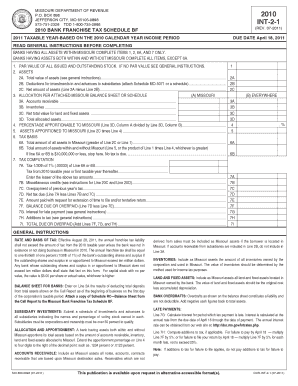

INT 2 1 Bank Franchise Tax Schedule BF Form

What is the INT 2 1 Bank Franchise Tax Schedule BF

The INT 2 1 Bank Franchise Tax Schedule BF is a specific tax form used by banks and financial institutions in the United States to report their franchise tax liability. This form is essential for compliance with state tax regulations, ensuring that banks accurately disclose their income and calculate the appropriate tax owed. The schedule is part of the broader franchise tax system, which varies by state, and is designed to assess the financial health and operational status of banking entities.

How to use the INT 2 1 Bank Franchise Tax Schedule BF

To effectively use the INT 2 1 Bank Franchise Tax Schedule BF, banks must first gather all necessary financial documentation, including income statements and balance sheets. The form requires detailed information about the bank's revenue, assets, and liabilities. After filling out the schedule, it should be submitted along with the main franchise tax return. Accurate completion is crucial to avoid penalties and ensure compliance with state regulations.

Steps to complete the INT 2 1 Bank Franchise Tax Schedule BF

Completing the INT 2 1 Bank Franchise Tax Schedule BF involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the schedule by entering required financial data, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the schedule along with the main franchise tax return to the appropriate state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the INT 2 1 Bank Franchise Tax Schedule BF can vary by state. Generally, banks must submit their franchise tax returns, including the schedule, by a specific date, often aligned with the end of the fiscal year. It is important for banks to check their state’s tax authority for exact deadlines to avoid late fees or penalties.

Legal use of the INT 2 1 Bank Franchise Tax Schedule BF

The INT 2 1 Bank Franchise Tax Schedule BF is legally required for banks operating in states that impose a franchise tax. Failure to file this schedule can result in significant penalties, including fines and interest on unpaid taxes. Compliance with the legal requirements ensures that banks maintain good standing with state tax authorities and avoid any legal repercussions.

Key elements of the INT 2 1 Bank Franchise Tax Schedule BF

Key elements of the INT 2 1 Bank Franchise Tax Schedule BF include:

- Bank identification information, such as name and tax identification number.

- Reporting of total income and deductions.

- Details of assets and liabilities.

- Calculation of the franchise tax owed based on reported figures.

Quick guide on how to complete int 2 1 bank franchise tax schedule bf

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your paperwork quickly and without delays. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and enhance your document-driven processes today.

How to edit and eSign [SKS] without effort

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, exhausting document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the int 2 1 bank franchise tax schedule bf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INT 2 1 Bank Franchise Tax Schedule BF?

The INT 2 1 Bank Franchise Tax Schedule BF is a specific form used by banks to report their franchise tax obligations. It provides detailed information about the bank's income and tax liabilities, ensuring compliance with state regulations. Understanding this schedule is crucial for accurate tax reporting.

-

How can airSlate SignNow help with the INT 2 1 Bank Franchise Tax Schedule BF?

airSlate SignNow simplifies the process of preparing and submitting the INT 2 1 Bank Franchise Tax Schedule BF by allowing users to eSign and send documents securely. Our platform streamlines document management, making it easier to gather necessary signatures and maintain compliance. This efficiency can save time and reduce errors in tax submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the completion of documents like the INT 2 1 Bank Franchise Tax Schedule BF. You can choose a plan that fits your budget while ensuring you have access to essential tools for document management.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools are particularly beneficial when dealing with forms like the INT 2 1 Bank Franchise Tax Schedule BF, as they enhance efficiency and accuracy. Users can easily track document status and ensure timely submissions.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow is fully compliant with legal standards for eSigning, including the ESIGN Act and UETA. This compliance ensures that documents like the INT 2 1 Bank Franchise Tax Schedule BF are legally binding and secure. Our platform prioritizes security and integrity in all electronic transactions.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. Whether you need to connect with accounting software or document management systems, our platform can seamlessly integrate to support processes involving the INT 2 1 Bank Franchise Tax Schedule BF.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the INT 2 1 Bank Franchise Tax Schedule BF, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document tracking, ensuring that you meet deadlines without hassle. This can lead to signNow time savings for your business.

Get more for INT 2 1 Bank Franchise Tax Schedule BF

- Life insurance claim form employee and retiree benefits state benefits iowa

- Life claim packet tiaa 1794tiaapdf form

- Id number member id group number date of birth date of birth form

- Term life amp disability enrollment form seiu503

- Sba 504 loan application checklist rmiinc form

- Mortgage brochure_coverai chase form

- How to use citibank online statements citicom form

- Baja properties ixc form

Find out other INT 2 1 Bank Franchise Tax Schedule BF

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement