Type Name of Persons to Receive Estate If Partner Form

What is the Type Name Of Persons To Receive Estate If Partner

The Type Name Of Persons To Receive Estate If Partner form is a legal document used to designate individuals who will inherit an estate in the event of a partner's passing. This form is essential for ensuring that the deceased's wishes regarding the distribution of their assets are honored. It typically includes the names of the beneficiaries, their relationship to the deceased, and the specific assets they are entitled to receive. Understanding this form is crucial for anyone involved in estate planning, as it helps to prevent disputes among heirs and ensures a smooth transition of assets.

Steps to Complete the Type Name Of Persons To Receive Estate If Partner

Completing the Type Name Of Persons To Receive Estate If Partner form involves several important steps:

- Gather necessary information: Collect details about the estate, including asset descriptions and the names of potential beneficiaries.

- Identify beneficiaries: Clearly list the names of individuals or entities that will receive the estate, along with their relationship to the deceased.

- Specify asset distribution: Clearly outline what each beneficiary will receive, whether it be specific items, percentages of the estate, or monetary amounts.

- Review legal requirements: Ensure compliance with state laws regarding estate distribution and beneficiary designations.

- Sign and date the form: Ensure that all parties involved sign the document to validate it legally.

Legal Use of the Type Name Of Persons To Receive Estate If Partner

The legal use of the Type Name Of Persons To Receive Estate If Partner form is vital in estate planning. It serves as a legally binding document that outlines how an individual's estate will be divided upon their death. This form must comply with state laws to be enforceable in a court of law. Proper execution of this form can prevent potential legal disputes among heirs and ensure that the deceased's wishes are respected. It is advisable to consult with a legal professional when drafting this document to ensure all legal requirements are met.

Examples of Using the Type Name Of Persons To Receive Estate If Partner

There are various scenarios in which the Type Name Of Persons To Receive Estate If Partner form may be utilized:

- Married couples: A spouse may designate their partner as the primary beneficiary of their estate, ensuring that their assets are passed on to them.

- Single individuals: A single person might choose friends or family members to inherit specific assets, such as property or financial accounts.

- Business partners: In a business partnership, one partner may specify how their share of the business will be distributed in the event of their death.

State-Specific Rules for the Type Name Of Persons To Receive Estate If Partner

Each state in the U.S. has its own laws governing estate distribution and the use of the Type Name Of Persons To Receive Estate If Partner form. It is essential to be aware of these state-specific regulations, as they can affect how the form is completed and executed. For instance, some states may require witnesses or notarization for the form to be valid, while others may have specific guidelines on how assets can be divided among beneficiaries. Consulting with a local attorney can provide clarity on these requirements.

How to Obtain the Type Name Of Persons To Receive Estate If Partner

The Type Name Of Persons To Receive Estate If Partner form can typically be obtained through various sources:

- Legal professionals: Attorneys specializing in estate planning can provide customized forms tailored to individual needs.

- Online legal resources: Many websites offer downloadable templates that can be filled out and customized.

- State government websites: Some states provide official forms that can be accessed online, ensuring compliance with local laws.

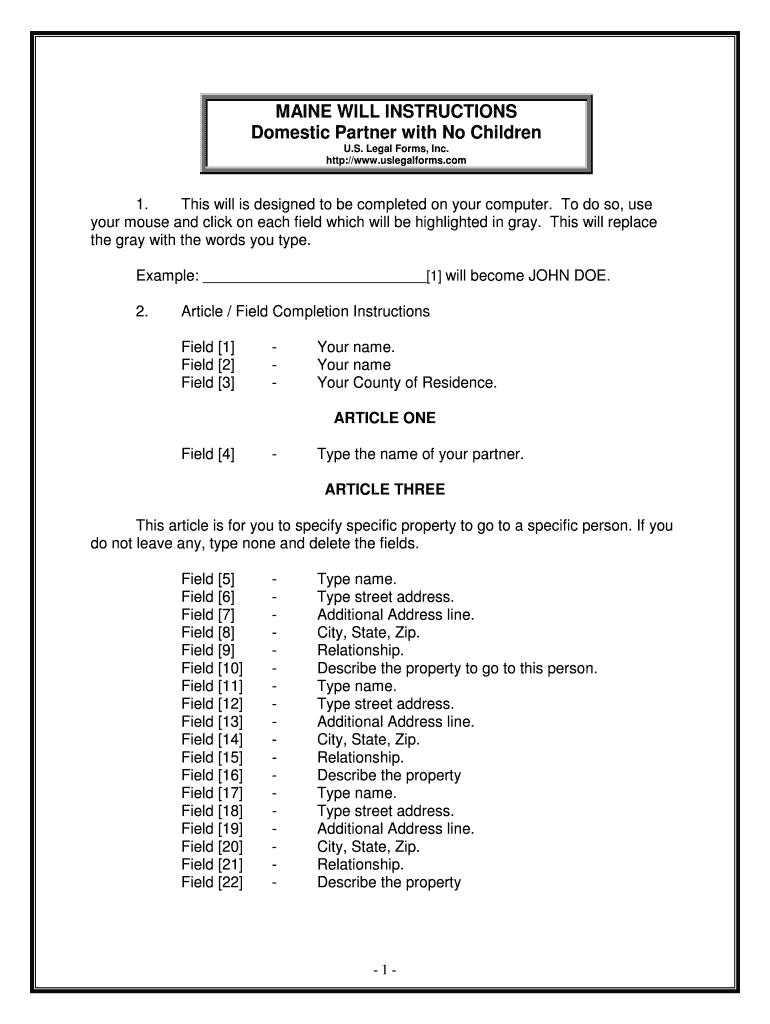

Quick guide on how to complete type name of persons to receive estate if partner

Complete Type Name Of Persons To Receive Estate If Partner seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Type Name Of Persons To Receive Estate If Partner on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Type Name Of Persons To Receive Estate If Partner effortlessly

- Locate Type Name Of Persons To Receive Estate If Partner and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant portions of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Type Name Of Persons To Receive Estate If Partner and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How do I type the name of persons to receive estate if my partner passes away?

To type the name of persons to receive estate if partner, you can use airSlate SignNow’s user-friendly interface to fill out the necessary forms quickly and accurately. Start by accessing the estate planning template that allows customization to input the names directly. Ensure all parties involved understand their roles.

-

What features does airSlate SignNow offer for estate planning?

airSlate SignNow provides a range of features specifically designed for estate planning, including customizable templates where you can easily type the name of persons to receive estate if partner. It also includes secure eSignature capabilities, document sharing, and storage solutions that ensure your estate documents are both secure and accessible.

-

Is airSlate SignNow affordable for personal estate planning needs?

Yes, airSlate SignNow offers affordable plans suitable for personal estate planning, allowing you to type the name of persons to receive estate if partner without breaking the bank. We provide monthly and annual subscriptions, ensuring you can choose a plan that fits your budget while still receiving top-notch service.

-

Can I integrate airSlate SignNow with other tools for managing my estate documents?

Absolutely! airSlate SignNow easily integrates with various tools and platforms, allowing you to manage estate documents efficiently. You can link your account with cloud services and CRM software, making it seamless to type the name of persons to receive estate if partner and fulfill other estate planning requirements.

-

How secure are the documents I create with airSlate SignNow?

Your documents are completely secure with airSlate SignNow. We utilize state-of-the-art encryption methods to protect sensitive information. This means when you type the name of persons to receive estate if partner, you can rest assured that your data is safe from unauthorized access.

-

Is there customer support available for using airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support to help you with any questions, including how to type the name of persons to receive estate if partner. Our support team is available through various channels to ensure that your experience is smooth and effective as you navigate our features.

-

What are the benefits of using airSlate SignNow for estate planning?

Using airSlate SignNow for estate planning offers numerous benefits, including streamlined document creation and the ability to quickly type the name of persons to receive estate if partner. Additionally, the eSignature functionality saves time and reduces the hassle of in-person signing, making the process more efficient.

Get more for Type Name Of Persons To Receive Estate If Partner

- Phone 217 424 2708 form

- Fire department village of matteson form

- Www jotform comform templatesstudentsstudents registration form templatejotform

- Osfm fire ca govmediazlghm4bofire marshal application california form

- California zoning verification letter form

- Www pdffiller com519953686 application forfillable online application for morongo tribal tanf program form

- Ca san bernardino county form

- Ca city council meeting form

Find out other Type Name Of Persons To Receive Estate If Partner

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast