EXHIBIT 8 D NAME of LOCAL GOVERNMENT or NON PROFIT ENTITY Whichever is Managing the Revolving Loan Fund SAMPLE REVOLVING LOAN FU Form

Understanding the Revolving Loan Fund Plan

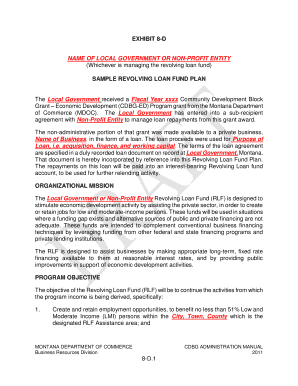

The EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN is a crucial document for local governments and non-profit entities. It outlines the management and operational framework for a revolving loan fund, which is designed to provide financial assistance for economic development projects. This plan typically includes details about the fund's purpose, the types of loans available, eligibility criteria for borrowers, and the repayment process.

The revolving loan fund is often supported by a Community Development Block Grant, which provides the necessary funding to help stimulate local economic growth. Understanding the components of this plan is essential for effective management and compliance with federal guidelines.

Steps to Complete the Revolving Loan Fund Plan

Completing the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN involves several key steps:

- Gather necessary documentation, including financial statements and project proposals.

- Define the goals and objectives of the revolving loan fund.

- Establish eligibility criteria for potential borrowers.

- Detail the loan terms, including interest rates, repayment schedules, and any fees.

- Outline the application process and approval timeline.

- Ensure compliance with federal and state regulations.

Following these steps will help ensure that the plan is comprehensive and meets all necessary requirements for effective fund management.

Key Elements of the Revolving Loan Fund Plan

Several key elements must be included in the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN:

- Purpose: Clearly state the intended use of the funds and the target audience.

- Loan Types: Specify the types of loans available, such as small business loans or housing rehabilitation loans.

- Eligibility Criteria: Define who can apply for loans, including any income or project requirements.

- Repayment Terms: Detail how and when borrowers must repay the loans.

- Monitoring and Reporting: Outline the process for tracking loan performance and borrower compliance.

Incorporating these elements will ensure that the plan is effective and meets the needs of the community.

Legal Use of the Revolving Loan Fund Plan

The EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN must adhere to various legal requirements. This includes compliance with federal regulations governing Community Development Block Grants and any state-specific laws related to lending practices. It is essential to consult with legal experts to ensure that the plan aligns with all applicable laws and regulations.

Failure to comply with these legal standards can result in penalties, loss of funding, and challenges in loan recovery. Therefore, understanding the legal framework surrounding the revolving loan fund is critical for its successful implementation.

Application Process for the Revolving Loan Fund

The application process for the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN typically involves several stages:

- Submission of a completed application form by the borrower.

- Review of the application by the fund manager to assess eligibility.

- Evaluation of the proposed project to determine its feasibility and alignment with fund objectives.

- Approval or denial of the application, with communication of the decision to the applicant.

- Signing of loan agreements upon approval, detailing terms and conditions.

This structured approach helps ensure that all applicants are treated fairly and that funds are allocated effectively to support community development initiatives.

Quick guide on how to complete exhibit 8 d name of local government or non profit entity whichever is managing the revolving loan fund sample revolving loan

Finalize [SKS] effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest method to modify and eSign [SKS] without any hassle

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exhibit 8 d name of local government or non profit entity whichever is managing the revolving loan fund sample revolving loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN?

The EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN outlines the structure and guidelines for managing a revolving loan fund. This plan is essential for local governments that have received a Fiscal Year XXXX Community Development Block Grant Economic, ensuring compliance and effective fund management.

-

How can airSlate SignNow assist with the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN?

airSlate SignNow provides a streamlined platform for eSigning and managing documents related to the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN. This simplifies the process of obtaining necessary signatures and ensures that all documentation is securely stored and easily accessible.

-

What are the pricing options for using airSlate SignNow for the revolving loan fund documentation?

airSlate SignNow offers various pricing plans tailored to meet the needs of organizations managing the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN. These plans are designed to be cost-effective, providing essential features without breaking the budget, especially for local governments utilizing community development grants.

-

What features does airSlate SignNow offer for managing the revolving loan fund?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking, all of which are beneficial for the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN. These tools help ensure that all processes are efficient and compliant with grant requirements.

-

How does airSlate SignNow ensure compliance with the revolving loan fund plan?

airSlate SignNow helps ensure compliance with the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN by providing audit trails and secure storage for all documents. This transparency is crucial for local governments that need to demonstrate adherence to the guidelines set forth in their community development block grants.

-

Can airSlate SignNow integrate with other tools for managing the revolving loan fund?

Yes, airSlate SignNow offers integrations with various tools that can enhance the management of the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN. These integrations allow for seamless data transfer and improved workflow efficiency, making it easier for local governments to manage their funds.

-

What benefits does airSlate SignNow provide for local governments using the revolving loan fund?

By using airSlate SignNow, local governments can streamline their processes related to the EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FUND PLAN. Benefits include reduced paperwork, faster turnaround times for document approvals, and enhanced security for sensitive information, all of which contribute to more effective fund management.

Get more for EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FU

- Scholar reporting form scholarships gov

- Town of seabrook nh application for commercial building form

- Contrato de trabajo temporal bcontratosbbnetcontratabbesb contratos netcontrata form

- The attached personal history statement phs is intended as a sample of what tcole considers to form

- Jjc letterheaddotx jjc form

- United kingdom association of professional engineers ukape org form

- With respect to all coverage parts the policy you are applying for is a claims made policy and subject to its provisions form

- Composite uncontested divorce forms

Find out other EXHIBIT 8 D NAME OF LOCAL GOVERNMENT OR NON PROFIT ENTITY Whichever Is Managing The Revolving Loan Fund SAMPLE REVOLVING LOAN FU

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document