5071 Corporation Investments InAdvances to Subsidiaries Schedule Form

What is the 5071 Corporation Investments InAdvances To Subsidiaries Schedule

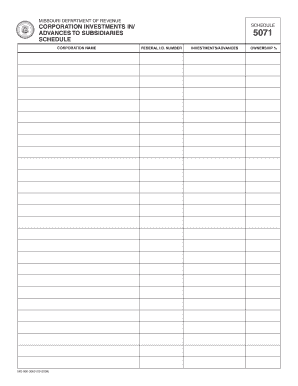

The 5071 Corporation Investments InAdvances To Subsidiaries Schedule is a specific financial document used by corporations to report investments made in their subsidiaries. This schedule is essential for accurately reflecting the financial position of a corporation, particularly in relation to its subsidiaries. It provides a detailed account of the advances and investments that a parent corporation has made, which can impact tax liabilities and financial reporting. Understanding this schedule is crucial for compliance with IRS regulations and for maintaining transparent financial practices.

Key elements of the 5071 Corporation Investments InAdvances To Subsidiaries Schedule

Several key elements are critical when completing the 5071 Corporation Investments InAdvances To Subsidiaries Schedule. These include:

- Identification of Subsidiaries: Clearly list each subsidiary receiving investments or advances.

- Amount of Investment: Specify the total amount invested in each subsidiary, including any advances made.

- Date of Investment: Include the date when each investment was made, which is vital for tracking financial flows.

- Purpose of Investment: Provide a brief description of the purpose behind each investment, which aids in understanding the strategic goals of the corporation.

Steps to complete the 5071 Corporation Investments InAdvances To Subsidiaries Schedule

Completing the 5071 Corporation Investments InAdvances To Subsidiaries Schedule involves several important steps:

- Gather all necessary financial documents related to investments and advances made to subsidiaries.

- Identify each subsidiary and the corresponding amounts invested.

- Document the purpose and date of each investment.

- Review IRS guidelines to ensure compliance with reporting requirements.

- Submit the completed schedule as part of the corporation's overall tax filing.

Legal use of the 5071 Corporation Investments InAdvances To Subsidiaries Schedule

The legal use of the 5071 Corporation Investments InAdvances To Subsidiaries Schedule is governed by IRS regulations. Corporations must accurately report their investments to ensure compliance with tax laws. Failure to report these investments correctly can lead to penalties, including fines or increased scrutiny from tax authorities. This schedule not only serves a legal purpose but also helps maintain transparency and accountability in corporate financial practices.

Filing Deadlines / Important Dates

Filing deadlines for the 5071 Corporation Investments InAdvances To Subsidiaries Schedule typically align with the overall tax filing deadlines for corporations. Generally, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. It is important to mark these dates on your calendar to ensure timely submission and avoid penalties. Keeping track of any changes in tax laws or deadlines is also advisable, as these can affect filing requirements.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the 5071 Corporation Investments InAdvances To Subsidiaries Schedule. These guidelines include detailed instructions on what information must be reported, how to calculate investment amounts, and the necessary documentation to support the reported figures. Corporations should refer to the latest IRS publications and updates to ensure compliance with current tax regulations and avoid potential issues during audits.

Quick guide on how to complete 5071 corporation investments inadvances to subsidiaries schedule

Prepare [SKS] easily on any device

Online document handling has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs within a few clicks from any device of your choosing. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5071 corporation investments inadvances to subsidiaries schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5071 Corporation Investments InAdvances To Subsidiaries Schedule?

The 5071 Corporation Investments InAdvances To Subsidiaries Schedule is a financial document that outlines the investments made by a corporation in its subsidiaries. This schedule provides detailed insights into the nature and amount of these investments, helping businesses maintain transparency and compliance with financial regulations.

-

How can airSlate SignNow help with the 5071 Corporation Investments InAdvances To Subsidiaries Schedule?

airSlate SignNow streamlines the process of creating and managing the 5071 Corporation Investments InAdvances To Subsidiaries Schedule by allowing users to easily eSign and send documents. This ensures that all necessary approvals are obtained quickly, reducing delays and improving overall efficiency in financial reporting.

-

What features does airSlate SignNow offer for managing financial documents like the 5071 Corporation Investments InAdvances To Subsidiaries Schedule?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing financial documents like the 5071 Corporation Investments InAdvances To Subsidiaries Schedule. These features enhance collaboration and ensure that all stakeholders can access and review documents in real-time.

-

Is airSlate SignNow cost-effective for small businesses needing the 5071 Corporation Investments InAdvances To Subsidiaries Schedule?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With competitive pricing plans, it provides essential tools for managing the 5071 Corporation Investments InAdvances To Subsidiaries Schedule without breaking the bank.

-

Can airSlate SignNow integrate with other financial software for the 5071 Corporation Investments InAdvances To Subsidiaries Schedule?

Absolutely! airSlate SignNow offers integrations with various financial software platforms, making it easy to incorporate the 5071 Corporation Investments InAdvances To Subsidiaries Schedule into your existing workflow. This seamless integration helps maintain data consistency and enhances productivity.

-

What are the benefits of using airSlate SignNow for the 5071 Corporation Investments InAdvances To Subsidiaries Schedule?

Using airSlate SignNow for the 5071 Corporation Investments InAdvances To Subsidiaries Schedule provides numerous benefits, including improved document security, faster turnaround times for approvals, and enhanced collaboration among team members. These advantages lead to more efficient financial management and reporting.

-

How secure is airSlate SignNow when handling the 5071 Corporation Investments InAdvances To Subsidiaries Schedule?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents like the 5071 Corporation Investments InAdvances To Subsidiaries Schedule. This ensures that your financial data remains confidential and secure throughout the signing process.

Get more for 5071 Corporation Investments InAdvances To Subsidiaries Schedule

- Crash report forms flhsmv

- Finding research on retention and access using eric pell institute pellinstitute form

- Form 2 application for planned development rezoning icgov

- Transparency and program integrity health care reform healthcarereform procon

- Cookies and log files it law at it law form

- Fulbruge iii clerk ca5 uscourts form

- Title iv authorization form

- Primary workers compensation csac excess insurance authority csac eia form

Find out other 5071 Corporation Investments InAdvances To Subsidiaries Schedule

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple