Reset Form Schedule CR 5 MICHIGAN Schedule of Taxes and Allocation to Each Agreement Michigan Department of Treasury 3820 Rev

Understanding the Reset Form Schedule CR 5 MICHIGAN

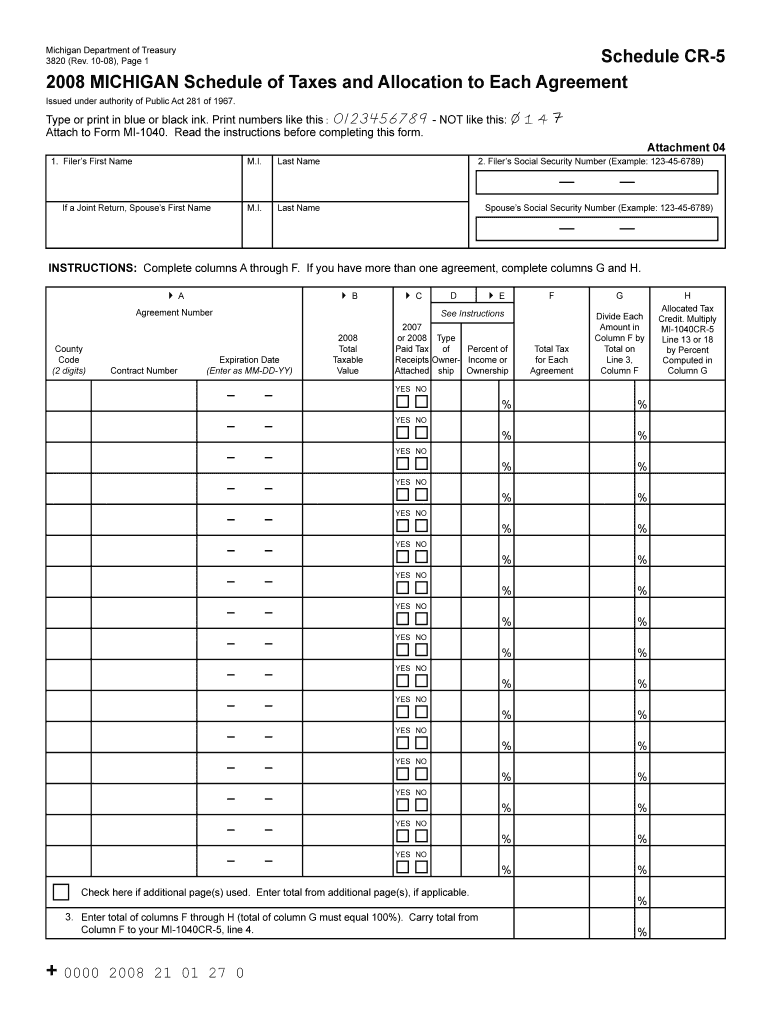

The Reset Form Schedule CR 5 MICHIGAN, officially known as the Schedule Of Taxes And Allocation To Each Agreement, is a document issued by the Michigan Department Of Treasury. This form is essential for businesses and individuals who need to report and allocate taxes accurately in accordance with state regulations. It serves as a tool for ensuring compliance with Michigan tax laws, facilitating the correct distribution of tax liabilities across various agreements.

How to Use the Reset Form Schedule CR 5 MICHIGAN

Using the Reset Form Schedule CR 5 involves several straightforward steps. First, gather all necessary financial documents and agreements related to the taxes you need to report. Next, fill out the form by entering the required information, such as the type of taxes being allocated and the corresponding agreements. Ensure that all entries are accurate to avoid any discrepancies. Once completed, review the form for any errors before submission to ensure compliance with Michigan tax regulations.

Steps to Complete the Reset Form Schedule CR 5 MICHIGAN

Completing the Reset Form Schedule CR 5 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents and agreements.

- Begin filling out the form with your personal or business information.

- Detail the taxes being reported and allocate them to the appropriate agreements.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

After completing these steps, you can submit the form through the designated channels as outlined by the Michigan Department Of Treasury.

Obtaining the Reset Form Schedule CR 5 MICHIGAN

The Reset Form Schedule CR 5 can be obtained directly from the Michigan Department Of Treasury's official website or through local tax offices. It is available in both digital and paper formats, allowing users to choose the method that best suits their needs. Ensure you have the most current version of the form, as updates may occur periodically.

Legal Use of the Reset Form Schedule CR 5 MICHIGAN

The Reset Form Schedule CR 5 is legally required for accurate tax reporting in Michigan. Businesses and individuals must use this form to comply with state tax laws and regulations. Failure to submit this form correctly can lead to penalties or legal repercussions. Thus, understanding its legal implications is crucial for anyone involved in tax reporting within the state.

Key Elements of the Reset Form Schedule CR 5 MICHIGAN

Several key elements are essential when filling out the Reset Form Schedule CR 5. These include:

- Identification information for the taxpayer or business.

- A detailed breakdown of taxes owed.

- Allocation of taxes to specific agreements.

- Signature and date fields for verification.

Each of these elements plays a critical role in ensuring that the form is completed accurately and in compliance with state regulations.

Quick guide on how to complete reset form schedule cr 5 michigan schedule of taxes and allocation to each agreement michigan department of treasury 3820 rev 11095913

Prepare [SKS] seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reset form schedule cr 5 michigan schedule of taxes and allocation to each agreement michigan department of treasury 3820 rev 11095913

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

The Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement is a document required by the Michigan Department Of Treasury to report tax allocations. It helps businesses ensure compliance with state tax regulations and accurately allocate taxes to each agreement.

-

How can airSlate SignNow assist with the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

airSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement. Our solution streamlines the process, ensuring that all necessary information is captured and submitted efficiently.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose a plan that fits your budget while gaining access to features that simplify the completion of the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow. You can connect with tools like Google Drive, Dropbox, and more to easily manage documents related to the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning. These features are particularly beneficial for managing the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement, ensuring accuracy and compliance.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and authentication measures to protect your documents, including the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement, ensuring that sensitive information remains confidential.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage and eSign the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement on the go. This flexibility ensures that you can complete your tasks anytime, anywhere.

Get more for Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

- Preliminary final plat application the city of lake worth lakeworthtx form

- Pdf usaid form

- Jdf 1000 2016 2019 form

- Form 74f affidavit of execution of will or codicil the queen s bench centre in the matter of the will and testament of deceased

- Application for charitable funding ci dania beach fl form

- Louisiana ldeq ldeq form

- The following sample letter can be amended to meet your specific situation and requirements form

- State board of cosmetology instructions and pa gov form

Find out other Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template