Corporate Income Tax Return Fillable Corporate Income Tax Return Fillable Form

What is the Corporate Income Tax Return?

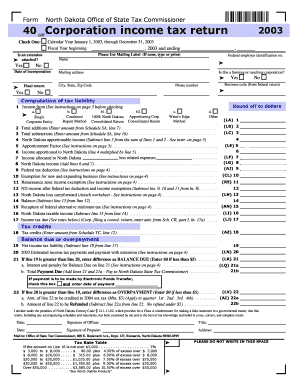

The Corporate Income Tax Return is a crucial document that corporations in the United States must file annually with the Internal Revenue Service (IRS). This form, often referred to as Form 1120, reports a corporation's income, gains, losses, deductions, and credits. It is essential for determining the amount of tax owed by the corporation. The fillable version allows businesses to complete the form electronically, ensuring accuracy and efficiency in the filing process.

How to Use the Corporate Income Tax Return

Using the Corporate Income Tax Return involves several steps. First, businesses need to gather all necessary financial documents, including income statements, balance sheets, and records of expenses. Once these documents are collected, the fillable form can be accessed online. Corporations can enter their financial information directly into the form, which automatically calculates tax liabilities based on the provided data. After completing the form, it can be eSigned and submitted electronically, streamlining the filing process.

Steps to Complete the Corporate Income Tax Return

Completing the Corporate Income Tax Return involves a systematic approach:

- Gather all relevant financial documents, such as income statements and expense records.

- Access the fillable Corporate Income Tax Return form online.

- Enter the corporation's income, deductions, and credits into the appropriate fields.

- Review the information for accuracy to avoid errors that could lead to penalties.

- eSign the completed form to verify authenticity.

- Submit the form electronically to the IRS.

Required Documents

To complete the Corporate Income Tax Return accurately, certain documents are necessary. These include:

- Income statements detailing revenue and sales.

- Balance sheets showing assets, liabilities, and equity.

- Records of deductible expenses, such as salaries, rent, and utilities.

- Documentation for any credits or deductions claimed.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines for filing their Corporate Income Tax Return. Generally, the due date for filing is the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April fifteenth. It is important to be aware of these dates to avoid late filing penalties.

Penalties for Non-Compliance

Failure to file the Corporate Income Tax Return on time can result in significant penalties. The IRS imposes a penalty for late filing, which can increase based on how late the return is submitted. Additionally, if a corporation underreports its income, it may face further penalties and interest on unpaid taxes. Compliance with filing requirements is crucial to avoid these financial repercussions.

Quick guide on how to complete corporate income tax return fillable corporate income tax return fillable

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for such tasks.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Corporate Income Tax Return Fillable Corporate Income Tax Return Fillable

Create this form in 5 minutes!

How to create an eSignature for the corporate income tax return fillable corporate income tax return fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Corporate Income Tax Return Fillable?

A Corporate Income Tax Return Fillable is a digital form that allows businesses to complete and submit their corporate tax returns electronically. This fillable format simplifies the process, ensuring accuracy and compliance with tax regulations. Using airSlate SignNow, you can easily fill out and eSign your Corporate Income Tax Return Fillable.

-

How does airSlate SignNow help with Corporate Income Tax Return Fillable?

airSlate SignNow provides a user-friendly platform for creating, filling, and eSigning your Corporate Income Tax Return Fillable. Our solution streamlines the tax filing process, reducing the time and effort required to manage your corporate tax documents. With our platform, you can ensure that your Corporate Income Tax Return Fillable is completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for Corporate Income Tax Return Fillable?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features specifically designed for managing Corporate Income Tax Return Fillable, ensuring you get the best value for your investment. Visit our pricing page to find the plan that suits your requirements.

-

Can I integrate airSlate SignNow with other software for Corporate Income Tax Return Fillable?

Yes, airSlate SignNow seamlessly integrates with various accounting and business software, enhancing your workflow for Corporate Income Tax Return Fillable. This integration allows you to import data directly into your tax forms, reducing manual entry and minimizing errors. Explore our integration options to see how we can fit into your existing systems.

-

What are the benefits of using airSlate SignNow for Corporate Income Tax Return Fillable?

Using airSlate SignNow for your Corporate Income Tax Return Fillable offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are securely stored and easily accessible, allowing for quick retrieval and submission. Experience the convenience of managing your corporate tax returns digitally.

-

Is it easy to eSign a Corporate Income Tax Return Fillable with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign your Corporate Income Tax Return Fillable. With just a few clicks, you can add your signature and send the document for approval, ensuring a smooth and efficient signing process.

-

What types of businesses can benefit from Corporate Income Tax Return Fillable?

Any business that needs to file corporate taxes can benefit from using a Corporate Income Tax Return Fillable. This includes small businesses, corporations, and partnerships looking to streamline their tax filing process. airSlate SignNow is designed to cater to the diverse needs of all types of businesses.

Get more for Corporate Income Tax Return Fillable Corporate Income Tax Return Fillable

Find out other Corporate Income Tax Return Fillable Corporate Income Tax Return Fillable

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later