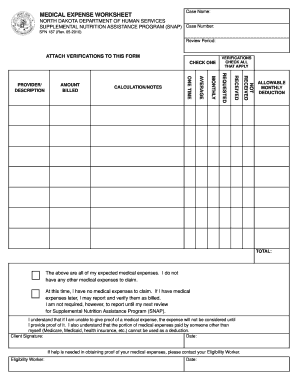

MEDICAL EXPENSE WORKSHEET Form

What is the Medical Expense Worksheet

The Medical Expense Worksheet is a detailed form used to track and report medical expenses incurred by individuals or families. This worksheet helps in organizing various healthcare costs, including hospital bills, doctor visits, prescriptions, and other related expenses. It is particularly useful for taxpayers looking to claim medical deductions on their federal income tax returns. By providing a clear summary of expenses, this worksheet assists in ensuring accurate reporting and maximizing potential tax benefits.

How to Use the Medical Expense Worksheet

Using the Medical Expense Worksheet involves several straightforward steps. First, gather all relevant documentation, such as receipts and invoices for medical services. Next, categorize the expenses into appropriate sections, such as hospital care, dental expenses, and prescription medications. Fill in the worksheet with the total amounts for each category, ensuring accuracy to facilitate a smooth filing process. Lastly, keep the completed worksheet with your tax documents for reference during tax preparation and potential audits.

Steps to Complete the Medical Expense Worksheet

Completing the Medical Expense Worksheet requires careful attention to detail. Begin by listing all medical expenses incurred throughout the year. Organize these expenses into specific categories, such as:

- Doctor visits

- Hospital stays

- Prescription medications

- Medical equipment

- Dental and vision care

Once categorized, total the expenses for each section. Ensure to include only eligible expenses as defined by IRS guidelines. After completing the worksheet, review it for accuracy before filing it with your tax return.

Key Elements of the Medical Expense Worksheet

The Medical Expense Worksheet includes several key elements that facilitate accurate reporting. These elements typically consist of:

- A section for personal information, including the taxpayer's name and Social Security number

- Categorized expense sections for easy organization

- Space to record the date of service and the provider's name

- Instructions for calculating totals and determining eligible expenses

These components ensure that users can effectively document their medical expenses and understand the requirements for claiming deductions.

IRS Guidelines

The IRS provides specific guidelines regarding what qualifies as a deductible medical expense. According to these guidelines, eligible expenses may include payments for medical services, prescription drugs, and certain long-term care services. However, not all costs are deductible; for instance, cosmetic procedures typically do not qualify. It is essential to refer to the latest IRS publications for detailed information on allowable deductions to ensure compliance and maximize potential tax benefits.

Eligibility Criteria

To utilize the Medical Expense Worksheet effectively, taxpayers must meet certain eligibility criteria. Generally, individuals or families who itemize their deductions on their federal income tax returns can claim medical expenses. Additionally, expenses must exceed a specified percentage of the taxpayer's adjusted gross income (AGI) to qualify for deductions. Understanding these criteria is crucial for determining whether to use the worksheet and how to report expenses accurately.

Quick guide on how to complete medical expense worksheet

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate creating new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] while ensuring excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MEDICAL EXPENSE WORKSHEET

Create this form in 5 minutes!

How to create an eSignature for the medical expense worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a MEDICAL EXPENSE WORKSHEET?

A MEDICAL EXPENSE WORKSHEET is a document that helps individuals track and organize their medical expenses throughout the year. This worksheet can be essential for budgeting and tax purposes, ensuring that you have a clear overview of your healthcare costs.

-

How can airSlate SignNow help with my MEDICAL EXPENSE WORKSHEET?

airSlate SignNow allows you to create, send, and eSign your MEDICAL EXPENSE WORKSHEET quickly and efficiently. With our user-friendly platform, you can easily manage your medical expenses and ensure that all necessary signatures are collected in a timely manner.

-

Is there a cost associated with using the MEDICAL EXPENSE WORKSHEET feature?

Yes, airSlate SignNow offers various pricing plans that include access to the MEDICAL EXPENSE WORKSHEET feature. Our plans are designed to be cost-effective, ensuring that you get the best value for your document management needs.

-

What are the key features of the MEDICAL EXPENSE WORKSHEET in airSlate SignNow?

The MEDICAL EXPENSE WORKSHEET in airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure document storage. These features streamline the process of managing your medical expenses and enhance your overall experience.

-

Can I integrate the MEDICAL EXPENSE WORKSHEET with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly incorporate your MEDICAL EXPENSE WORKSHEET into your existing workflows. This ensures that you can manage your medical expenses alongside other important business processes.

-

What benefits does using a MEDICAL EXPENSE WORKSHEET provide?

Using a MEDICAL EXPENSE WORKSHEET helps you maintain a clear record of your healthcare costs, making it easier to manage your budget and prepare for tax season. Additionally, airSlate SignNow's eSigning capabilities ensure that your documents are legally binding and securely stored.

-

Is the MEDICAL EXPENSE WORKSHEET easy to use?

Yes, the MEDICAL EXPENSE WORKSHEET in airSlate SignNow is designed to be user-friendly. With an intuitive interface, you can quickly fill out and manage your worksheet without any technical expertise, making it accessible for everyone.

Get more for MEDICAL EXPENSE WORKSHEET

- Llc 1a 2016 2019 form

- Updates to business account information pdf 2012 2019

- Welcome to ladbsamp39 data request service ladbs makes it ladbs form

- 4766g 2016 2019 form

- Form 103 metro 2013 2019

- Zoning certificate application building permit pdf city of berkeley form

- California manufactured certificate for transfer without probate 2016 2019 form

- Re207 2016 2019 form

Find out other MEDICAL EXPENSE WORKSHEET

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors