Corp Surety Bond Decedent Courts Mo Form

What is the Corp Surety Bond Decedent Courts Mo

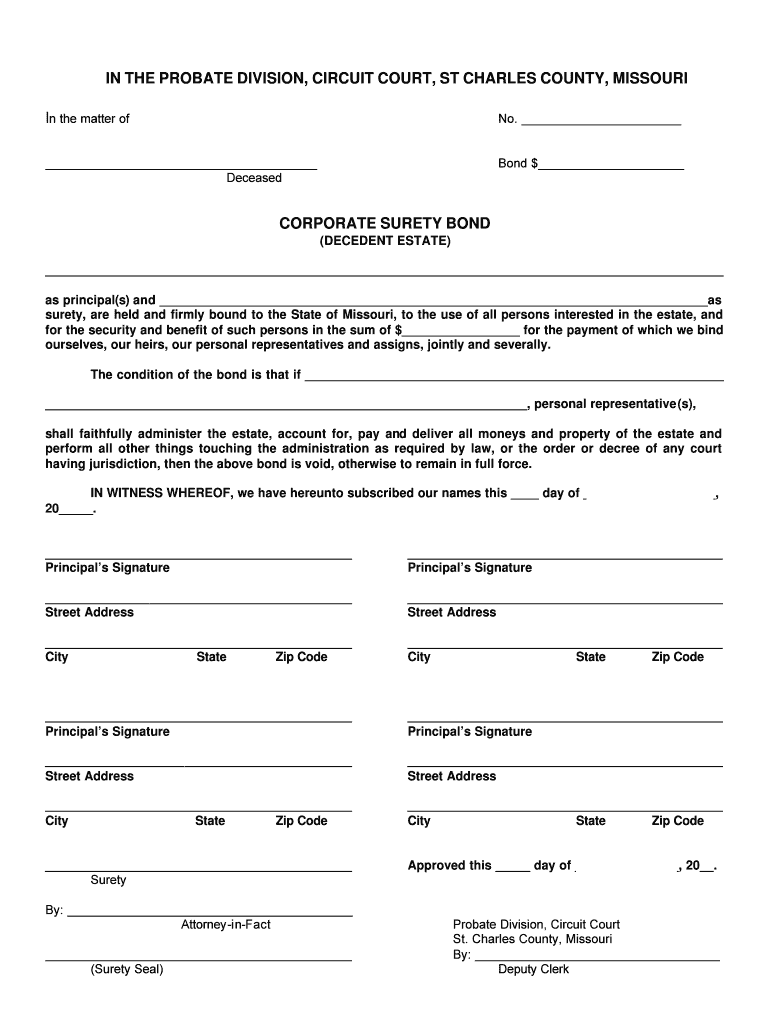

The Corp Surety Bond Decedent Courts Mo is a legal instrument required in Missouri for the administration of estates when a decedent passes away. This bond serves as a guarantee that the appointed personal representative will manage the estate in accordance with state laws and the decedent's wishes. It ensures that the estate's assets are protected and that debts and taxes are paid before any distribution to beneficiaries occurs. The bond amount is typically determined based on the value of the estate, providing a financial safety net for the court and interested parties.

How to obtain the Corp Surety Bond Decedent Courts Mo

To obtain the Corp Surety Bond Decedent Courts Mo, individuals must first identify a licensed surety company that operates in Missouri. The process generally involves the following steps:

- Gather necessary information about the estate, including its value and any outstanding debts.

- Contact a surety bond provider to request a quote for the bond amount required.

- Complete an application with the surety company, providing details about the decedent and the estate.

- Undergo a credit check, as this may influence the bond premium.

- Once approved, pay the premium to receive the bond.

Steps to complete the Corp Surety Bond Decedent Courts Mo

Completing the Corp Surety Bond Decedent Courts Mo involves several key steps:

- Identify the need for a surety bond based on the estate's requirements.

- Choose a surety company and apply for the bond.

- Review the bond terms and conditions provided by the surety company.

- Sign the bond agreement, ensuring all details are accurate.

- Submit the bond to the appropriate court as part of the estate administration process.

Legal use of the Corp Surety Bond Decedent Courts Mo

The legal use of the Corp Surety Bond Decedent Courts Mo is crucial for ensuring compliance with Missouri estate laws. This bond protects the interests of the decedent's creditors and beneficiaries by holding the personal representative accountable for their actions. If the representative fails to fulfill their obligations, the bond can be claimed against to cover any losses incurred. Courts require this bond to safeguard the estate's assets and ensure proper administration, making it an essential component of the probate process.

Required Documents

When applying for the Corp Surety Bond Decedent Courts Mo, several documents may be required:

- The death certificate of the decedent.

- A copy of the will, if available.

- Documentation outlining the estimated value of the estate.

- Identification and financial information of the personal representative.

Eligibility Criteria

Eligibility to obtain the Corp Surety Bond Decedent Courts Mo typically includes:

- The applicant must be a legally appointed personal representative or executor of the estate.

- The applicant should have a satisfactory credit history, as this may affect the bond premium.

- Compliance with any specific court requirements related to the estate's administration.

Quick guide on how to complete corp surety bond decedent courts mo

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained immense popularity among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-centered processes today.

How to Edit and eSign [SKS] Simply

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] to guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corp surety bond decedent courts mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Corp Surety Bond Decedent Courts Mo?

A Corp Surety Bond Decedent Courts Mo is a legal bond required by courts in Missouri when handling the estate of a deceased individual. This bond ensures that the appointed executor or administrator will manage the estate responsibly and in accordance with the law. It protects the interests of the beneficiaries and creditors involved in the estate.

-

How much does a Corp Surety Bond Decedent Courts Mo cost?

The cost of a Corp Surety Bond Decedent Courts Mo varies based on the value of the estate and the specific requirements of the court. Typically, the premium ranges from 1% to 3% of the bond amount. It's essential to consult with a bonding company to get an accurate quote tailored to your situation.

-

What are the benefits of obtaining a Corp Surety Bond Decedent Courts Mo?

Obtaining a Corp Surety Bond Decedent Courts Mo provides peace of mind to beneficiaries and creditors, ensuring that the estate is managed properly. It also helps expedite the probate process, allowing for quicker distribution of assets. Additionally, having this bond can enhance the credibility of the executor or administrator in the eyes of the court.

-

How can I apply for a Corp Surety Bond Decedent Courts Mo?

To apply for a Corp Surety Bond Decedent Courts Mo, you typically need to provide information about the estate, including its value and the names of the beneficiaries. You can apply through a licensed surety bond provider or an insurance agent who specializes in probate bonds. The application process usually involves a review of your financial history and may require collateral.

-

What documents are needed for a Corp Surety Bond Decedent Courts Mo?

When applying for a Corp Surety Bond Decedent Courts Mo, you will need to provide several documents, including the court order appointing the executor, a copy of the will, and financial statements related to the estate. Additional documentation may be required based on the bonding company's policies. It's best to check with your surety provider for a complete list of requirements.

-

Can I cancel my Corp Surety Bond Decedent Courts Mo?

Yes, you can cancel your Corp Surety Bond Decedent Courts Mo, but the process may vary depending on the bonding company. Generally, you will need to notify the surety provider in writing and may need to provide a reason for the cancellation. Keep in mind that cancellation may affect your legal obligations regarding the estate.

-

Are there any alternatives to a Corp Surety Bond Decedent Courts Mo?

In some cases, alternatives to a Corp Surety Bond Decedent Courts Mo may include a personal bond or a court waiver if the estate qualifies. However, these alternatives are not always available and depend on the specific circumstances of the estate and the court's requirements. It's advisable to consult with a legal professional to explore your options.

Get more for Corp Surety Bond Decedent Courts Mo

- Satisfactory academic progress appeal form tuskegeeedu

- Mac performer app installation instructions

- Enrollment form therxhelpercom therxhelpercom

- Travis county esd 12 fire code permit application 405 west parsons st form

- Case no cb order nam state of indiana in form

- Employment application the city of lake worth lakeworthtx form

- Volunteer work comp election form volunteer workers compensation coverage opers ucsc

- Washingtonbaltimore hidta training registration form caseexplorer

Find out other Corp Surety Bond Decedent Courts Mo

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile