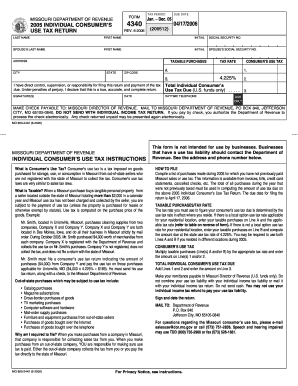

MISSOURI DEPARTMENT of REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV

What is the Missouri Department of Revenue Form 4340?

The Missouri Department of Revenue Form 4340 is specifically designed for individual consumers to report and pay the Consumer's Use Tax. This form is essential for residents who purchase goods for use in Missouri but do not pay sales tax at the time of purchase. The form captures necessary details such as the taxpayer's last name, first name, tax period, and the amount of use tax owed. Understanding this form is crucial for compliance with state tax laws.

How to Use the Missouri Department of Revenue Form 4340

To effectively use Form 4340, individuals must first gather all relevant information regarding their purchases that are subject to the Consumer's Use Tax. This includes receipts and records of transactions where sales tax was not collected. Once the necessary information is compiled, fill out the form accurately, ensuring that all required fields are completed. After completing the form, it must be submitted to the Missouri Department of Revenue by the specified due date to avoid penalties.

Steps to Complete the Missouri Department of Revenue Form 4340

Completing Form 4340 involves several key steps:

- Gather all documentation related to purchases made without sales tax.

- Enter your last name and first name in the designated fields.

- Specify the tax period for which you are reporting.

- Calculate the total amount of use tax owed based on your purchases.

- Review the completed form for accuracy before submission.

Following these steps ensures that the form is filled out correctly, minimizing the risk of errors that could lead to compliance issues.

Filing Deadlines and Important Dates for Form 4340

It is important to be aware of the filing deadlines associated with Form 4340. The due date for submitting this form typically aligns with the end of the tax period for which the use tax is being reported. Missing the deadline can result in penalties and interest on the amount owed. Therefore, individuals should mark their calendars and prepare to submit the form on time to maintain compliance with state tax regulations.

Required Documents for Form 4340

When completing Form 4340, certain documents are necessary to support your claims. These include:

- Receipts or invoices for purchases made without sales tax.

- Records of any previous use tax payments made.

- Any correspondence from the Missouri Department of Revenue regarding your tax status.

Having these documents ready will facilitate a smoother filing process and ensure that all information reported is accurate and verifiable.

Penalties for Non-Compliance with Form 4340

Failure to file Form 4340 on time or to pay the appropriate use tax can lead to significant penalties. The Missouri Department of Revenue may impose fines, interest on unpaid taxes, and other legal consequences. It is essential for individuals to understand these risks and take timely action to avoid non-compliance, which can have long-term financial implications.

Quick guide on how to complete missouri department of revenue form tax period due date individual consumers use tax return last name first name 4340 rev dor mo

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed paperwork, as you can easily obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to alter and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management demands in just a few clicks from any device of your choice. Alter and eSign [SKS] and promote exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV

Create this form in 5 minutes!

How to create an eSignature for the missouri department of revenue form tax period due date individual consumers use tax return last name first name 4340 rev dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo.?

The MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo. is a tax form used by individuals to report and pay consumer use tax in Missouri. It is essential for ensuring compliance with state tax regulations and avoiding penalties.

-

How can airSlate SignNow help with the MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo.?

airSlate SignNow provides an efficient platform to complete and eSign the MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo. digitally. This streamlines the process, making it easier to submit your tax return on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different needs, including a free trial. Each plan provides access to features that simplify the completion and signing of forms like the MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo.

-

Are there any integrations available with airSlate SignNow for tax preparation?

Yes, airSlate SignNow integrates with various accounting and tax preparation software, enhancing your ability to manage the MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo. seamlessly. This allows for a more streamlined workflow and better data management.

-

What features does airSlate SignNow offer for completing tax forms?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and document tracking. These tools are particularly useful for efficiently managing the MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your information, including details on the MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo., is protected throughout the signing process.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to complete and eSign the MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV Dor Mo. on the go. This flexibility is ideal for busy individuals managing their tax responsibilities.

Get more for MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV

- Occ proposed a rule office of the comptroller of the currency occ form

- Travel form 19 example adjustment ouhsc

- Peace corps works a cross sectional analysis of 21 host country form

- Package mice cran fhcrc form

- 31 july 2001 memorandum foia foia navy form

- Boumediene et al form

- U s bank application no referencelayout 1 qxd form

- Department of mathematics natural and computer science form

Find out other MISSOURI DEPARTMENT OF REVENUE FORM TAX PERIOD DUE DATE INDIVIDUAL CONSUMER'S USE TAX RETURN LAST NAME FIRST NAME 4340 REV

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template