MICHIGAN Adjustments of Gains and Losses from Sales of Business Property MI 4797 Reported on U Form

Understanding the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797

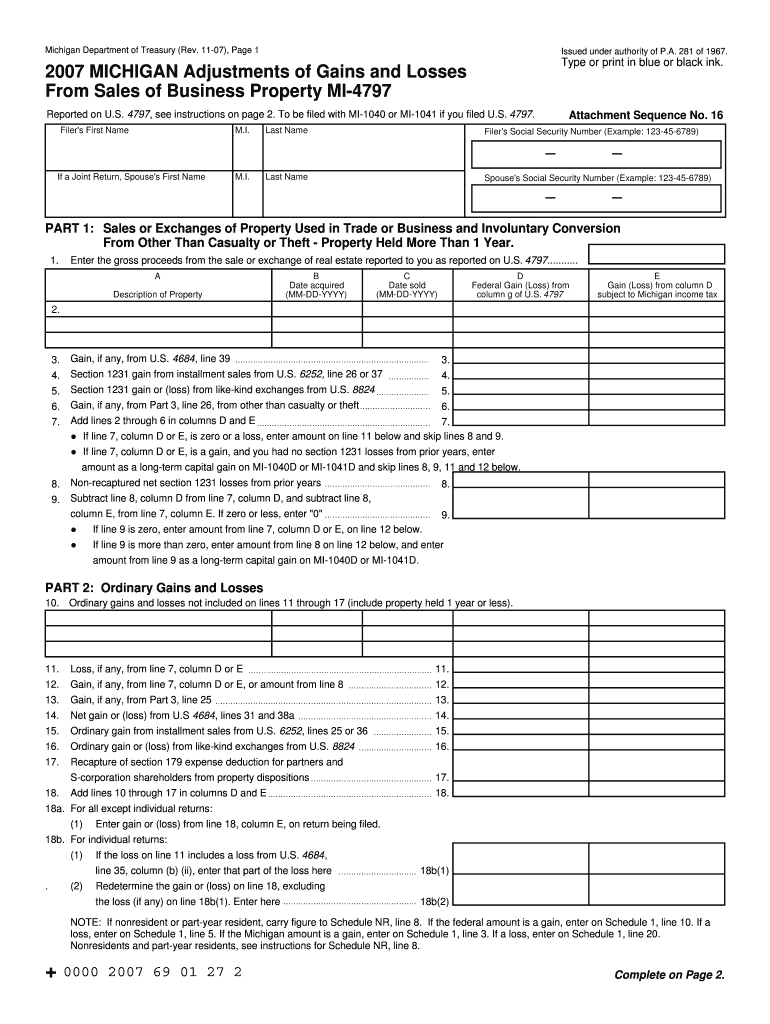

The MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 is a tax form used by business owners in Michigan to report adjustments related to the sale of business property. This form is essential for accurately calculating gains and losses that may affect the overall tax liability. It is specifically designed to capture the nuances of business property transactions, ensuring compliance with state tax regulations.

How to Use the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797

Using the MI 4797 form involves several key steps. First, gather all necessary documentation related to the sale of business property, including purchase agreements and sale receipts. Next, carefully fill out the form, detailing the adjustments for gains and losses. It is important to ensure that all information is accurate to avoid potential issues with tax authorities. After completing the form, review it for errors before submission.

Steps to Complete the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797

Completing the MI 4797 requires a systematic approach:

- Collect all relevant financial documents related to the sale of business property.

- Begin filling out the form by entering basic information, including the taxpayer's identification and details of the property sold.

- Calculate the total gain or loss from the sale, taking into account any adjustments necessary for depreciation or improvements made to the property.

- Double-check all calculations and ensure that all fields are completed accurately.

- Submit the form by the designated deadline to avoid penalties.

Key Elements of the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797

Several key elements are essential when filling out the MI 4797 form. These include:

- Taxpayer identification information.

- Details of the business property sold, including its original purchase price and sale price.

- Adjustments for depreciation that may have been claimed in previous tax years.

- Any additional costs associated with the sale, such as closing costs or commissions.

Filing Deadlines for the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797

It is crucial to be aware of filing deadlines for the MI 4797 form. Typically, the form must be submitted by the same deadline as the federal income tax return. For most taxpayers, this is April 15 of the following year. However, if additional time is needed, an extension may be requested, but it is important to ensure that all tax obligations are met to avoid penalties.

Legal Use of the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797

The MI 4797 form serves a legal purpose in documenting the financial impacts of selling business property. Accurate completion of this form is necessary for compliance with Michigan tax laws. Failure to file or inaccuracies on the form can lead to audits, penalties, or additional tax liabilities. It is advisable for business owners to consult with a tax professional to ensure proper use of the form.

Quick guide on how to complete michigan adjustments of gains and losses from sales of business property mi 4797 reported on u

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an excellent environmentally-friendly substitute for conventional printed and signed papers, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage [SKS] across any platform with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark signNow sections of the document or redact sensitive information using the specific tools offered by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and hit the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U

Create this form in 5 minutes!

How to create an eSignature for the michigan adjustments of gains and losses from sales of business property mi 4797 reported on u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. form?

The MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. form is used to report adjustments related to the sale of business property in Michigan. This form helps taxpayers accurately calculate their gains and losses, ensuring compliance with state tax regulations. Understanding this form is crucial for businesses to avoid potential penalties.

-

How can airSlate SignNow assist with the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. process?

airSlate SignNow streamlines the process of completing and submitting the MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. form. Our platform allows users to easily eSign and send documents, ensuring that all necessary adjustments are accurately recorded. This efficiency saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U.?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. forms. Our plans are cost-effective, providing access to essential features without breaking the bank. You can choose a plan that fits your budget and document volume.

-

What features does airSlate SignNow provide for managing MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U.?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. forms. These tools enhance productivity and ensure that all documents are handled efficiently. Users can also collaborate in real-time, making the process seamless.

-

Are there any integrations available with airSlate SignNow for MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U.?

Yes, airSlate SignNow integrates with various applications to facilitate the management of MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. forms. These integrations allow users to connect their existing workflows and enhance productivity. Popular integrations include CRM systems, cloud storage services, and accounting software.

-

What are the benefits of using airSlate SignNow for MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U.?

Using airSlate SignNow for MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and are easily accessible. Additionally, the eSigning feature speeds up the approval process, allowing for quicker submissions.

-

Is airSlate SignNow user-friendly for completing MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U.?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U. forms. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively. Training resources are also available for additional support.

Get more for MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U

- Critical observation report rules regulations and columbus form

- Usps eap directory by usps area magellan health form

- Transcript amp diploma request education verification carrington form

- David lundquist memorial scholarship odessa r vii form

- Petition for appointment of guardian successor guardian horrycounty form

- Sublease agreement asuw housing asuw form

- Calliope amp district community bank funding application form

- Form 12 903 2015 2019

Find out other MICHIGAN Adjustments Of Gains And Losses From Sales Of Business Property MI 4797 Reported On U

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document