tangible personal property or services that are subject to sales tax. Additionally, the items purchased must be intended for resale, not for personal or business use. Understanding these criteria is essential for compliance and to avoid potential tax liabilities.

Quick guide on how to complete uniform sales use tax resale certificate multiju

Prepare UNIFORM SALES & USE TAX RESALE CERTIFICATE MULTIJU effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage UNIFORM SALES & USE TAX RESALE CERTIFICATE MULTIJU on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and eSign UNIFORM SALES & USE TAX RESALE CERTIFICATE MULTIJU with ease

- Find UNIFORM SALES & USE TAX RESALE CERTIFICATE MULTIJU and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign UNIFORM SALES & USE TAX RESALE CERTIFICATE MULTIJU and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform sales use tax resale certificate multiju

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt letter template?

A tax exempt letter template is a pre-formatted document that allows organizations to request tax exemption status from vendors or government entities. Using a tax exempt letter template simplifies the process, ensuring that all necessary information is included and formatted correctly.

-

How can airSlate SignNow help with tax exempt letter templates?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning tax exempt letter templates. With our solution, you can customize your templates, streamline the approval process, and securely store your documents for future reference.

-

Is there a cost associated with using the tax exempt letter template feature?

airSlate SignNow offers competitive pricing plans that include access to the tax exempt letter template feature. Depending on your chosen plan, you can enjoy unlimited document signing and template creation without hidden fees.

-

Can I integrate airSlate SignNow with other software for tax exempt letter templates?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to enhance your workflow when using tax exempt letter templates. Popular integrations include CRM systems, cloud storage services, and accounting software.

-

What are the benefits of using a tax exempt letter template?

Using a tax exempt letter template saves time and reduces errors in documentation. It ensures that your requests for tax exemption are clear and professional, which can lead to quicker approvals and better relationships with vendors.

-

Can I customize my tax exempt letter template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your tax exempt letter template to meet your specific needs. You can add your organization's branding, adjust the content, and include any necessary fields for signatures or additional information.

-

How secure is my information when using tax exempt letter templates with airSlate SignNow?

Security is a top priority at airSlate SignNow. When using tax exempt letter templates, your information is protected with advanced encryption and secure storage, ensuring that your sensitive data remains confidential and safe from unauthorized access.

Get more for UNIFORM SALES & USE TAX RESALE CERTIFICATE MULTIJU

Find out other UNIFORM SALES & USE TAX RESALE CERTIFICATE MULTIJU

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile