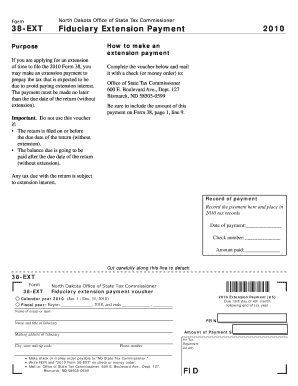

Form North Dakota Office of State Tax Commissioner 38 EXT Purpose Fiduciary Extension Payment How to Make an Extension Payment C

Understanding the Form North Dakota Office Of State Tax Commissioner 38 EXT

The Form North Dakota Office Of State Tax Commissioner 38 EXT is specifically designed for fiduciaries seeking an extension for tax payments. This form allows taxpayers to request additional time to file their tax returns while ensuring that any owed taxes are paid on time. The form is essential for maintaining compliance with state tax laws and avoiding penalties associated with late payments.

Steps to Complete the Form North Dakota Office Of State Tax Commissioner 38 EXT

Completing the Form North Dakota Office Of State Tax Commissioner 38 EXT involves several straightforward steps:

- Begin by downloading the form from the official state tax website or accessing it through authorized channels.

- Fill in the required personal information, including the fiduciary's name, address, and tax identification number.

- Indicate the tax period for which the extension is being requested.

- Calculate the estimated tax due and enter the amount on the form.

- Complete the voucher section, ensuring all details are accurate.

- Sign and date the form before mailing it to the Office of State Tax Commissioner.

How to Obtain the Form North Dakota Office Of State Tax Commissioner 38 EXT

The Form North Dakota Office Of State Tax Commissioner 38 EXT can be obtained through several methods:

- Visit the official North Dakota Office of State Tax Commissioner website to download the form directly.

- Request a physical copy by contacting the office via phone or email.

- Access the form through local tax offices or libraries that provide tax resources.

Legal Use of the Form North Dakota Office Of State Tax Commissioner 38 EXT

This form is legally recognized for requesting an extension on fiduciary tax payments in North Dakota. It is crucial for fiduciaries to use this form to ensure compliance with state tax regulations. Failure to utilize the form correctly may result in penalties or interest on unpaid taxes.

Form Submission Methods

The completed Form North Dakota Office Of State Tax Commissioner 38 EXT can be submitted in the following ways:

- By mail: Send the form along with a check or money order to the Office of State Tax Commissioner at the specified address.

- In-person: Deliver the completed form directly to the Office of State Tax Commissioner during business hours.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form North Dakota Office Of State Tax Commissioner 38 EXT. Typically, the extension request must be submitted by the original tax due date to avoid penalties. Keeping track of these dates ensures timely compliance and helps manage tax obligations effectively.

Quick guide on how to complete form north dakota office of state tax commissioner 38 ext purpose fiduciary extension payment how to make an extension payment

Complete [SKS] seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-driven procedure today.

The easiest way to alter and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to start.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form North Dakota Office Of State Tax Commissioner 38 EXT Purpose Fiduciary Extension Payment How To Make An Extension Payment C

Create this form in 5 minutes!

How to create an eSignature for the form north dakota office of state tax commissioner 38 ext purpose fiduciary extension payment how to make an extension payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form North Dakota Office Of State Tax Commissioner 38 EXT Purpose Fiduciary Extension Payment?

The Form North Dakota Office Of State Tax Commissioner 38 EXT Purpose Fiduciary Extension Payment is a document used to request an extension for fiduciary tax payments in North Dakota. This form allows taxpayers to submit their payment while ensuring compliance with state tax regulations.

-

How do I make an extension payment using the Form North Dakota Office Of State Tax Commissioner 38 EXT?

To make an extension payment using the Form North Dakota Office Of State Tax Commissioner 38 EXT, complete the voucher included with the form. Mail it along with a check or money order to the Office Of State Tax Commissioner at 600 E. This ensures your payment is processed correctly.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management streamlines the process of sending and eSigning documents. It provides a cost-effective solution that enhances efficiency, allowing you to focus on your business while ensuring compliance with forms like the Form North Dakota Office Of State Tax Commissioner 38 EXT.

-

Is there a fee associated with filing the Form North Dakota Office Of State Tax Commissioner 38 EXT?

There is no fee for filing the Form North Dakota Office Of State Tax Commissioner 38 EXT itself, but you must include the payment amount due with your submission. Ensure that your check or money order is made out correctly to avoid delays in processing.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow offers integrations with various software solutions to enhance your tax management process. This allows you to seamlessly manage documents like the Form North Dakota Office Of State Tax Commissioner 38 EXT alongside your existing tools.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking of document status. These features make it easy to manage important documents, including the Form North Dakota Office Of State Tax Commissioner 38 EXT, efficiently and securely.

-

How can I ensure my payment is processed on time using the Form North Dakota Office Of State Tax Commissioner 38 EXT?

To ensure your payment is processed on time, complete the Form North Dakota Office Of State Tax Commissioner 38 EXT accurately and mail it promptly. Using airSlate SignNow can help you manage the process efficiently, ensuring that your payment signNowes the Office Of State Tax Commissioner by the deadline.

Get more for Form North Dakota Office Of State Tax Commissioner 38 EXT Purpose Fiduciary Extension Payment How To Make An Extension Payment C

Find out other Form North Dakota Office Of State Tax Commissioner 38 EXT Purpose Fiduciary Extension Payment How To Make An Extension Payment C

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later