Form North Dakota Office of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN for the Calendar Year Jan

What is the Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher

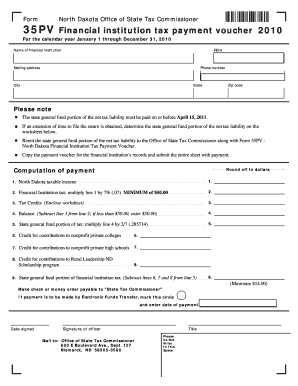

The Form North Dakota Office Of State Tax Commissioner 35PV is a specific tax payment voucher designed for financial institutions operating within North Dakota. This form is used to report and remit the financial institution tax for the calendar year, which runs from January 1 through December 31. It requires essential information such as the name of the financial institution, mailing address, phone number, city, state, and zip code. By accurately completing this form, financial institutions ensure compliance with state tax regulations and facilitate the proper processing of their tax payments.

How to Use the Form North Dakota Office Of State Tax Commissioner 35PV

Using the Form North Dakota Office Of State Tax Commissioner 35PV involves several straightforward steps. First, gather all necessary information regarding your financial institution, including the Federal Employer Identification Number (FEIN) and contact details. Next, fill out the form with accurate data, ensuring that all required fields are completed. Once the form is filled out, it should be signed and submitted according to the guidelines provided by the North Dakota Office of State Tax Commissioner. This ensures that your tax payment is processed correctly and on time.

Steps to Complete the Form North Dakota Office Of State Tax Commissioner 35PV

Completing the Form North Dakota Office Of State Tax Commissioner 35PV requires careful attention to detail. Start by entering the name of your financial institution in the designated field. Then, provide the mailing address, including city, state, and zip code. Next, include your institution's phone number and FEIN. It is crucial to double-check all entries for accuracy. After completing the form, sign it to validate the information provided. Finally, submit the form by the specified deadline to avoid potential penalties.

Key Elements of the Form North Dakota Office Of State Tax Commissioner 35PV

Several key elements are essential for the proper completion of the Form North Dakota Office Of State Tax Commissioner 35PV. These include:

- Name of Financial Institution: The official name as registered with state authorities.

- Mailing Address: The complete address where correspondence should be sent.

- Phone Number: A contact number for any inquiries related to the form.

- FEIN: The Federal Employer Identification Number, which is necessary for tax identification.

- Tax Year: The calendar year for which the tax payment is being submitted.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form North Dakota Office Of State Tax Commissioner 35PV. Typically, the form must be submitted by a specific date following the end of the calendar year. Ensure that you check the latest guidelines from the North Dakota Office of State Tax Commissioner for the exact deadlines to avoid late fees or penalties. Timely submission is crucial for maintaining compliance with state tax laws.

Form Submission Methods

The Form North Dakota Office Of State Tax Commissioner 35PV can be submitted through various methods. Financial institutions may choose to file the form online, by mail, or in person, depending on their preference and the options provided by the North Dakota Office of State Tax Commissioner. Each submission method has its own set of instructions, so it is important to follow the guidelines carefully to ensure proper processing of the tax payment.

Quick guide on how to complete form north dakota office of state tax commissioner 35pv financial institution tax payment voucher fein for the calendar year

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and electronically sign [SKS] and guarantee excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN For The Calendar Year Jan

Create this form in 5 minutes!

How to create an eSignature for the form north dakota office of state tax commissioner 35pv financial institution tax payment voucher fein for the calendar year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN?

The Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN is a document used by financial institutions to report and remit taxes for the calendar year. It includes essential information such as the name of the financial institution, mailing address, phone number, city, state, and zip code. This form ensures compliance with state tax regulations.

-

How can airSlate SignNow help with the Form North Dakota Office Of State Tax Commissioner 35PV?

airSlate SignNow provides an efficient platform for completing and eSigning the Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN. With its user-friendly interface, businesses can easily fill out the required fields and securely send the form to the appropriate state department. This streamlines the tax payment process.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking, which are essential for managing tax forms like the Form North Dakota Office Of State Tax Commissioner 35PV. These features enhance efficiency and ensure that all necessary information is accurately captured and submitted on time.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost will depend on the features you choose and the number of users. Investing in airSlate SignNow can save time and reduce errors when completing forms like the Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software. This allows users to streamline their workflow when handling documents like the Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN, ensuring all data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Form North Dakota Office Of State Tax Commissioner 35PV, offers numerous benefits. It enhances document security, reduces processing time, and minimizes the risk of errors. Additionally, the platform provides a clear audit trail for compliance purposes.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your tax documents. When using the Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN, you can trust that your sensitive information is safeguarded against unauthorized access.

Get more for Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN For The Calendar Year Jan

- Form tr 2013 2019

- Comprehensive plan amendment application city of form

- Electrical currents newsletters lampampi access washington form

- Pr2200gamebirdreleasepermitdoc michigan form

- Fax 517 284 4416 form

- Fis 0262 2014 2019 form

- Bls 3020 2016 2018 form

- Kcmo police security alarm department 2018 2019 form

Find out other Form North Dakota Office Of State Tax Commissioner 35PV Financial Institution Tax Payment Voucher FEIN For The Calendar Year Jan

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document