North Dakota Individual Income Tax Return 37 S 37 S Form

What is the North Dakota Individual Income Tax Return 37 S 37 S

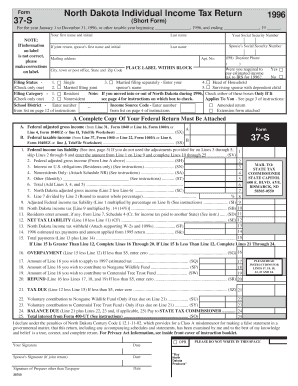

The North Dakota Individual Income Tax Return 37 S 37 S is a state tax form used by residents of North Dakota to report their personal income and calculate their state income tax liability. This form is essential for individuals who earn income within the state and are required to pay taxes on that income. The 37 S designation indicates a specific version of the form tailored for individual taxpayers, ensuring compliance with North Dakota's tax laws.

How to use the North Dakota Individual Income Tax Return 37 S 37 S

To effectively use the North Dakota Individual Income Tax Return 37 S 37 S, taxpayers must first gather all necessary financial documents, including W-2 forms, 1099s, and any other relevant income statements. The form requires detailed information about income, deductions, and credits. Taxpayers should carefully follow the instructions provided with the form to ensure accurate completion. Once filled out, the form can be submitted either online or via mail, depending on the taxpayer's preference.

Steps to complete the North Dakota Individual Income Tax Return 37 S 37 S

Completing the North Dakota Individual Income Tax Return 37 S 37 S involves several key steps:

- Gather all necessary documentation, including income statements and deduction records.

- Fill out personal information, such as name, address, and Social Security number.

- Report total income, including wages, interest, and other earnings.

- Claim any applicable deductions and credits to reduce taxable income.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Taxpayers in North Dakota should be aware of specific deadlines associated with the Individual Income Tax Return 37 S 37 S. Generally, the deadline for filing this form aligns with the federal tax deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any extensions available for filing, as well as deadlines for making tax payments to avoid penalties.

Required Documents

To complete the North Dakota Individual Income Tax Return 37 S 37 S, taxpayers must prepare several key documents:

- W-2 forms from employers detailing annual wages.

- 1099 forms for other sources of income, such as freelance work or interest earnings.

- Records of any deductible expenses, such as medical costs or charitable contributions.

- Previous year’s tax return for reference, if applicable.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the North Dakota Individual Income Tax Return 37 S 37 S can result in penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for severe non-compliance. It is crucial for taxpayers to file on time and ensure all information is accurate to avoid these consequences.

Quick guide on how to complete north dakota individual income tax return 37 s 37 s

Complete [SKS] effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and electronically sign [SKS] seamlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign [SKS] and ensure outstanding communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to North Dakota Individual Income Tax Return 37 S 37 S

Create this form in 5 minutes!

How to create an eSignature for the north dakota individual income tax return 37 s 37 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the North Dakota Individual Income Tax Return 37 S 37 S?

The North Dakota Individual Income Tax Return 37 S 37 S is a specific form used by residents of North Dakota to report their individual income tax. This form is essential for accurately calculating tax liabilities and ensuring compliance with state tax regulations. By using airSlate SignNow, you can easily eSign and submit your North Dakota Individual Income Tax Return 37 S 37 S online.

-

How can airSlate SignNow help with the North Dakota Individual Income Tax Return 37 S 37 S?

airSlate SignNow provides a streamlined solution for completing and eSigning the North Dakota Individual Income Tax Return 37 S 37 S. Our platform allows you to fill out the form digitally, ensuring accuracy and efficiency. Additionally, you can securely store and manage your tax documents within our system.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, especially for those needing to manage documents like the North Dakota Individual Income Tax Return 37 S 37 S. You can choose a plan that fits your budget while enjoying all the features we offer.

-

Are there any features specifically for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the North Dakota Individual Income Tax Return 37 S 37 S and automated reminders for filing deadlines. These features help ensure that you never miss an important date and that your documents are always organized and accessible. Our user-friendly interface makes it easy to navigate through your tax documents.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your North Dakota Individual Income Tax Return 37 S 37 S alongside your other financial documents. This integration enhances your workflow by enabling data transfer between platforms, reducing manual entry, and minimizing errors. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing, including the North Dakota Individual Income Tax Return 37 S 37 S, offers numerous benefits such as increased efficiency, enhanced security, and ease of use. Our platform allows you to eSign documents quickly and securely, reducing the time spent on paperwork. Additionally, you can access your documents from anywhere, making tax filing more convenient.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes the security of your sensitive tax information, including the North Dakota Individual Income Tax Return 37 S 37 S. We implement advanced encryption and security protocols to protect your data. You can trust that your documents are safe with us, allowing you to focus on completing your tax returns without worry.

Get more for North Dakota Individual Income Tax Return 37 S 37 S

Find out other North Dakota Individual Income Tax Return 37 S 37 S

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template