MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo Form

What is the MO 1120 MO Corporation Income Tax Return

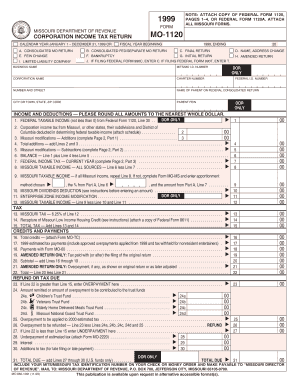

The MO 1120 MO Corporation Income Tax Return is the official form used by corporations operating in Missouri to report their income, deductions, and credits to the state. This form is essential for corporations to comply with state tax laws and ensure proper taxation based on their financial performance. It is specifically designed for C corporations, which are taxed separately from their owners. The form requires detailed financial information, including gross receipts, expenses, and any applicable tax credits.

How to use the MO 1120 MO Corporation Income Tax Return

Using the MO 1120 involves several steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, accurately complete the form by entering your corporation's financial data in the appropriate sections. Ensure that all calculations are correct to avoid errors. After completing the form, review it thoroughly for accuracy before submitting it to the Missouri Department of Revenue. Corporations must also keep a copy of the submitted form for their records.

Steps to complete the MO 1120 MO Corporation Income Tax Return

Completing the MO 1120 requires careful attention to detail. Follow these steps:

- Gather financial documents, including income statements and balance sheets.

- Fill out the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and any other income sources.

- List all allowable deductions, such as operating expenses and tax credits.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable tax rate.

- Sign and date the form, ensuring that it is submitted by the appropriate deadline.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines for filing the MO 1120. Generally, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is typically due by April 15. It is important to file on time to avoid penalties and interest on unpaid taxes. If additional time is needed, corporations can request an extension, but this does not extend the time to pay any taxes owed.

Required Documents

To complete the MO 1120, corporations need to prepare several documents, including:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Records of any tax credits or deductions claimed.

- Federal tax return information, as it may be required for state tax calculations.

Having these documents organized and accessible will streamline the completion of the form and ensure accuracy.

Penalties for Non-Compliance

Failing to file the MO 1120 on time or inaccurately reporting information can lead to significant penalties. The Missouri Department of Revenue may impose fines for late filings, which can accumulate over time. Additionally, interest may accrue on any unpaid taxes. In severe cases, non-compliance could result in legal action or further scrutiny of the corporation's financial practices. It is crucial for corporations to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete mo 1120 mo corporation income tax returnmo ft dor mo

Set up [SKS] effortlessly on any gadget

Web-based document administration has gained signNow traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow provides you with all the resources required to create, alter, and electronically sign your documents swiftly without any delays. Handle [SKS] on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and electronically sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or obscure private information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind the concerns of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo

Create this form in 5 minutes!

How to create an eSignature for the mo 1120 mo corporation income tax returnmo ft dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo?

The MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo is a tax form used by corporations in Missouri to report their income, deductions, and credits. This form is essential for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations accurately.

-

How can airSlate SignNow assist with filing the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo?

airSlate SignNow simplifies the process of preparing and submitting the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo by allowing users to eSign and send documents securely. Our platform streamlines document management, making it easier for businesses to handle their tax filings efficiently.

-

What features does airSlate SignNow offer for managing the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo. These tools help ensure that all necessary information is included and that the filing process is smooth and compliant.

-

Is airSlate SignNow cost-effective for businesses filing the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to file the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo. Our pricing plans are designed to accommodate various business sizes and needs, ensuring that you get the best value for your document management and eSigning requirements.

-

Can I integrate airSlate SignNow with other software for filing the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo. This integration allows for a more streamlined workflow, reducing the time spent on document preparation and submission.

-

What are the benefits of using airSlate SignNow for the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo?

Using airSlate SignNow for the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo offers numerous benefits, including enhanced security, faster processing times, and improved accuracy. Our platform ensures that your documents are handled securely and efficiently, allowing you to focus on your business operations.

-

How does airSlate SignNow ensure the security of my MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo documents?

airSlate SignNow prioritizes the security of your documents, including the MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo, by employing advanced encryption and secure access protocols. This ensures that your sensitive information remains protected throughout the eSigning and document management process.

Get more for MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo

- Notice and acknowledgment of reo purchaser screening form

- City of charleston south carolina charleston sc form

- Pc053048 notice of commencement work copy keep pascocountyfl form

- Complaintarrest affidavit 1306227002 201600064911 form

- 2017 gabwa membership application wordpresscom form

- Community internship log form xavier

- Get caloptima form

- Notice of right to reclaim or disposion of property under 500 disposing of property form

Find out other MO 1120 MO Corporation Income Tax ReturnMO FT Dor Mo

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document