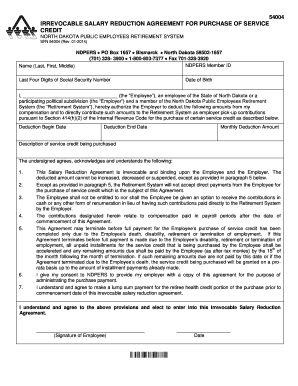

Irrevocable Salary Reduction Agreement for Purchase of Service Credit Form

What is the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit

The Irrevocable Salary Reduction Agreement For Purchase Of Service Credit is a formal document that allows employees to allocate a portion of their salary toward the purchase of service credits in a retirement plan. This agreement is designed to enhance retirement benefits by enabling employees to buy additional service time, which can lead to increased pension payouts upon retirement. The agreement is irrevocable, meaning once it is signed, the employee cannot change the decision to reduce their salary for this purpose.

Key elements of the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit

This agreement typically includes several essential components:

- Employee Information: Name, position, and identification details of the employee.

- Salary Reduction Amount: The specific percentage or dollar amount of salary to be deducted.

- Duration: The period for which the salary reduction will be in effect.

- Purpose: A clear statement indicating that the funds will be used for purchasing service credits.

- Signature: The employee's signature, confirming their agreement to the terms.

Steps to complete the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit

Completing the Irrevocable Salary Reduction Agreement involves several straightforward steps:

- Review the Agreement: Carefully read the terms and conditions outlined in the document.

- Determine Salary Reduction: Decide on the amount or percentage of salary to be allocated for service credit purchase.

- Fill Out Personal Information: Provide necessary details such as name, employee ID, and position.

- Sign the Agreement: Sign and date the document to indicate acceptance of the terms.

- Submit the Agreement: Deliver the signed agreement to the appropriate department or HR personnel.

How to obtain the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit

To obtain the Irrevocable Salary Reduction Agreement, employees can follow these methods:

- Human Resources Department: Contact the HR department to request a copy of the agreement.

- Company Intranet: Access the company’s internal website, where forms and documents are often available for download.

- Retirement Plan Administrator: Reach out to the administrator of the retirement plan for specific forms related to service credit purchases.

Legal use of the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit

The legal use of this agreement is governed by both federal and state laws regarding retirement plans. It is essential for employees to ensure that the agreement complies with applicable regulations, including those set forth by the Internal Revenue Service (IRS). The irrevocable nature of the agreement means that employees should fully understand the implications of their salary reduction before signing.

Eligibility Criteria

Eligibility to enter into an Irrevocable Salary Reduction Agreement typically includes:

- Being a full-time employee of the organization.

- Participation in a qualified retirement plan that allows for the purchase of service credits.

- Meeting any specific criteria set by the employer or retirement plan administrator.

Quick guide on how to complete irrevocable salary reduction agreement for purchase of service credit

Effortlessly Prepare [SKS] on Any Device

The management of documents online has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] across any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you'd like to submit your form, whether by email, SMS, invite link, or download to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign [SKS] to ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Irrevocable Salary Reduction Agreement For Purchase Of Service Credit

Create this form in 5 minutes!

How to create an eSignature for the irrevocable salary reduction agreement for purchase of service credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Irrevocable Salary Reduction Agreement For Purchase Of Service Credit?

An Irrevocable Salary Reduction Agreement For Purchase Of Service Credit is a legal document that allows employees to allocate a portion of their salary towards purchasing additional service credits. This agreement is irrevocable, meaning once established, it cannot be changed or canceled. It is designed to help employees enhance their retirement benefits.

-

How does the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit work?

The Irrevocable Salary Reduction Agreement For Purchase Of Service Credit works by allowing employees to agree to a salary reduction that is then used to purchase service credits. This process typically involves submitting the agreement to your employer and ensuring compliance with relevant retirement plan rules. It ultimately helps in increasing the employee's retirement benefits.

-

What are the benefits of using an Irrevocable Salary Reduction Agreement For Purchase Of Service Credit?

The benefits of using an Irrevocable Salary Reduction Agreement For Purchase Of Service Credit include enhanced retirement savings, potential tax advantages, and the ability to increase pension benefits. By committing a portion of your salary, you can secure additional service credits that contribute to a more substantial retirement income. This agreement also provides peace of mind knowing your retirement planning is on track.

-

Are there any costs associated with the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit?

While the agreement itself may not have direct costs, there could be administrative fees associated with processing the salary reduction and purchasing service credits. It's essential to review your employer's policies and any applicable fees before entering into an Irrevocable Salary Reduction Agreement For Purchase Of Service Credit. Understanding these costs can help you make informed financial decisions.

-

Can I modify my Irrevocable Salary Reduction Agreement For Purchase Of Service Credit?

No, once you establish an Irrevocable Salary Reduction Agreement For Purchase Of Service Credit, it cannot be modified or revoked. This irrevocability is a key feature that ensures the commitment to salary reduction remains intact for the duration of the agreement. If you need to make changes, you may have to wait until the next enrollment period or consult your HR department.

-

How can airSlate SignNow assist with the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit. Our solution streamlines the document management process, ensuring that all agreements are securely stored and easily accessible. With airSlate SignNow, you can efficiently manage your retirement planning documents.

-

What integrations does airSlate SignNow offer for managing the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit?

airSlate SignNow integrates seamlessly with various HR and payroll systems, making it easier to manage the Irrevocable Salary Reduction Agreement For Purchase Of Service Credit. These integrations allow for automatic updates and streamlined workflows, ensuring that your salary reductions are accurately reflected in your payroll. This connectivity enhances efficiency and reduces the risk of errors.

Get more for Irrevocable Salary Reduction Agreement For Purchase Of Service Credit

- Cacfp meal benefit income eligibility form july 2011 2016 2019

- Gop data center form

- Application for chair on the party general primary ballot form

- 14 de diciembre texas secretary of state sos state tx form

- Pers 282 2014 2019 form

- Lhl009 2017 2019 form

- Prod publishsales and return policies apple store form

- Backflow test and maintenance report form 2017

Find out other Irrevocable Salary Reduction Agreement For Purchase Of Service Credit

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy