Specifically List Amounts Withheld, and Reason Why Such Withholding is Wrongful Form

What is the Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful

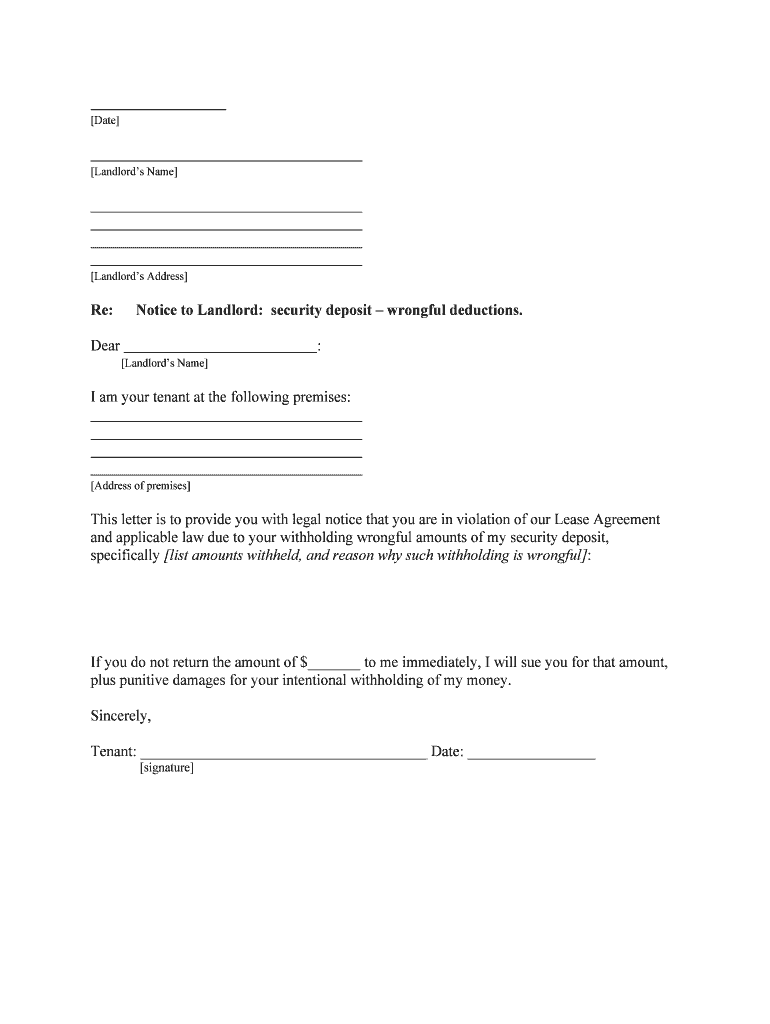

The Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful form is a crucial document used to detail specific amounts that have been withheld from an individual's earnings or benefits. This form serves as a means to challenge the legitimacy of the withholding, providing a structured way to articulate why such actions may be deemed incorrect or unjust. It is often utilized in contexts such as employment disputes, tax issues, or benefits claims, where clarity on withheld amounts is necessary for resolution.

Steps to complete the Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful

Completing the Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful form involves several important steps:

- Gather Documentation: Collect all relevant documents that detail the amounts withheld, including pay stubs, tax forms, or correspondence from employers or agencies.

- Detail Withheld Amounts: Clearly list each amount that has been withheld, specifying the source and the reason for each deduction.

- Provide Justification: Articulate the reasons why you believe the withholding is wrongful. This may include legal references, personal circumstances, or discrepancies in the amounts listed.

- Review for Accuracy: Ensure all information is accurate and complete before submission to avoid delays or complications.

Legal use of the Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful

This form is legally significant as it provides a formal avenue for individuals to contest wrongful withholding. By submitting this form, individuals can initiate discussions or disputes regarding the amounts deducted from their earnings. It can be used in various legal contexts, including employment law, tax disputes, and administrative hearings, serving as a critical tool for protecting one’s financial rights.

Examples of using the Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful

Examples of situations where this form may be applicable include:

- A former employee contests the withholding of taxes that were not properly calculated by their employer.

- A taxpayer disputes the amount withheld from their refund due to errors in reported income.

- An individual challenges the withholding of benefits based on incorrect eligibility determinations.

Required Documents

To effectively complete the Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful form, you may need to provide several supporting documents:

- Pay stubs or wage statements showing the amounts withheld.

- Tax returns or IRS correspondence related to the withholding.

- Any relevant contracts or agreements that clarify the terms of employment or benefits.

Who Issues the Form

The Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful form is typically issued by governmental agencies, employers, or financial institutions, depending on the context of the withholding. For tax-related issues, the IRS may provide guidelines on how to contest withholding through specific forms or processes. Employers may also have their own internal forms for employees to report discrepancies in withheld amounts.

Quick guide on how to complete specifically list amounts withheld and reason why such withholding is wrongful

Effortlessly Prepare Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful with Ease

- Find Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact confidential information using tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or missing documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does airSlate SignNow offer for document eSigning?

airSlate SignNow provides a user-friendly platform to send and electronically sign documents securely. Businesses can streamline their workflows and avoid wrongful withholdings by ensuring accurate record-keeping. It’s essential to specifically list amounts withheld, and reason why such withholding is wrongful, to maintain transparency.

-

How can airSlate SignNow help me avoid wrongful withholdings?

By utilizing airSlate SignNow, you can create clear, concise documents that specify amounts and reasons for any withholding. This clarity reduces confusion and helps prevent scenarios that could be deemed wrongful withholding. Proper documentation is key to protecting your business.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Dropbox. These integrations ensure that essential data is easily accessed and managed, which can help specifically list amounts withheld, and reason why such withholding is wrongful in any business process.

-

Is there a pricing plan that suits small businesses?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes, including small businesses. Choosing a cost-effective solution allows you to manage your documents efficiently and specifically list amounts withheld, and reason why such withholding is wrongful without overspending.

-

Can I customize the documents I send with airSlate SignNow?

Absolutely, airSlate SignNow allows you to customize your documents to meet your specific needs. You can add fields for relevant information, ensuring you specifically list amounts withheld, and reason why such withholding is wrongful. This customization helps create more precise and effective communication.

-

What security measures does airSlate SignNow have in place?

airSlate SignNow prioritizes your data security by employing advanced encryption techniques and secure cloud storage. These measures ensure the safety of your documents and are essential when specifically listing amounts withheld, and reason why such withholding is wrongful. Trust is vital in electronic transactions.

-

How does airSlate SignNow enhance collaboration?

With airSlate SignNow, teams can collaborate in real-time, making it easy to share documents and get approvals quickly. Collaborative features help ensure that all parties understand exactly what is included, such as specifically listing amounts withheld, and reason why such withholding is wrongful, minimizing disputes.

Get more for Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful

- Credit verification form

- Rachael ray rebate 25544842 form

- Star in a box answer key form

- Bulletin de versement eres form

- Dichiarazione sostitutiva di certificazione stato di famiglia form

- Dc health form 106934

- Printable esl progress report template form

- Programsession observation protocol effectiveness initiatives in evaluativethinking form

Find out other Specifically List Amounts Withheld, And Reason Why Such Withholding Is Wrongful

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement