Schedule K 1 Form 38 Beneficiary's Share of ND Income Nd

What is the Schedule K-1 Form 38 Beneficiary's Share of ND Income?

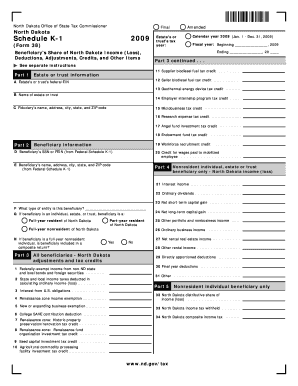

The Schedule K-1 Form 38 is a tax document used in North Dakota to report a beneficiary's share of income, deductions, and credits from an estate or trust. This form is essential for beneficiaries who receive income from these entities, as it provides the necessary information to accurately report their income on individual tax returns. The K-1 form outlines the specific amounts allocated to each beneficiary, ensuring transparency and compliance with tax regulations.

How to Use the Schedule K-1 Form 38 Beneficiary's Share of ND Income

To effectively use the Schedule K-1 Form 38, beneficiaries should first review the information provided on the form, which includes details about the income received, deductions, and credits. This information is crucial for completing the individual tax return accurately. Beneficiaries should ensure that the amounts reported on the K-1 align with their financial records. It is advisable to consult a tax professional if there are any discrepancies or questions regarding the entries on the form.

Steps to Complete the Schedule K-1 Form 38 Beneficiary's Share of ND Income

Completing the Schedule K-1 Form 38 involves several steps:

- Review the form for accuracy, ensuring all information is correct.

- Gather supporting documents, such as bank statements and previous tax returns, to verify income and deductions.

- Fill out the required fields, including the beneficiary's name, address, and taxpayer identification number.

- Report the income, deductions, and credits as indicated on the form.

- Consult a tax professional if needed to ensure compliance with tax laws.

Key Elements of the Schedule K-1 Form 38 Beneficiary's Share of ND Income

Key elements of the Schedule K-1 Form 38 include:

- Beneficiary's name and identification details.

- Income types, such as ordinary income, capital gains, and other distributions.

- Deductions and credits allocated to the beneficiary.

- Signature of the trustee or executor, confirming the accuracy of the information.

Legal Use of the Schedule K-1 Form 38 Beneficiary's Share of ND Income

The Schedule K-1 Form 38 is legally required for beneficiaries of estates and trusts in North Dakota. It serves as an official record of the income and deductions that beneficiaries must report on their tax returns. Failure to report the information accurately can result in penalties or audits by tax authorities. Therefore, it is crucial for beneficiaries to understand their obligations regarding this form and to maintain accurate records.

Filing Deadlines / Important Dates

Beneficiaries should be aware of the filing deadlines associated with the Schedule K-1 Form 38. Typically, the form must be provided to beneficiaries by the end of March following the tax year in which the income was earned. Beneficiaries must then include the information from the K-1 on their individual tax returns, which are generally due by April fifteenth. It is important to stay informed about any changes to these deadlines to ensure timely compliance.

Quick guide on how to complete schedule k 1 form 38 beneficiary39s share of nd income nd

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly option compared to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and streamline your document-centric processes today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure top-notch communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 38 beneficiary39s share of nd income nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd?

The Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for beneficiaries in North Dakota to accurately report their share of income on their personal tax returns.

-

How can airSlate SignNow help with the Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd?

airSlate SignNow provides a streamlined solution for sending and eSigning the Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd. Our platform ensures that all documents are securely signed and stored, making it easy for beneficiaries to manage their tax-related paperwork efficiently.

-

What are the pricing options for using airSlate SignNow for Schedule K 1 Form 38?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can easily manage the Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd.

-

Are there any features specifically designed for handling tax documents like the Schedule K 1 Form 38?

Yes, airSlate SignNow includes features tailored for tax documents, such as templates for the Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd, automated reminders for signatures, and secure document storage. These features simplify the process of managing important tax forms.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows you to easily import and export the Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd, enhancing your workflow and ensuring accuracy in your tax filings.

-

What benefits does airSlate SignNow offer for businesses dealing with Schedule K 1 Form 38?

Using airSlate SignNow for the Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform helps businesses streamline their document management processes, allowing them to focus on their core operations.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital signatures?

Yes, airSlate SignNow is designed with user-friendliness in mind. Even if you are unfamiliar with digital signatures, our intuitive interface makes it easy to complete and eSign the Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd without any hassle.

Get more for Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd

- Rc66 2017 2019 form

- Bc msp online payment 2016 2019 form

- Application for gsthst public service bodies rebate and gst self government refund form

- Gst66 fillable form 2010

- Ir56e 2015 2019 form

- Notification by an employer of an employee who commences to be employed ir56e notification by an employer of an employee who form

- Safehome proposal form rsa insurance ireland

- F20 form 2015

Find out other Schedule K 1 Form 38 Beneficiary's Share Of ND Income Nd

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation