FORM MO 1040C M 03 Missouri Department of Revenue Dor Mo

What is the FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo

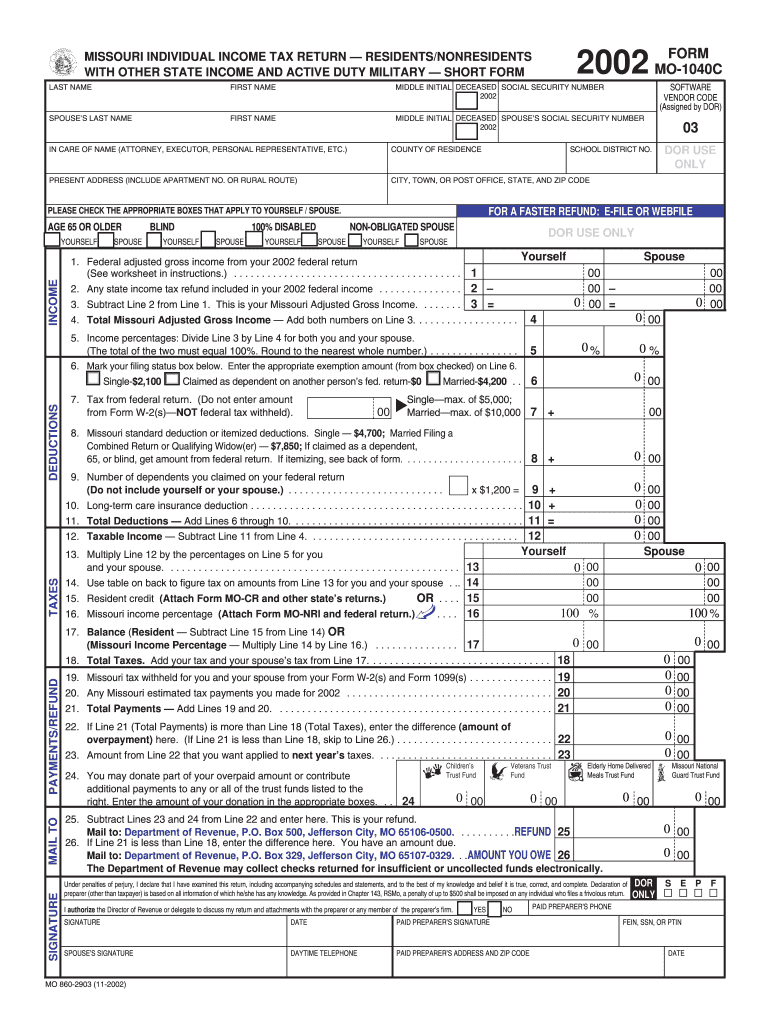

The FORM MO 1040C M 03 is a tax form issued by the Missouri Department of Revenue. It is specifically designed for individuals who need to report their income and calculate their tax liability for the state of Missouri. This form is typically used by taxpayers who have a change in their income or filing status, allowing them to adjust their tax obligations accordingly. It is important for residents to understand the purpose of this form to ensure accurate reporting and compliance with state tax laws.

How to use the FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo

Using the FORM MO 1040C M 03 involves several straightforward steps. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to report all sources of income accurately. After completing the form, review it for any errors, then submit it according to the instructions provided on the form.

Steps to complete the FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo

Completing the FORM MO 1040C M 03 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information at the top of the form.

- Report your total income from all sources in the designated section.

- Calculate your deductions and credits, if applicable, to determine your taxable income.

- Compute the total tax owed based on the current tax rates.

- Sign and date the form to certify that the information provided is accurate.

Key elements of the FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo

The FORM MO 1040C M 03 includes several key elements that are essential for proper tax reporting. These elements consist of personal identification details, income reporting sections, deductions and credits, and the final tax calculation. Each section is designed to guide taxpayers through the process of accurately reporting their financial situation to the Missouri Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the FORM MO 1040C M 03 are crucial for compliance. Typically, the form must be submitted by April 15 of the following tax year, aligning with federal tax deadlines. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the FORM MO 1040C M 03. The form can be filed online through the Missouri Department of Revenue's e-filing system, which offers a convenient and efficient way to submit your tax return. Alternatively, taxpayers can mail the completed form to the designated address provided on the form. In-person submissions are also accepted at local Department of Revenue offices for those who prefer direct interaction.

Quick guide on how to complete form mo 1040c m 03 missouri department of revenue dor mo

Complete FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo effortlessly on any device

Digital document management has become favored among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary format and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and efficiently. Manage FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo effortlessly

- Locate FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo and click on Get Form to initiate the process.

- Utilize the tools we supply to fill out your form.

- Mark important sections of your documents or redact sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Edit and eSign FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040c m 03 missouri department of revenue dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo?

FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo is a tax form used by residents of Missouri to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax regulations and can be easily completed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo?

airSlate SignNow provides a user-friendly platform to complete and eSign FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo efficiently. With our solution, you can streamline the signing process, ensuring that your tax documents are submitted on time and securely.

-

Is there a cost associated with using airSlate SignNow for FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all tailored to assist with FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo. These features enhance the efficiency of your document management process, making it easier to handle tax forms.

-

Can I integrate airSlate SignNow with other software for FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo alongside your existing tools. This integration capability enhances your workflow and improves productivity.

-

What are the benefits of using airSlate SignNow for FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo?

Using airSlate SignNow for FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo. Our platform employs advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo

- Flex claim form ortho contract williamson county texas wilco

- Loan redemption letter sample form

- City of tustin fillable claim form

- Chemistry form ws2 3 3b answers

- Australian society of orthodontics treatment consent form oliver

- Bescom forms download

- Prospect bible pdf form

- Earth and environmental science final review packet answer key form

Find out other FORM MO 1040C M 03 Missouri Department Of Revenue Dor Mo

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF