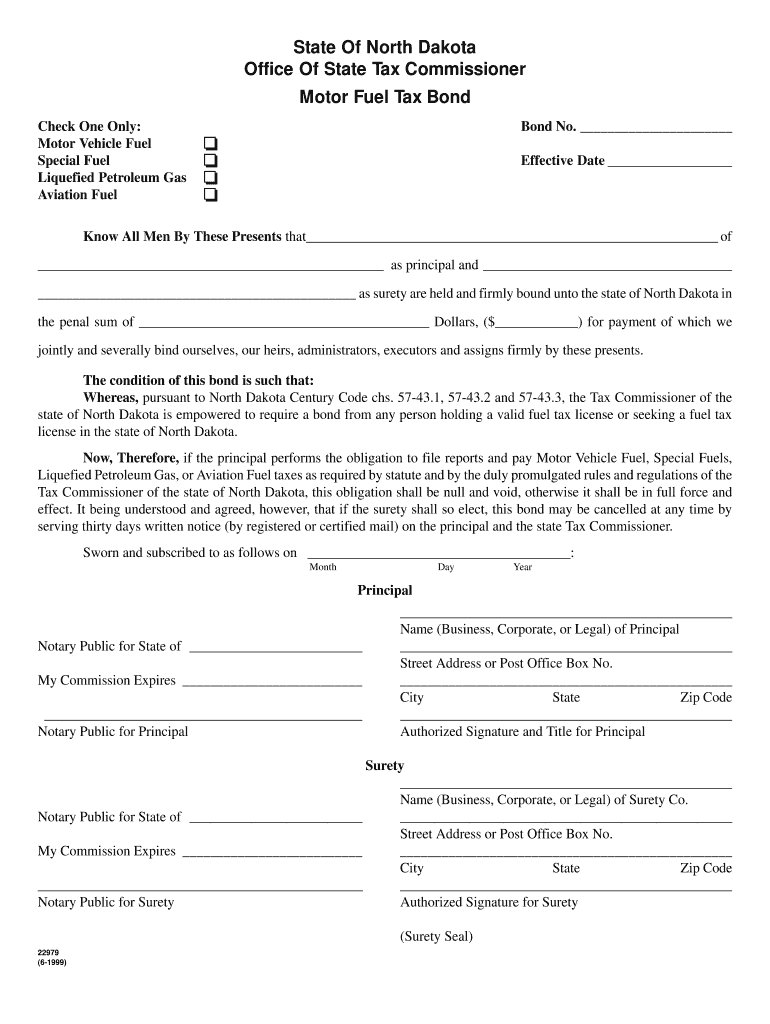

Motor Fuel Tax Bond State of North Dakota Form

What is the Motor Fuel Tax Bond State Of North Dakota

The Motor Fuel Tax Bond in the State of North Dakota is a financial guarantee required from businesses that distribute motor fuel. This bond ensures that these businesses comply with state tax laws regarding the collection and remittance of motor fuel taxes. It serves as a protective measure for the state, ensuring that tax revenues are secured and that businesses operate within legal parameters.

How to obtain the Motor Fuel Tax Bond State Of North Dakota

To obtain the Motor Fuel Tax Bond in North Dakota, businesses must first determine the required bond amount, which is based on anticipated fuel sales. The next step involves contacting a surety company that is authorized to issue bonds in the state. After submitting the necessary application and financial information, the surety will evaluate the application and determine eligibility. Once approved, the business will pay the premium and receive the bond documentation.

Steps to complete the Motor Fuel Tax Bond State Of North Dakota

Completing the Motor Fuel Tax Bond involves several key steps:

- Determine the bond amount based on projected fuel sales.

- Gather required financial documentation to support the bond application.

- Contact a licensed surety company to initiate the bond process.

- Complete the bond application form provided by the surety.

- Submit the application along with any required fees.

- Receive the bond once approved and ensure it is filed with the appropriate state agency.

Legal use of the Motor Fuel Tax Bond State Of North Dakota

The legal use of the Motor Fuel Tax Bond in North Dakota is primarily to ensure compliance with state tax regulations. Businesses that fail to remit collected taxes may face penalties, and the bond acts as a financial safeguard for the state. In the event of non-compliance, the state can claim against the bond to recover unpaid taxes, thereby protecting public funds.

Key elements of the Motor Fuel Tax Bond State Of North Dakota

Key elements of the Motor Fuel Tax Bond include:

- Bond Amount: The specific dollar amount required based on fuel sales.

- Obligee: The State of North Dakota, which requires the bond.

- Principal: The business or individual obtaining the bond.

- Surety: The company that issues the bond and guarantees compliance.

- Duration: The bond is typically valid for one year and must be renewed annually.

State-specific rules for the Motor Fuel Tax Bond State Of North Dakota

North Dakota has specific rules governing the Motor Fuel Tax Bond, including:

- All motor fuel distributors must maintain a bond to operate legally.

- The bond amount is determined by the North Dakota Department of Transportation based on estimated fuel sales.

- Businesses must notify the state of any changes in ownership or operational status that may affect the bond.

- Failure to maintain an active bond can result in penalties or suspension of business operations.

Quick guide on how to complete motor fuel tax bond state of north dakota

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools provided to fill out your form.

- Emphasize important sections of the documents or hide sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to finalize your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Motor Fuel Tax Bond State Of North Dakota

Create this form in 5 minutes!

How to create an eSignature for the motor fuel tax bond state of north dakota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Motor Fuel Tax Bond in the State of North Dakota?

A Motor Fuel Tax Bond in the State of North Dakota is a financial guarantee required for businesses that distribute motor fuel. This bond ensures compliance with state tax regulations and protects the state from potential revenue loss. By obtaining this bond, businesses can operate legally and avoid penalties.

-

How much does a Motor Fuel Tax Bond cost in North Dakota?

The cost of a Motor Fuel Tax Bond in North Dakota varies based on factors such as the bond amount and the applicant's creditworthiness. Typically, businesses can expect to pay a percentage of the total bond amount as a premium. It's advisable to get quotes from multiple providers to find the best rate.

-

What are the benefits of obtaining a Motor Fuel Tax Bond in North Dakota?

Obtaining a Motor Fuel Tax Bond in North Dakota allows businesses to legally distribute motor fuel while ensuring compliance with state laws. It also builds trust with customers and regulatory agencies, demonstrating financial responsibility. Additionally, it can help avoid costly fines and legal issues.

-

How long does it take to get a Motor Fuel Tax Bond in North Dakota?

The process of obtaining a Motor Fuel Tax Bond in North Dakota can vary, but it typically takes a few days to a week. Factors such as the completeness of your application and the underwriting process can influence the timeline. Working with a reputable bond provider can expedite the process.

-

Are there any specific requirements for a Motor Fuel Tax Bond in North Dakota?

Yes, to obtain a Motor Fuel Tax Bond in North Dakota, applicants must meet certain requirements, including providing financial statements and proof of business operations. Additionally, the bond amount is determined by the volume of fuel distributed. It's essential to check with the state for any specific regulations.

-

Can I renew my Motor Fuel Tax Bond in North Dakota?

Yes, Motor Fuel Tax Bonds in North Dakota can be renewed annually. It's important to keep track of the renewal date to ensure continuous compliance with state regulations. Most bond providers will send reminders and assist with the renewal process.

-

What happens if I fail to obtain a Motor Fuel Tax Bond in North Dakota?

Failing to obtain a Motor Fuel Tax Bond in North Dakota can result in severe penalties, including fines and the suspension of your business operations. Additionally, it can damage your reputation and hinder your ability to secure future contracts. Compliance is crucial for maintaining your business's legitimacy.

Get more for Motor Fuel Tax Bond State Of North Dakota

- Standard intake record maac emergency assistance and hmis form

- Riversource form 2015 2019

- 2015 2016 accident form

- 1847_arizona_mb_eng_03 13 kampk insurance susd30 form

- Disclosure inspection amendment of memorial hermann form

- Public service health care plan pshcp claim form

- Subpoena trial 2013 2019 form

- Ppskbapcpa formsdir formsform 255 1207wpd uscourts

Find out other Motor Fuel Tax Bond State Of North Dakota

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement